-

Clark heads global transaction banking at MUFG Americas Holdings and is Bay Area president of MUFG Union Bank.

October 6 -

Executives from banks, credit unions, card issuers and investment firms at American Banker's Card Forum discussed ways the public's embrace of digital transactions and credit alternatives like buy now/pay later is shaping everything from products to business strategies.

October 5 -

Venture capital firms are pouring money into startups whose data-crunching technology — including machine-learning systems that predict funds availability — speed payments and inform credit decisions in e-commerce.

October 4 -

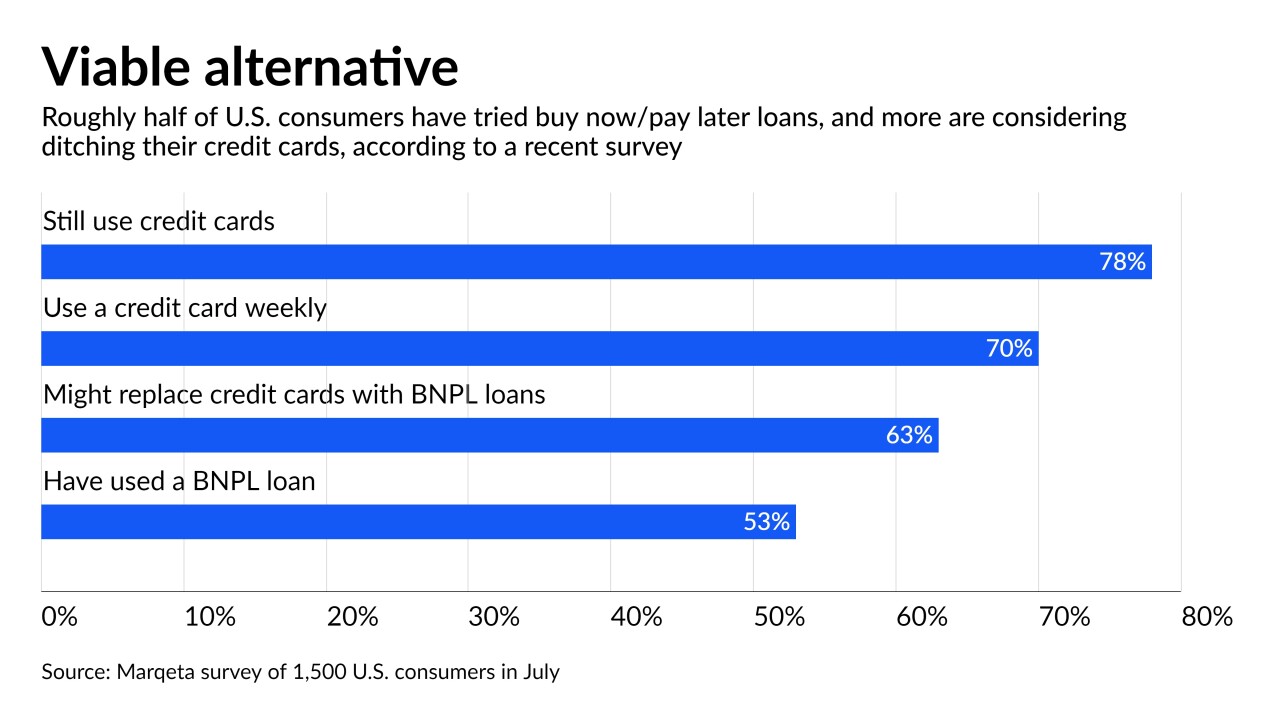

By limiting the credit offered to new borrowers during the pandemic, banks created an opening for installment lenders like Affirm, Afterpay and Klarna.

October 1 -

FirstBank is working with the two major U.S. real-time payments systems so that it can suit the preferences of different customers. Its flexibility could set an example for regional and small institutions.

October 1 -

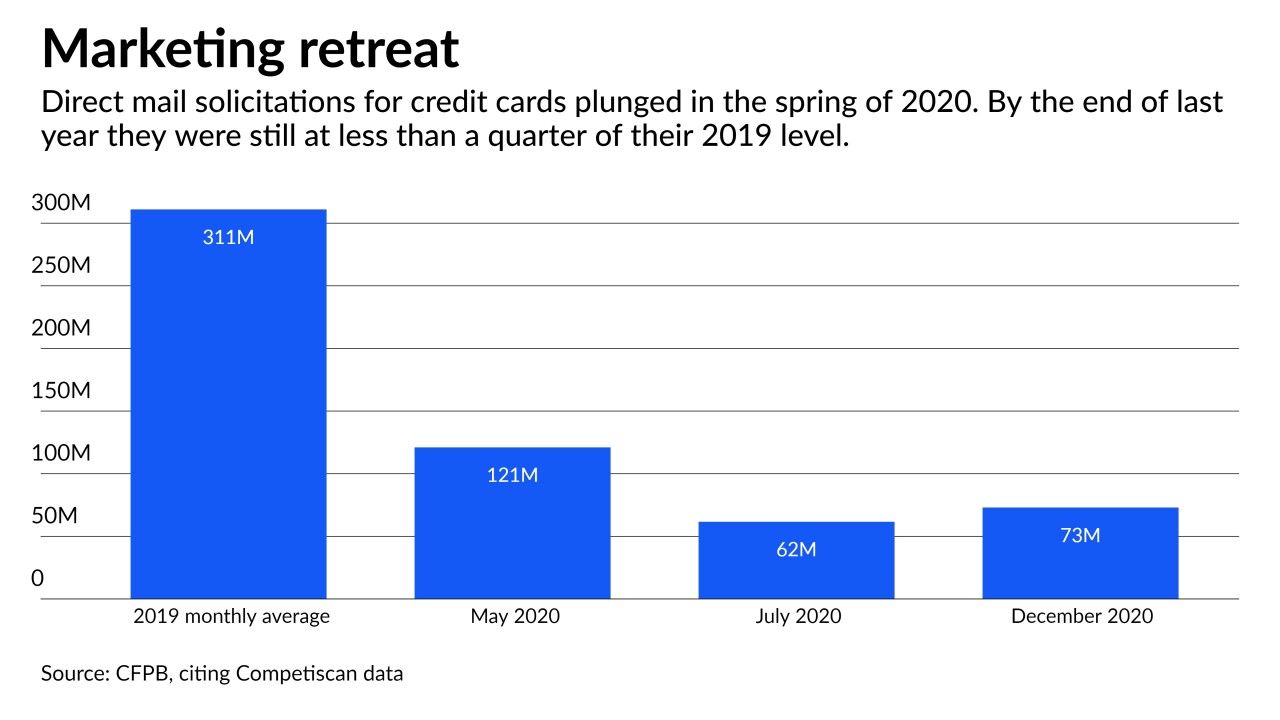

Banks generally did not curtail loans to existing cardholders last year despite mass unemployment, according to new research by the Consumer Financial Protection Bureau. The results contrasted with what happened during the Great Recession.

October 1 -

TD and others are partnering with the money transmitter to respond to the competitive threat posed by startups offering low-value remittances. "Change is going to happen. Real-time payments are coming," a TD executive said at American Banker's Card Forum.

September 30 -

Several company leaders will relocate to Atlanta as part of the expansion, and the office will focus on technology and client services.

September 29 -

In many cases, stopping fraud in the moment is costly — and any transactions a bank flags incorrectly could alienate its best customers, a Bangor Savings Bank executive said at American Banker's Card Forum.

September 29 -

The second of three credit cards announced in June, Reflect rewards consumers who don't miss payments by extending the 18-month promotional period for its 0% annual percentage rate to 21 months.

September 29 -

Small merchants will be able to send customers directly to online stores from videos, advertisements or shopping sites using a new product created by the two companies.

September 29 -

Using data aggregation subsidiary Finicity, the card network will allow its bank and credit union partners to offer installment loans directly to consumers, who can repay from checking and savings accounts.

September 28 -

The tech giant's high-stakes court battle with Epic Games over App Store checkout pricing has gotten most of the attention. But its policies are also facing scrutiny in the U.K., Japan, Australia and elsewhere.

September 27 -

Apple has a new method for integrating health records with its Wallet app, helping retailers check vaccination status before accepting payment. Here's why that could be concerning for credit card issuers.

September 24 -

The country has long expressed displeasure with cryptocurrencies because of their ties to fraud and money laundering, and the excessive energy usage needed to produce them.

September 24 -

Longtime bank executive Uma Wilson will head the cross-disciplinary team.

September 23 -

The company's new app bundles banking services such as payments, buy now/pay later and direct deposit. But the company plans to add features that could include stock trading, a popular offering from tech startups.

September 21 -

Bilt Rewards, which offers a loyalty program and credit card that converts rent into reward points, raised $60 million from investors including Mastercard and Wells Fargo, giving the startup a $350 million valuation.

September 21 -

Merchants and banks have taken predictably opposing positions on a Federal Reserve proposal to increase competition among networks that route online debit transactions. But amid the hundreds of comments, it's those from supposedly neutral parties — the Department of Justice and the Federal Trade Commission — that stand out.

September 20 National Association of Convenience Stores

National Association of Convenience Stores -

More than a third of installment borrowers are delinquent, according to new research. Fintechs and the banks that are following them into the market are willing to tolerate the credit risk — for now — because of BNPL’s rapid growth and the fee income from merchants.

September 17