-

The social network's test of its Novi wallet drew criticism from Democratic senators who say the company does not have a strong track record of protecting user data.

October 20 -

PayPal Holdings is exploring an acquisition of the social media company Pinterest, people with knowledge of the matter said.

October 20 -

The integration with Goldman Sachs Transaction Banking could position Amex to capture more commercial card spending from the largest global corporations.

October 20 -

The payment company has agreed to buy the India-based reconciliation company in its latest investment in back-office technology for internet businesses.

October 20 -

Fintechs have led the way in installment lending, but banks, credit card issuers and payments companies are responding with products of their own. Here's an overview of what they're rolling out.

October 19 -

Best known as a website management company, GoDaddy began directly offering digital and offline payments after learning that its clients were getting those services from fintechs. The company is also now selling terminals for in-store payments.

October 18 -

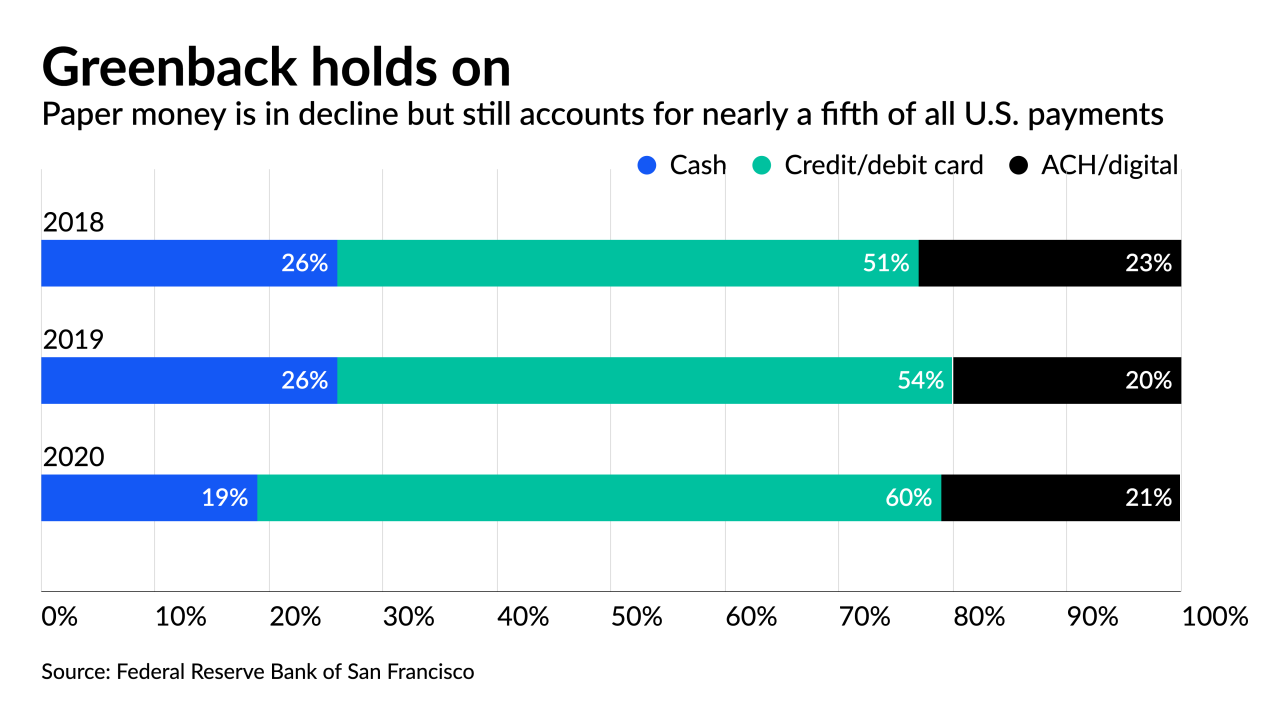

During a House hearing, Democrats advocated for measures that ensure businesses keep accepting paper money, while Republicans argued in favor of chartering more fintechs and promoted stablecoins to extend access to the underbanked.

October 15 -

In a bid to boost fee income, the Minneapolis company is upgrading its payments technology to allow businesses to manage inventory, payroll and other functions — as well as make payments — all in one place. The tech is modeled after an offering from Square.

October 14 -

U.S. consumers have been more punctual than ever before in paying back debts as the economy rebounds from the pandemic.

October 14 -

The $317 million deal will provide the London company with a large base of American clients and help it compete with technology firms like Square, PayPal and Stripe.

October 14 -

Chase Payment Solutions combines Chase Merchant Services with WePay, a fintech the bank bought in 2017, to provide more tailored offerings — such as card acceptance without a merchant account — to entrepreneurs.

October 14 -

The lender is building on a 20-year-old partnership with Fiserv to provide options such as revolving credit, with plans to add buy now/pay later.

October 14 -

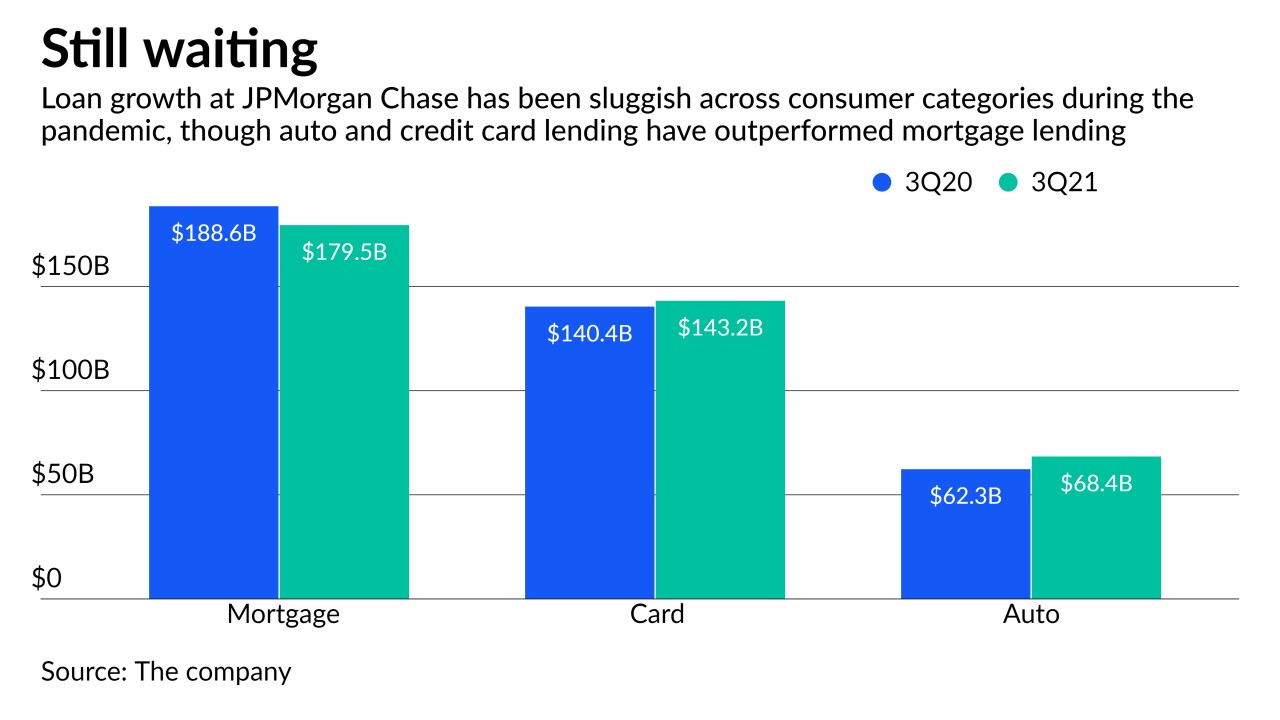

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

Banks working with Swift, The Clearing House and EBA Clearing have completed a successful pilot transaction from the U.S. to Europe and are ready to bring the system to other international corridors.

October 13 -

The payments firm dropped support for Bitcoin payments in 2018, but company executives say the increasing popularity of digital currency makes it a good time to reenter the market.

October 13 -

By partnering with the London-based fintech, Andrews Federal Credit Union will enable members to send transfers to 80 countries.

October 13 -

The bank-supported blockchain organization plans to use the acquired assets to speed testing for digital currencies.

October 12 -

Nonfungible tokens, which provide proof of ownership in the digital world, are booming. Payment companies are betting they will require payment rails to fund high-value purchases and attract new customers for loyalty marketing.

October 12 -

Bank of America is giving businesses new ways to transfer money to their customers with the rollout of a system called Recipient Select.

October 12 -

Many of the application programming interfaces that help banks and fintechs share data predate the law that established open banking on the Continent.

October 7