-

On Dec. 31, 2021. Dollars in thousands.

May 2 -

"Apple may have restricted competition, to the benefit of its own solution Apple Pay," Margrethe Vestagar of the European Commission said. It's an accusation Apple's fought many times across the globe.

May 2 -

About two dozen banks in the U.S. and Europe, including ABN Amro and Bank of America, are working with The Clearing House and EBA Clearing, using technology from SWIFT, to make instant international transactions ubiquitous for business and e-commerce sales.

May 2 -

10 things to know in April: Apple teams with Visa, the Consumer Financial Protection Bureau examines payday lenders, and more.

April 30 -

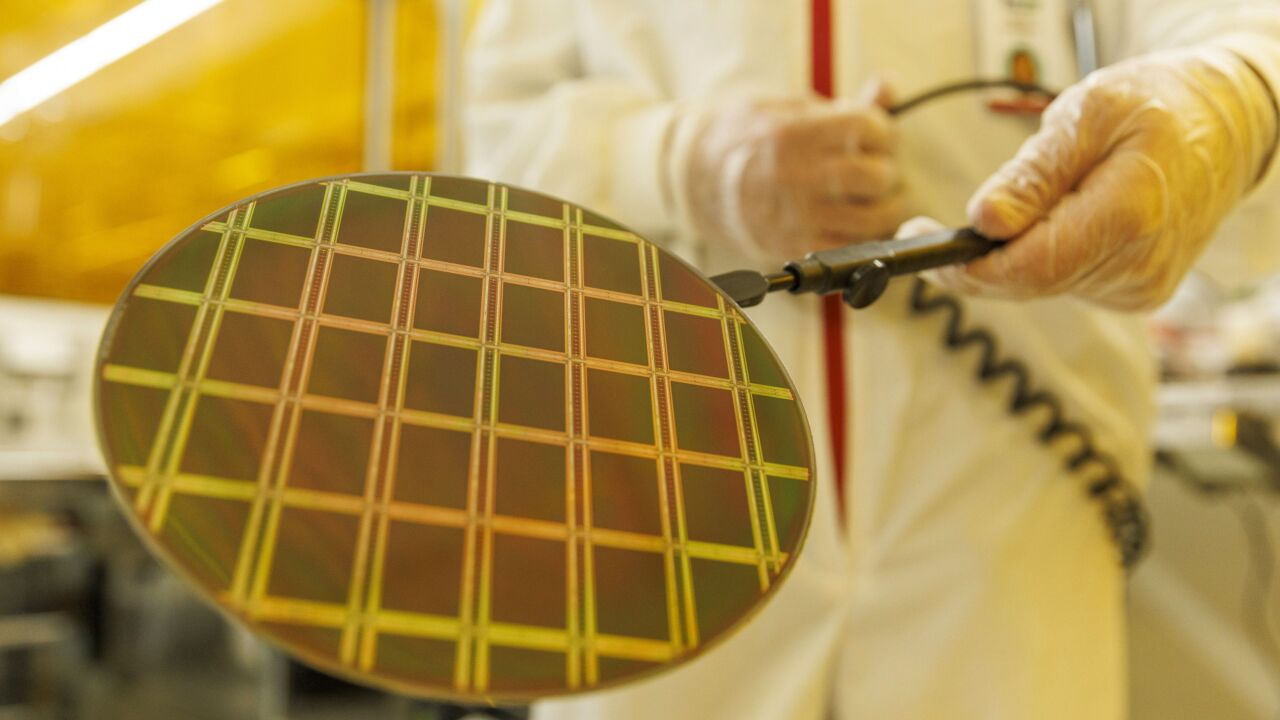

The global microchip shortage is being exacerbated by Russia's war in Ukraine and the COVID lockdowns in China. Experts are warning of an impending strain on the manufacture of cards and point-of-sale hardware.

April 29 -

The recovery for airline and related spending has been robust — and thus far immune to geopolitical and inflationary pressures — according to the card network, following similar reports from Visa and American Express.

April 28 -

Fewer new customers signed up during the first quarter as e-commerce sales momentum slowed and inflation rose, forcing the company to reduce its overall growth expectations for the year.

April 28 -

Analysts were expecting Capital One’s marketing spending to slow significantly after it surged to nearly $1 billion at the end of the year.

April 27 -

In global news this week, scammers target Revolut's program for Ukrainian refugees; Commerzbank applies for a crypto license in Germany; Nium merging with Socash; MyPinPad merging with SmartPesa; and more.

April 27 -

The country was a large part of the card brand's cross-border digital business, though expansion in other markets and new services will help offset the negative impact, according to CEO Alfred Kelly.

April 26 -

The financial services technology company is backing the first retail sportsbook connected to an MLB stadium, adding to its support for automated ticketing, concessions, staff compensation and loyalty. It's a broader combination the technology company hopes to replicate elsewhere.

April 26 -

The card network will use artificial intelligence to improve authentication via its latest team-up with the tech giant.

April 25 -

While most consumer sectors have been going digital, many physicians' offices, hospitals and clinics cling to a reimbursement system that relies heavily in printed statements, checks and manual processing.

April 25 -

The move gives the technology company a larger merchant network as it prepares to turn iPhones into payment acceptance devices.

April 22 -

Powered by a surge of bookings in March, travel and entertainment card spending at American Express rose 121% in the first quarter. The company also added 3 million accounts.

April 22 -

Bank of America said it will make all of its plastic credit and debit cards from recycled material beginning next year.

April 21 -

Financial institutions are confronting major compliance challenges given the demands of Russian sanctions as well as the explosion of online gaming transactions and marijuana sales.

April 20 -

A day after Bank of Russia Gov. Elvira Nabiullina touted the country’s alternative to the SWIFT financial-messaging service, the regulator said it will no longer publicly disclose who participates.

April 19 -

The companies, which partnered to create a new digital shopping experience, say it made sense to focus on mom and pop stores that had to pivot to e-commerce during the pandemic. These businesses will be the first to get collaborative cloud-based tools including maps, marketing and payments.

April 19 -

Robinhood Markets agreed to acquire Ziglu, a London-based crypto and payments company, ending the U.S. brokerage’s long pause on international expansion.

April 19