-

U.S. consumers have been more punctual than ever before in paying back debts as the economy rebounds from the pandemic.

October 14 -

The $317 million deal will provide the London company with a large base of American clients and help it compete with technology firms like Square, PayPal and Stripe.

October 14 -

Chase Payment Solutions combines Chase Merchant Services with WePay, a fintech the bank bought in 2017, to provide more tailored offerings — such as card acceptance without a merchant account — to entrepreneurs.

October 14 -

The lender is building on a 20-year-old partnership with Fiserv to provide options such as revolving credit, with plans to add buy now/pay later.

October 14 -

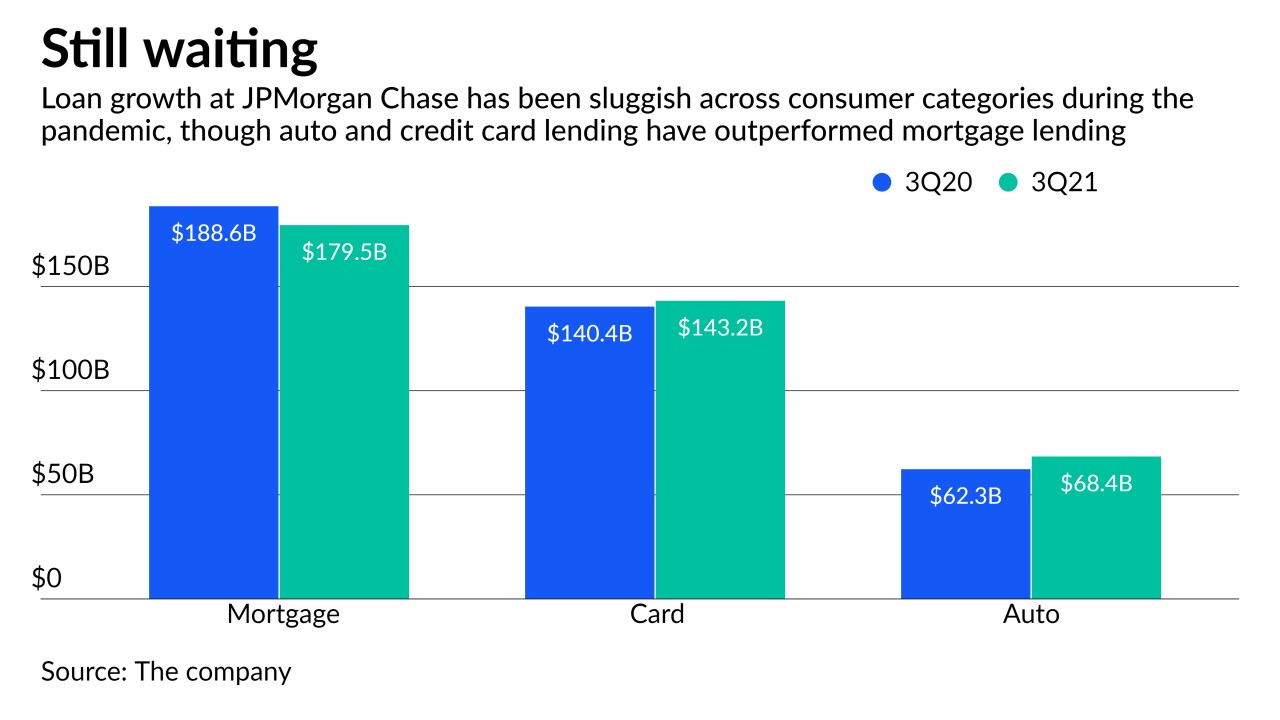

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

Banks working with Swift, The Clearing House and EBA Clearing have completed a successful pilot transaction from the U.S. to Europe and are ready to bring the system to other international corridors.

October 13 -

The payments firm dropped support for Bitcoin payments in 2018, but company executives say the increasing popularity of digital currency makes it a good time to reenter the market.

October 13 -

By partnering with the London-based fintech, Andrews Federal Credit Union will enable members to send transfers to 80 countries.

October 13 -

The bank-supported blockchain organization plans to use the acquired assets to speed testing for digital currencies.

October 12 -

Nonfungible tokens, which provide proof of ownership in the digital world, are booming. Payment companies are betting they will require payment rails to fund high-value purchases and attract new customers for loyalty marketing.

October 12