-

The Spanish bank introduced the installment product in Germany nine months ago, and is planning to bring it to 18 European markets this year.

January 26 -

JPMorgan Chase's recent purchase of a stake in the Greek fintech will allow the U.S. company to offer new services like merchant credit in Europe, where it is No. 5 among merchant acquirers.

January 26 -

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

Acquiring the earned-wage-access firm and challenger bank would further efforts by the retailer and its partners to develop a "super app" featuring mobile financial tools.

January 26 -

The buy now/pay later craze already has retailers demanding lower fees, according to Klarna.

January 25 -

The controversial cryptocurrency project that Mark Zuckerberg once defended in front of Congress is unraveling after regulatory pressure.

January 25 -

The new service was designed to lower costs for community banks while adding security features and providing customers with access to Venmo and other peer-to-peer payment systems.

January 25 -

American Express predicts travel will account for just 20% of its spending for the foreseeable future, compared with 30% before the pandemic, as younger consumers spend more on merchandise.

January 25 -

The announcement marks JPMorgan’s first deal in 2022, on the heels of its most prolific year for buying and taking stakes in smaller firms since at least the financial crisis.

January 25 -

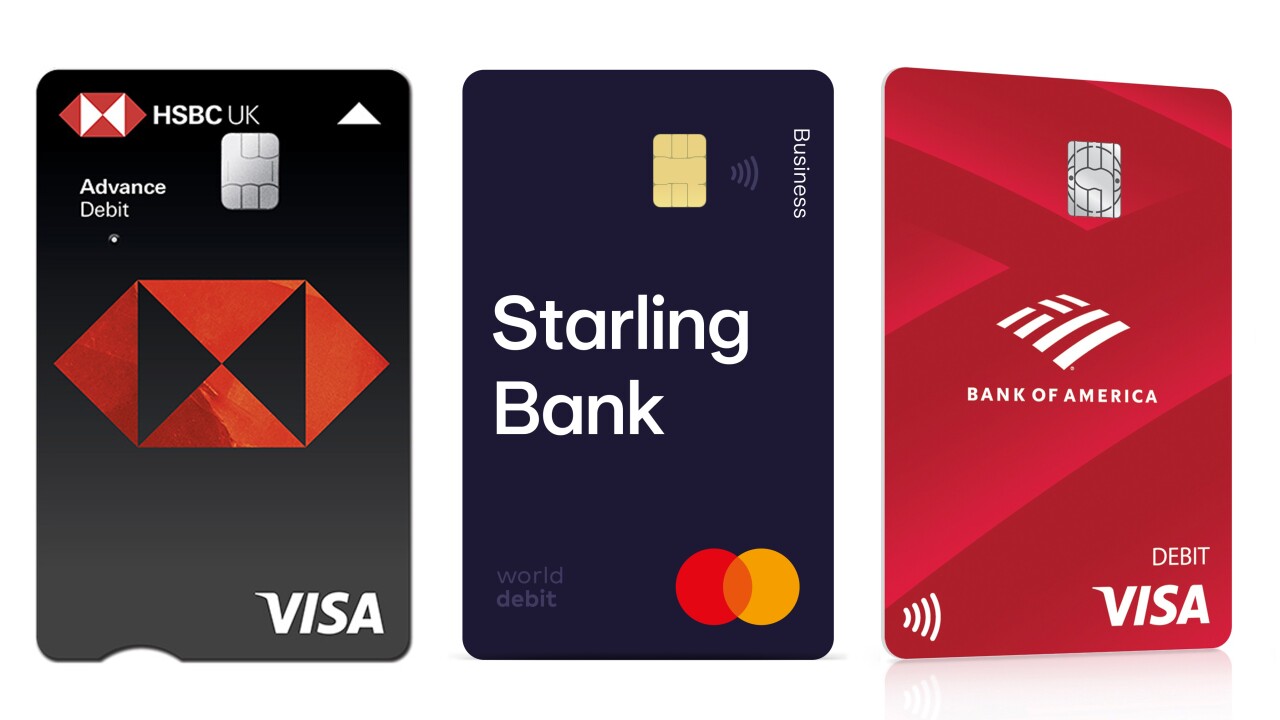

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24 -

A new service speeds payments by using artificial intelligence to predict which buyers are most likely to pay.

January 21 -

Though the retailer's threat to drop Visa in the U.K. appears to have subsided, companies like Clik2pay, Affirm and Curve have seized on an opportunity to advance account-to-account transactions, buy now/pay later and cryptocurrency.

January 21 -

A long-awaited report from the Federal Reserve is a historic step toward the possible development of a central bank digital currency. But the Fed emphasized it would not create one without a clear directive from Congress and the White House.

January 20 -

The issuer says it can offer installment loans without jeopardizing the kind of growth in credit card volume that it reported for the fourth quarter.

January 20 -

JPMorgan Chase will introduce a credit card with Instacart this year, the first foray into grocery for the country’s largest co-brand credit card issuer.

January 20 -

Google has hired former PayPal executive Arnold Goldberg to run its payments division and set a new course for the business after it scrapped a push into banking.

January 19 -

Valuations for payment technology companies skyrocketed over the past year, pushed by a wave of public listings and record venture capital investments. Some potential acquirers are waiting for prices to cool.

January 19 -

A coalition of trade associations representing some of the world's largest retailers called on U.S. antitrust regulators to examine the fees charged by credit card companies after Amazon.com threatened to ban Visa cards in the U.K.

January 19 -

-

It has also taken a stake in Rêv Worldwide, developer of the bank's cross-border traveler account that supports currencies including the U.S. dollar, the euro and the Mexican peso.

January 18