-

First NBC Bank Holding of New Orleans disclosed that it will miss a self-imposed deadline for filing reports for the first and second quarters.

September 26 -

The subprime auto lender continues to struggle to get its arms around accounting issues that date to 2013.

September 23 -

A compliance-at-all-costs mentality, which is the overarching attitude in many banks, results in overspending and overallocating valuable resources to meet both real and perceived compliance standards.

September 23 Resurgent Performance

Resurgent Performance -

Paper-based marketing not digital communication remains a more promising way to reach customers 50 and older, who also tend to be a bank's wealthiest client segment.

September 21 Liberty Bank

Liberty Bank -

The activist investor is irate that the company's board will not meet to discuss concerns it has over executive compensation and corporate governance.

September 20 -

Contrary to expectations about growing mortgage lending volumes, current industry trends suggest a gradual reduction in capacity for both lending and servicing that should alarm policymakers.

September 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Bancorp is keeping its cards close to its vest when it comes to job cuts it made last week. The move is leaving analysts guessing as to exactly how many people and what types of positions were cut.

September 19 -

The revelations at Wells Fargo are reminder to directors that when a bank's performance is too good to be true, it likely is.

September 19

-

The embattled bank is under pressure to claw back bonus pay from executives. Its decision figures to have ripple effects throughout the industry.

September 16 - Minnesota

Speaking at an investor event Thursday, U.S. Bancorp Chief Executive Richard Davis said he has no plans to court Wells Fargo customers who might be put off by the recent account-related scandal at their bank.

September 15 -

The scorcher at Wells is giving some community bankers an opening to differentiate themselves from larger institutions that seem fee-dependent or "too big to manage."

September 15 -

For First Foundation, the government-backed program should help address a recent CRA exam's criticism that it has "poor penetration among businesses of different revenue sizes."

September 14 -

Regions Financial in Birmingham, Ala., has lowered its forecast for annual loan growth, citing weak demand for commercial loans.

September 14 -

Banks will report quarterly results in about a month, and big-bank chiefs cautioned that lending is sluggish because businesses have little desire to take on more debt amid economic and political uncertainty.

September 13 -

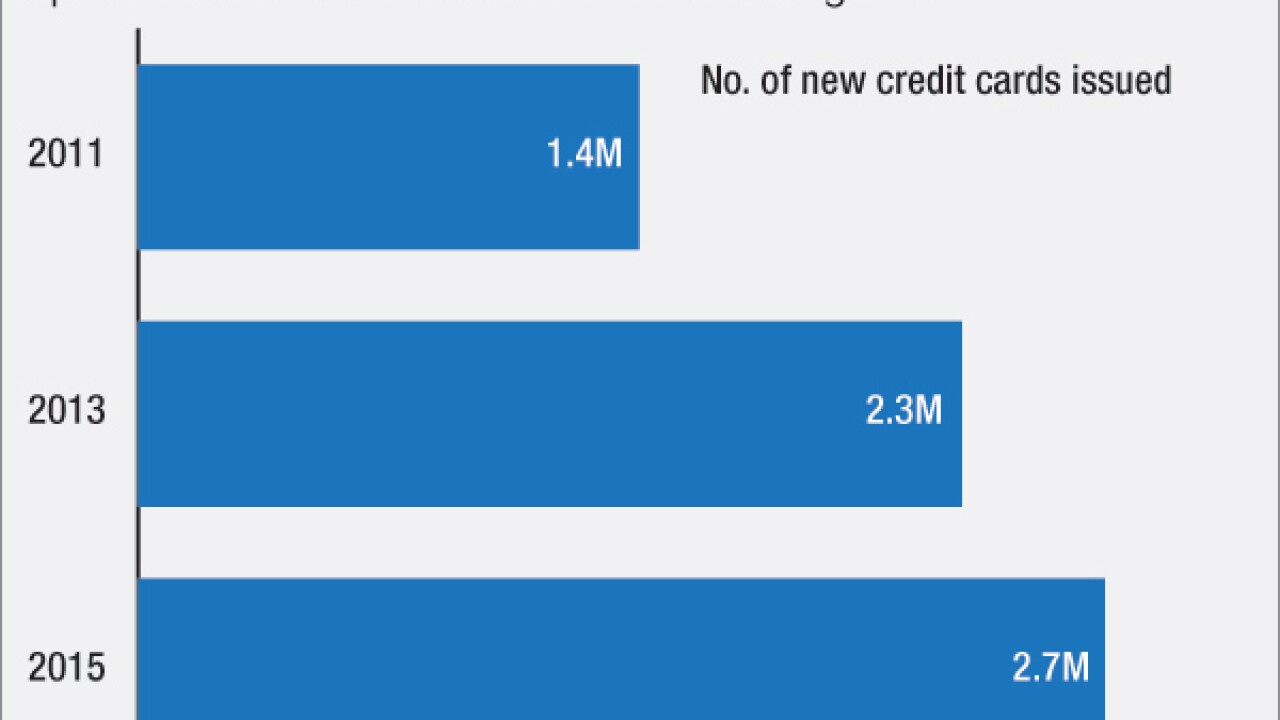

New credit card accounts at JPMorgan Chase have grown by double digits thanks partly to its embrace of borrowers with lower FICO scores, but it sought to reassure investors that credit quality has suffered only slightly.

September 12 -

While troubling factors such as higher risk profiles may be behind the recent lending boom, the industry could also just be returning to the historical average for loan growth following the "Great Panic" of 2008-2010.

September 12

-

The revelation Thursday that Wells Fargo employees were opening accounts for customers without their consent is sparking doubt about the accuracy of the reported growth in the credit card business. The scandal also casts in a harsh new light on Wells strategy of building a large credit card operation through its branch network.

September 9 -

The Financial Accounting Standards Board's accounting rules for credit risk have good intentions, but a likely amplification of the ups and downs of the credit market was probably not one of them.

September 9 Milepost Capital Management

Milepost Capital Management -

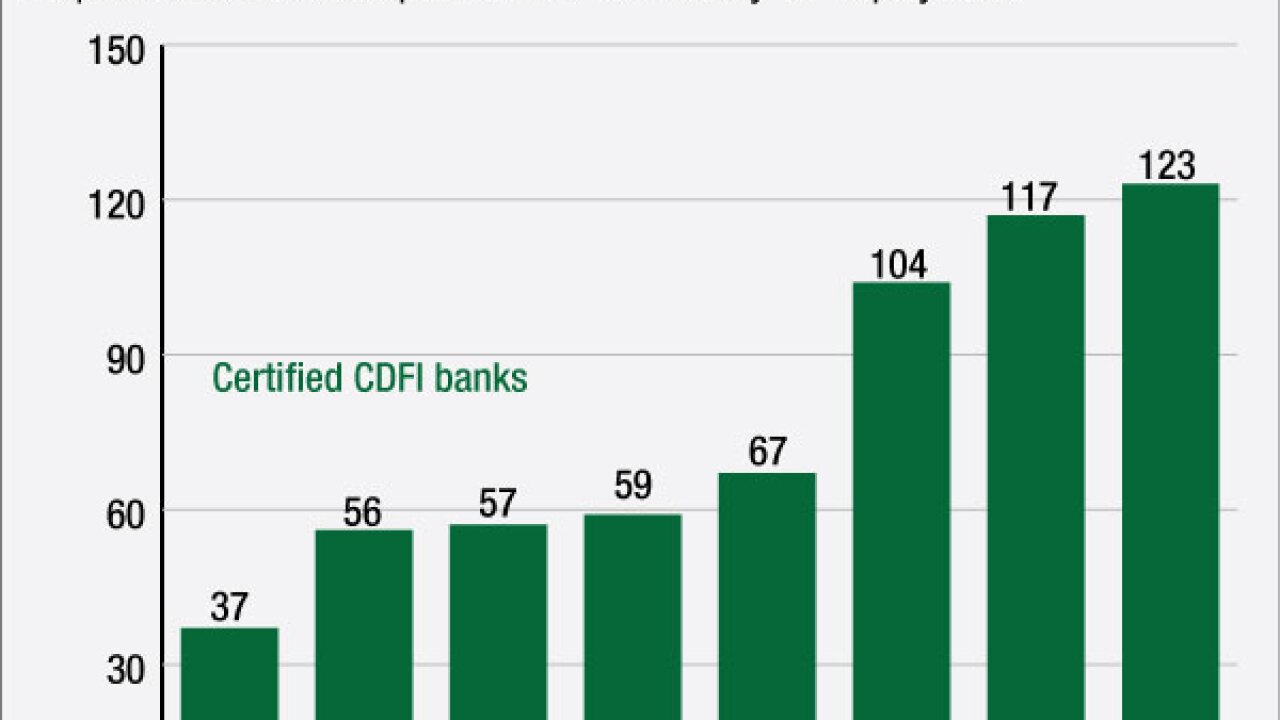

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

The Federal Deposit Insurance Corp.s recent statements encouraging new bank applications are promising, but some barriers to new charters may remain inside the FDIC and we are still waiting for the first de novo of 2016.

September 6 American Bankers Association

American Bankers Association