-

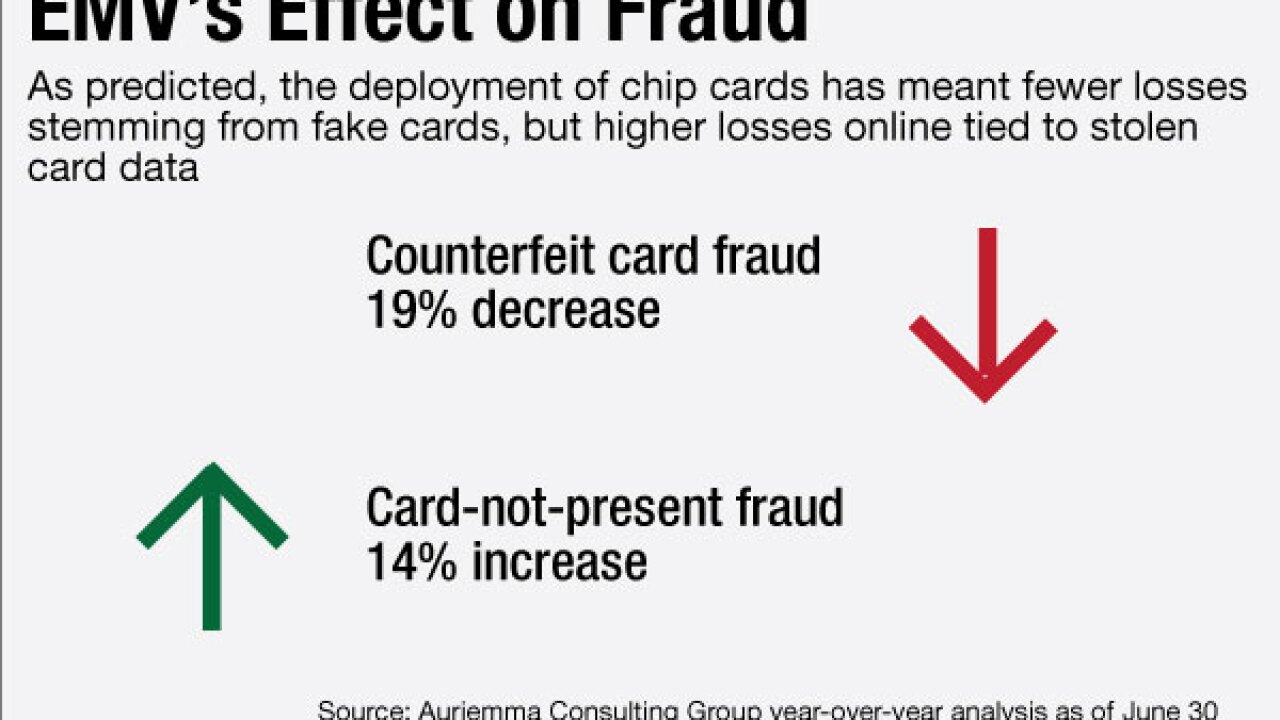

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Banks and data aggregators agree that screen scraping is a practice probably best left behind. In the coming year, the two might get better at sharing data via APIs.

December 12 -

A preview of the next version of Moven's personal financial management app finds a new direction helping people understand the trade-offs they make between short-term and long-term financial goals.

December 6 -

Intuit's personal finance app Mint has launched a bill tracking and payment function to keep customers on top of their bill management.

December 6 -

In the days of diskettes, Quicken was an innovator. Now, the personal financial manager aims to reclaim its glory days as it targets the 35-and-older crowd.

November 18 -

The Center For Financial Services Innovation has released a framework it says is designed to spur safe data sharing between banks, fintechs and third-party data aggregators.

October 24 -

When a mobile banking vendor told a San Antonio Federal Credit Union it didn't have the capabilities it wanted, the institution took a note from Facebook's strategy with Messenger and created a companion app.

September 14 -

Nearly six months into its partnership with TD Bank in Canada, Moven is on the hunt for additional partners as it looks to take its real-time spending insights to the masses.

September 2 -

Screen scraping is an out-of-date way to share transaction data with mobile apps and services. It's high time for banks to invest in OAuth, a protocol that lets customers access their financial data in a portal of their choosing and is secure.

August 24 Wallaby Financial

Wallaby Financial -

Sure, there is an inherent business tension between banks' digital offerings and personal financial management software. However, the ground rules for making account data available to consumers for use in external software products and apps are in place and the so-called rivalry is overblown.

August 23 Quicken Inc.

Quicken Inc. -

A handful of banks and fintech companies are letting bank customers connect via chat bots on platforms like Slack of Facebook messenger. Some say this is the next big thing, while others say the technology still has a ways to go.

August 1 -

Propel Venture Partners, the venture capital firm backed by BBVA, led a $7 million investment round in Guideline, a fintech startup focused on 401(k)s.

July 19 -

The U.K.'s mobile-first Starling Bank has received a banking license from the Financial Conduct Authority and Prudential Regulation Authority.

July 14 -

Banks are experimenting with apps and mobile features that are available to everyone as they search for new ways to connect with potential customers.

July 11 -

UBS is partnering with the technology developer SigFig to launch a robo platform for its 7,000 advisers, making this one of the most high-profile deals of its kind between a wealth management firm and a tech startup.

May 16 -

Sallie Krawcheck unveiled Ellevest, a digital investment platform for women and the latest of her female-oriented ventures, on Wednesday.

May 11 -

Varo Money, a mobile-only startup that focuses on financial health, announced Monday it has raised more than $27 million. The global private equity firm Warburg Pincus led the round.

May 2 -

Two startups are working to educate millennials on the importance of credit and issue them small credit lines. Credit to young adults largely dried up following the CARD Act of 2009, which changed the way banks and others could market to the group.

April 27 -

With the purchase of Sweep, Max Levchin's firm is betting that daily engagement with consumers will pay long-term dividends.

April 27 -

Ally Financial has launched a mobile app that uses geolocation to caution smartphone-carrying customers when they are arriving at stores where they overspend.

April 18