-

A handful of banks and fintech companies are letting bank customers connect via chat bots on platforms like Slack of Facebook messenger. Some say this is the next big thing, while others say the technology still has a ways to go.

August 1 -

Propel Venture Partners, the venture capital firm backed by BBVA, led a $7 million investment round in Guideline, a fintech startup focused on 401(k)s.

July 19 -

The U.K.'s mobile-first Starling Bank has received a banking license from the Financial Conduct Authority and Prudential Regulation Authority.

July 14 -

Banks are experimenting with apps and mobile features that are available to everyone as they search for new ways to connect with potential customers.

July 11 -

UBS is partnering with the technology developer SigFig to launch a robo platform for its 7,000 advisers, making this one of the most high-profile deals of its kind between a wealth management firm and a tech startup.

May 16 -

Sallie Krawcheck unveiled Ellevest, a digital investment platform for women and the latest of her female-oriented ventures, on Wednesday.

May 11 -

Varo Money, a mobile-only startup that focuses on financial health, announced Monday it has raised more than $27 million. The global private equity firm Warburg Pincus led the round.

May 2 -

Two startups are working to educate millennials on the importance of credit and issue them small credit lines. Credit to young adults largely dried up following the CARD Act of 2009, which changed the way banks and others could market to the group.

April 27 -

With the purchase of Sweep, Max Levchin's firm is betting that daily engagement with consumers will pay long-term dividends.

April 27 -

Ally Financial has launched a mobile app that uses geolocation to caution smartphone-carrying customers when they are arriving at stores where they overspend.

April 18 -

Banks are slowly warming up to the idea of open APIs, essentially tools that allow banks to easily connect with others, but BBVA's Shamir Karkal says that they will likely also push banks to modernize their core systems.

April 11 -

More than half of all U.S. households have suffered a "financial shock" in the past five years. Some say mobile apps could help users brace for and recover from such setbacks.

March 30 -

HarborOne Bank is proving that financial education really can improve the bottom line.

March 30 -

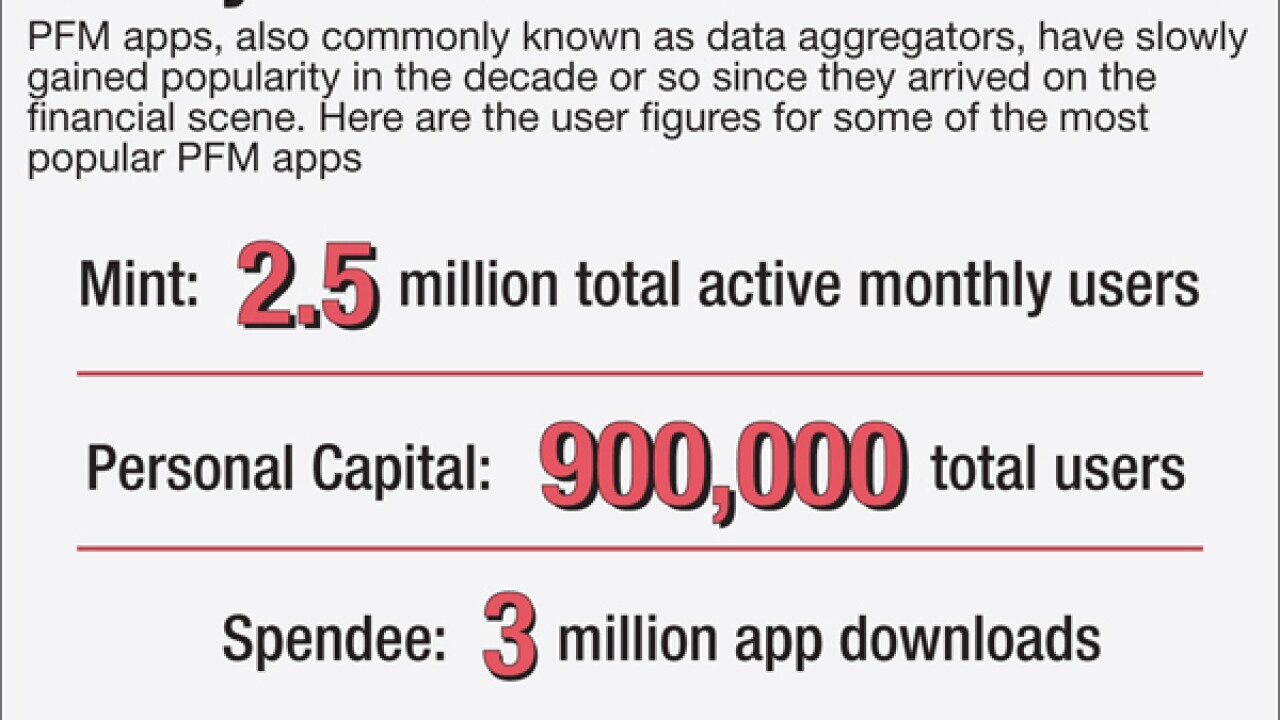

Less than a year after investing in MX Technologies, USAA has partnered with the startup to provide personal financial management tools to its 11.4 million members.

March 15 -

The bank that for many defines ultrawealthy is now in the market to serve investors whose employers don't even offer 401(k)s.

March 14 -

Chase is investing in digital and technology resources in a way that's reminiscent of the Silicon Valley model, as it looks to create more direct interaction with its customers on its website.

March 14 -

Banks need to rethink their purpose to serve its younger customers, many of whom are inundated with choices. Banks have a tremendous opportunity to win these overbanked customers if they can figure out a way to become the financial hub.

March 7 -

The Madrid-based bank announced Thursday that it will invest $250 million in Propel Venture Partners.

February 11 -

HSBC is testing a new money management app that uses push notifications to nudge customers into saving more and spending less.

January 29 -

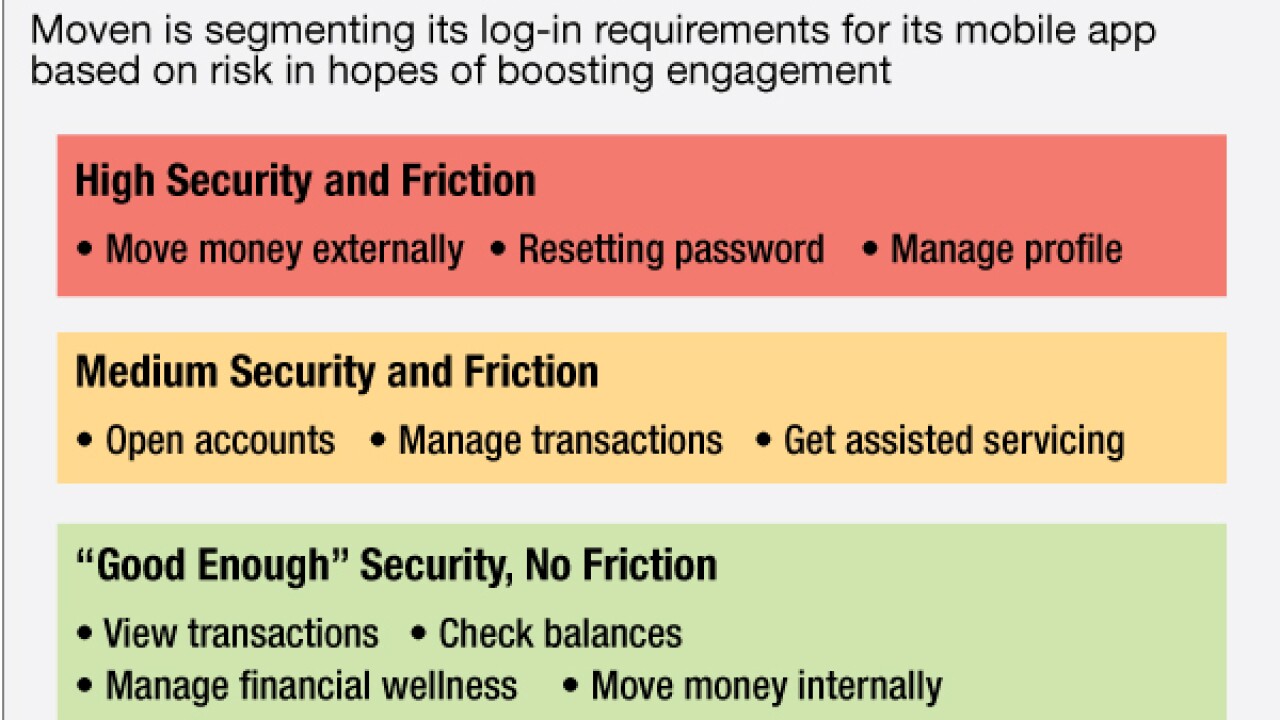

Moven will soon prompt its customers for usernames and passwords only for riskier transactions. By removing the login for most functions, the company aims to drive engagement in an app meant to be used on the go.

December 17