-

A carve-out that shielded billions of dollars in collateralized loan obligations from Dodd-Frank's risk-retention mandate could work against banks and other CLO managers if Dodd-Frank is overhauled.

April 12 -

The Office of the Comptroller of the Currency's top examiner at Wells Fargo was removed last month, according to Reuters.

April 7 -

Reader reactions to criticism of Jamie Dimon, the House GOP ganging up on Richard Cordray, a bank's decision to part with Excel to measure credit losses, and more.

April 7 -

Fifteen months before he resigned under a cloud, Jeffrey Lacker, then president of the Federal Reserve Bank of Richmond, found himself in an odd position.

April 6 -

In a private meeting with lawmakers, White House economic adviser Gary Cohn reportedly said he supports a policy that could radically reshape Wall Street's biggest firms by separating their consumer-lending businesses from their investment banks.

April 6 -

Republicans on the House Financial Services Committee barraged the director of the Consumer Financial Protection Bureau on Wednesday with accusations that the agency is corrupt, as they tried to lay the groundwork for President Trump to remove the director for cause.

April 5 -

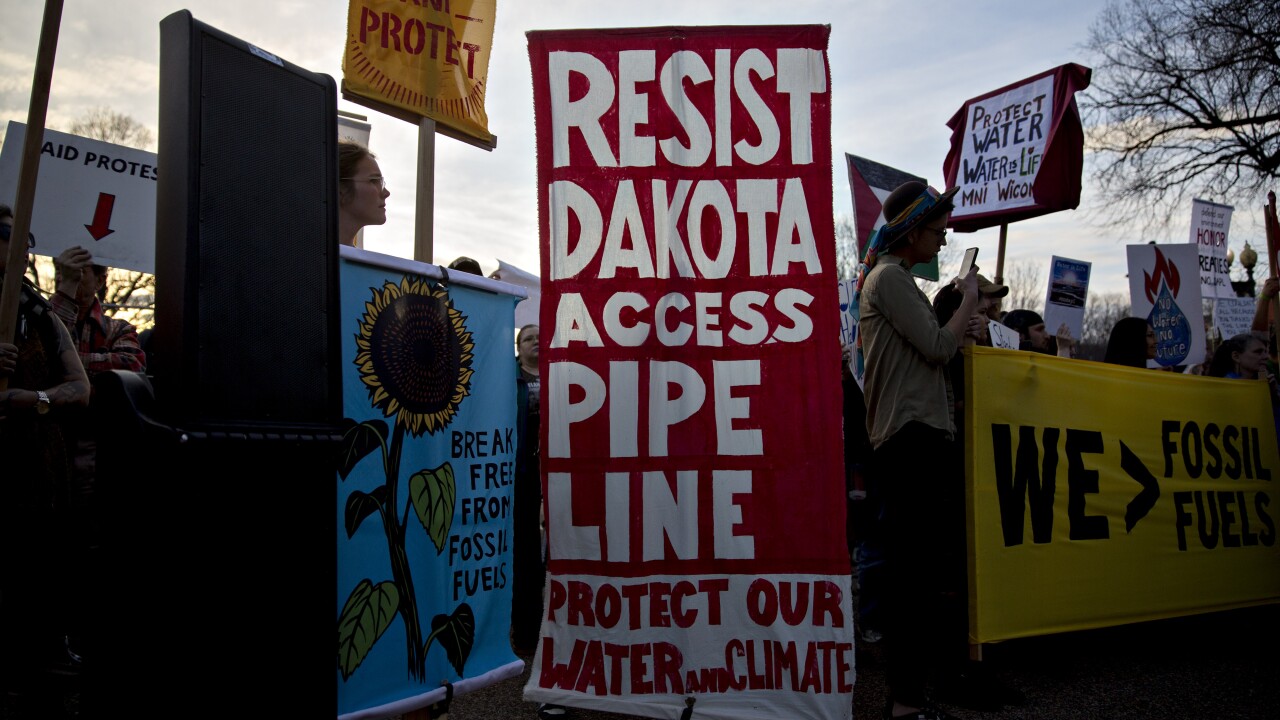

The French megabank has sold its $120 million stake in a $2.5 billion syndicated loan to build the controversial Dakota Access pipeline.

April 5 -

Efforts at regulatory reform often ignore the source of what led to the overregulation in the first place: the legislative process.

April 3 Werb & Sullivan

Werb & Sullivan -

Nearly 40 current and former congressional Democrats — including the namesakes of the Dodd-Frank Act — challenged the notion that Congress may not dictate the organization of federal agencies.

March 31 -

Policymakers speak of expanding consumer choice, but for the vast majority of borrowers and investors, standardizing choices that make the most financial sense has greater merit.

March 31