-

Sen. Elizabeth Warren, D-Mass., said the new ethics rules on securities trading by Federal Reserve officials are insufficient and reiterated her opposition to the renomination of Jerome Powell to a second term as Fed chairman.

October 21 -

The central bank's new ethics guidelines follow revelations that several high-level officers engaged in questionable trading activity last year while privy to the Fed's internal discussions about its coronavirus response.

October 21 -

-

More banks are boosting salaries to lure and keep workers in a highly competitive hiring market, but the pressure is on to trim expenses elsewhere to offset the pay hikes.

October 12 -

-

-

-

-

As part of American Banker's Most Powerful Women in Banking and Finance program, we have selected five "Top Teams" for 2021. Centric Financial is one of the team honorees.

October 6 -

Sen. Elizabeth Warren, D-Mass., said questionable financial transactions by senior Federal Reserve officials — two of whom have resigned — cast doubt on Fed Chair Jerome Powell’s ability to steer the central bank as President Biden mulls whether to reappoint him.

October 5 -

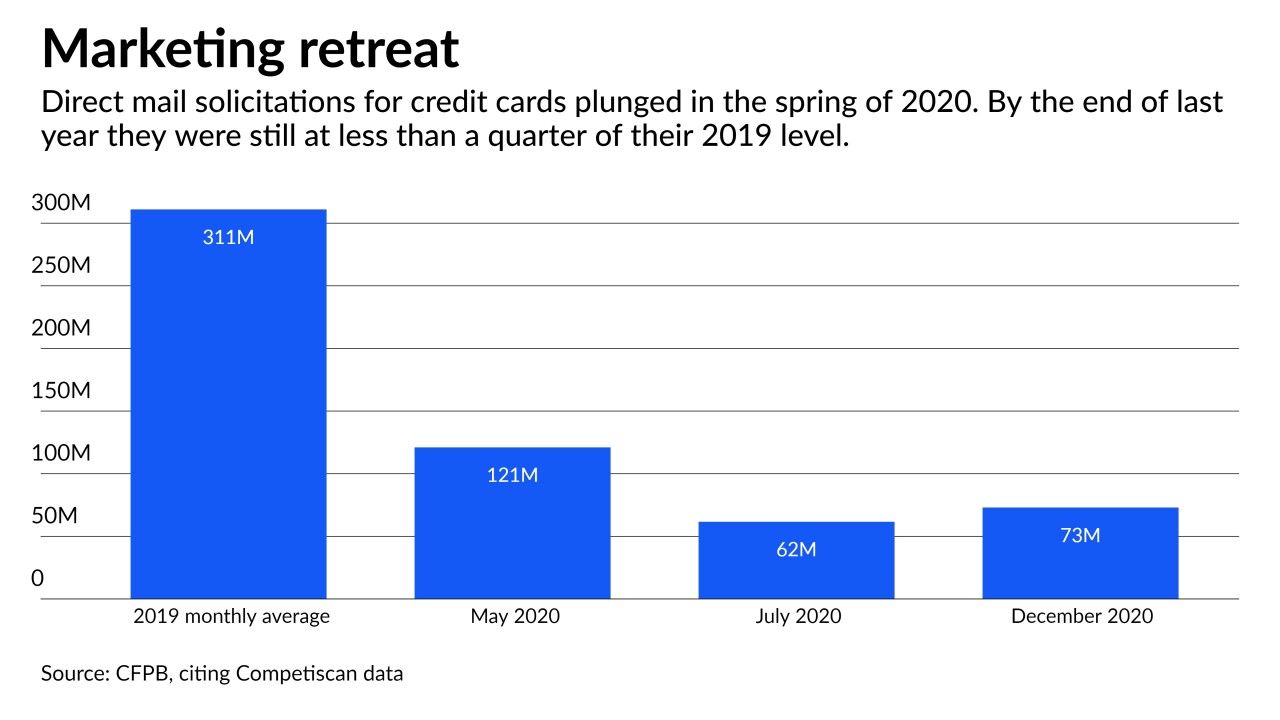

Banks generally did not curtail loans to existing cardholders last year despite mass unemployment, according to new research by the Consumer Financial Protection Bureau. The results contrasted with what happened during the Great Recession.

October 1 -

Brent McIntosh is joining Citigroup as it overhauls its internal systems to modernize the bank and satisfy two regulatory consent orders.

September 28 -

Federal Reserve Bank of Dallas President Robert Kaplan cited his desire “to eliminate any distractions” at the central bank just hours after his Boston Fed counterpart, Eric Rosengren, said he will leave earlier than planned because of a health issue. They had engaged in stock transactions that drew criticism in light of their knowledge about the Fed's pandemic response.

September 27 -

A new study from Moody’s found a small correlation between greater gender diversity and higher credit ratings. But researchers at the ratings firm warned that their efforts were hampered by a lack of consistent data.

September 24 -

The chair of the Federal Reserve said the backlash over the personal financial transactions of two Fed bank presidents — made when they were privy to discussions about the central bank’s coronavirus response — demonstrated that internal guidelines can be bolstered to avoid the appearance of conflicts.

September 22 -

Anthony Taylor was recently honored for his hard work in helping build Ascend into one of the largest credit unions in Tennessee. Taylor says he jumped at the opportunity to give back to the credit union that decades earlier welcomed him and other Black consumers when they struggled to find affordable credit elsewhere.

September 20 -

Josh Wooley succeeds Glenna Jarvis, who retired in June as president and CEO. Wooley had worked at a larger credit union across the Kansas state line.

September 16 -

Truepic, which helps companies like banks and insurers fight fraud by verifying images, raised $26 million in a funding round led by Microsoft’s M12 venture capital arm.

September 14 -

In the wake of Hurricane Ida, the latest storm to batter the Gulf Coast, John Hairston is grappling with the consequences of a warming planet. He suggests that it's imperative for banks and their regulators to be part of the solution.

September 14 -

The sale comes nearly a year after the Cleveland bank said it would stop making consumer loans through car dealerships and focus more on relationship-oriented businesses. It plans to spend the proceeds on repurchasing up to $585 million of its own stock.

September 13