-

The Charlotte, N.C., company has shuttered 400 branches in the past year and intends to close nearly 500 more by early 2022. It’s also eliminating office space and reducing headcount as it aims to keep quarterly expenses under $3 billion.

April 15 -

Janet Sanders has retired after 13 years at the helm of the $142 million-asset credit union. She is succeeded by the credit union's longtime executive vice president, Shelley Sanders. The two are not related.

April 15 -

The Iowa company, which operates a dozen individually branded banks, now has a name that matches its stock symbol.

April 14 -

PNC Financial Services Group Chief Executive Bill Demchak said he wants to position the bank to perform in a sector in which smaller firms are disappearing amid a wave of consolidation.

April 14 -

The company will gain seven branches, including one in Richmond, Va., after it acquires Sevier County, which is based in eastern Tennessee.

April 14 -

Net income was boosted by a $1.6 billion release of loan-loss reserves.

April 14 -

The Michigan-based institution has positioned itself for additional growth by making it easier to qualify for membership.

April 13 -

The Wisconsin company is paying $248 million for Mackinac, which has $1.5 billion of assets and $1.3 billion of deposits.

April 12 -

The Mississippi company has never done a deal this large. But buying Houston-based Cadence would take it into high-growth markets and reduce both companies' concentrations in sectors such as energy, dining and hospitality.

April 12 -

Katz Investment agreed to buy Camp Grove Bancorp in March 2019. The Federal Reserve approved the buyer's application to form a bank holding company earlier this year.

April 12 -

The Louisiana credit union holds just $3.5 million of assets and could not find a successor for its retiring chief executive.

April 12 -

Bank of Montreal agreed to sell its Europe, Middle East and Africa asset management unit to Ameriprise Financial for 615 million pounds ($847 million), marking CEO Darryl White’s biggest move yet to trim the bank’s portfolio of noncore businesses.

April 12 -

BancorpSouth would have $44 billion of assets after it buys Houston-based Cadence. The company will be rebranded, while the bank will retain the Cadence name.

April 12 -

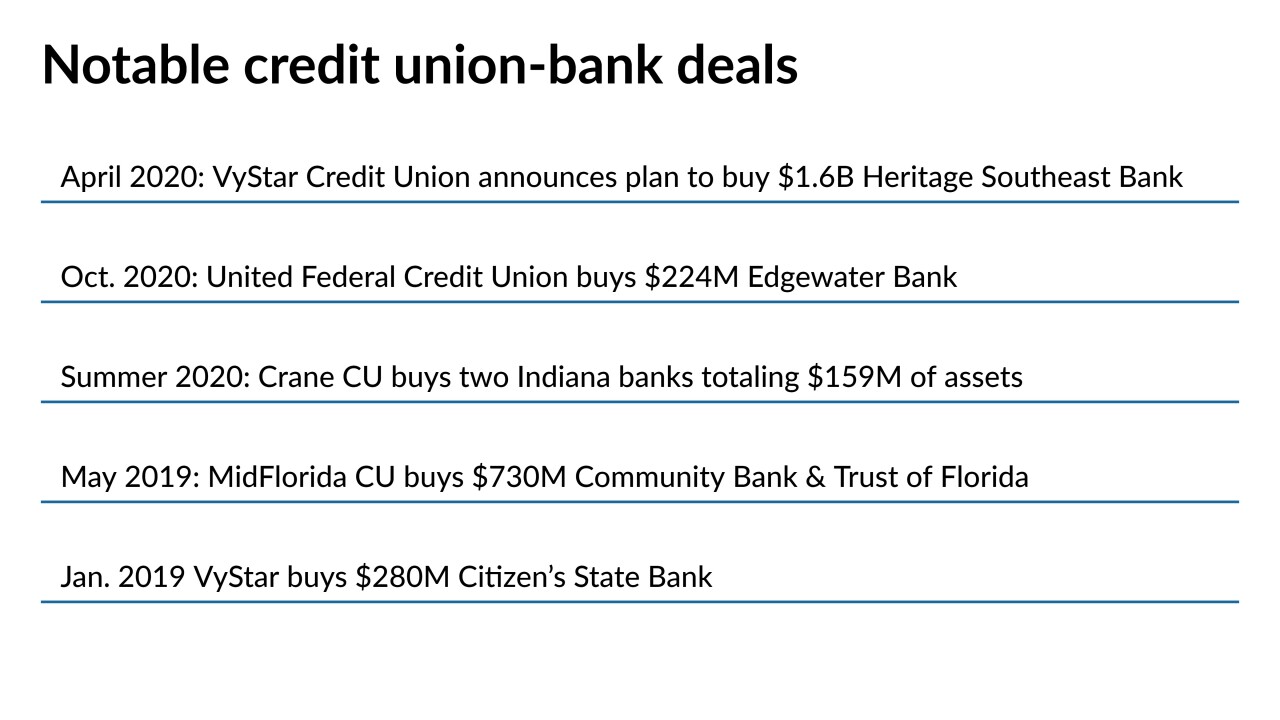

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

Ann Dubie stepped down from the Joliet, Ill.-based credit union in March after 20 years at the helm.

April 9 -

Valley National wanted to become more customer friendly, while Washington Federal needed more commercial clients. The leaders of those companies recently discussed the tough decisions they made to bring about much-needed change.

April 9 -

The California company has not established a time or pricing for the IPO.

April 9 -

The deal will see the $16 million-asset Georgetown FCU join the $258 million-asset PAHO/WHO. The combined institution will serve more than 7,500 members.

April 9 -

Dozens of European and U.S. banks are considering throwing their weight behind the White House’s Earth Day summit under plans being drawn up by former Bank of England Gov. Mark Carney.

April 9 -

With its deal for Century Bancorp, Eastern will significantly boost its deposit share in greater Boston while gaining an entrée into several new business lines, including cannabis banking.

April 8