-

The Louisiana company sold $30 million in stock to help fund its purchase of Cheaha Financial Group.

December 20 -

Credit unions across the country are increasing their charitable giving for the 2019 holiday season.

December 20 -

Renee Ouellette has taken the helm as a permanent successor to UCU's previous CEO, who took a position with a bank earlier this year.

December 20 -

Following a merger earlier this fall, McCone County FCU has unveiled its new name.

December 20 -

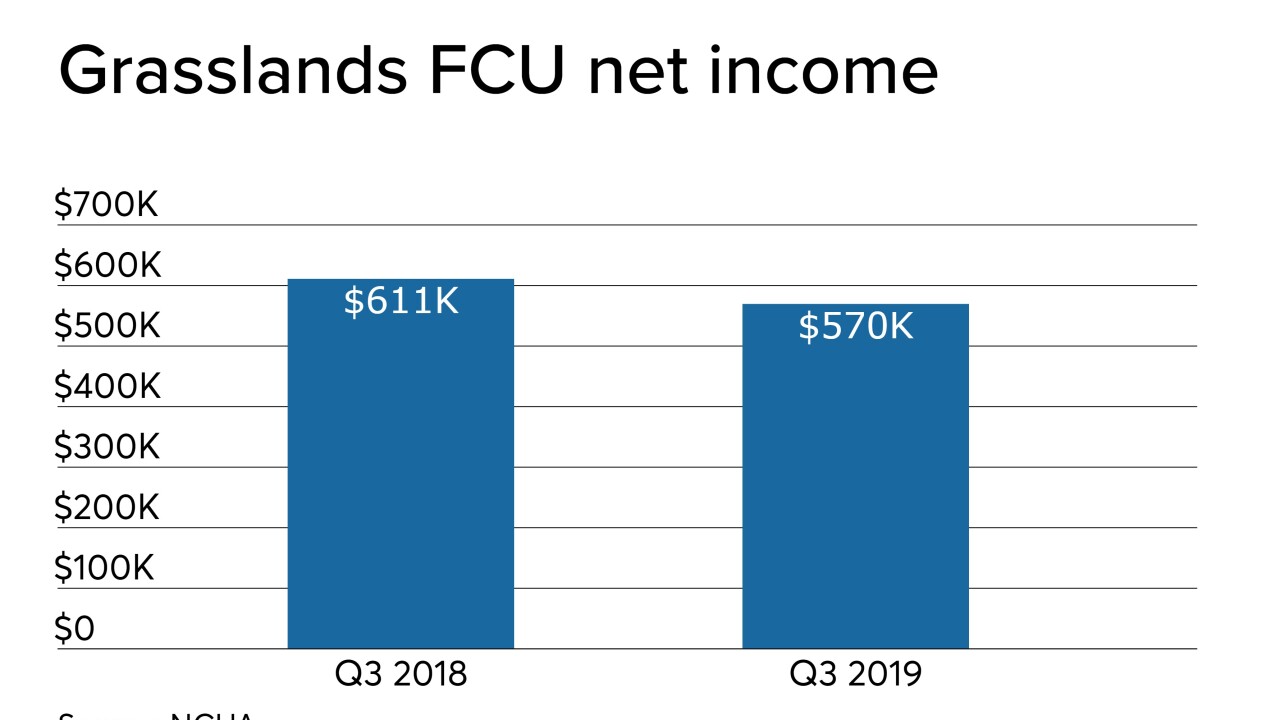

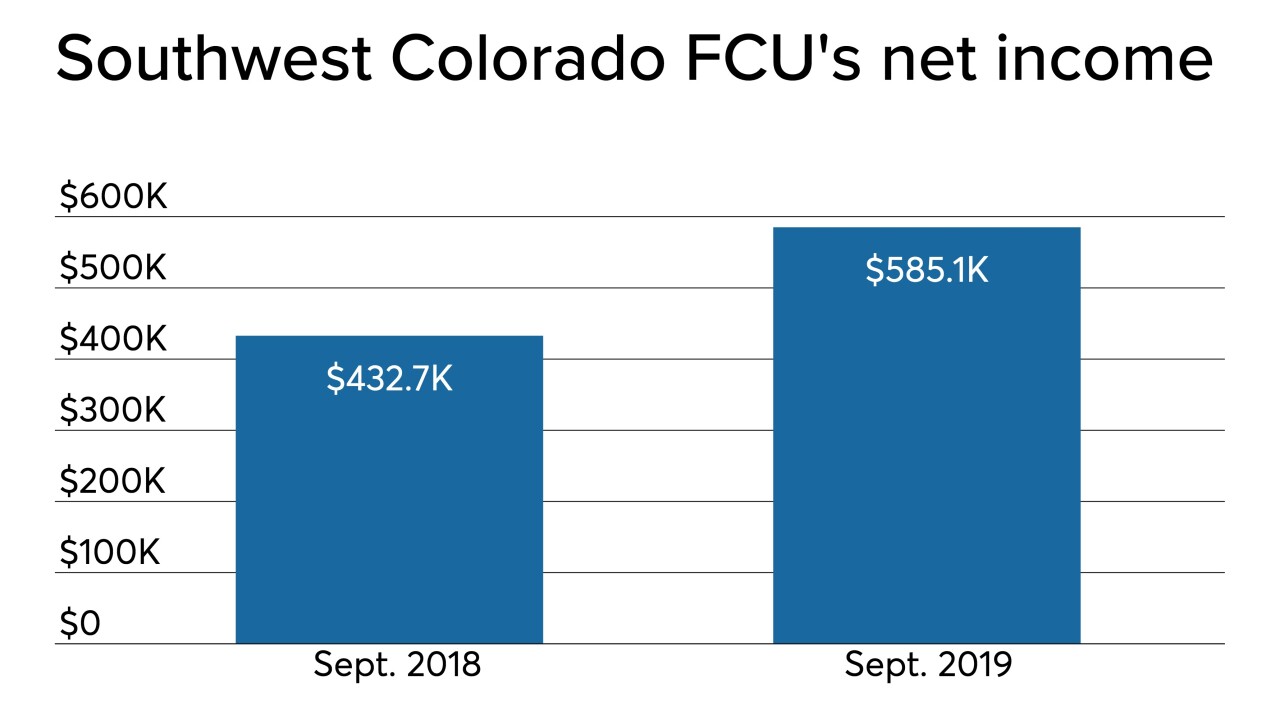

Members of Southwest Colorado Federal Credit Union in Durango have approved a deal that will see the $55 million-asset shop merge into Credit Union of Colorado.

December 20 -

The state has proposed a law to cap the interest rate on certain consumer loans, but nonbanks aim to skirt it by seeking a rent-a-charter.

December 20 California Department of Business Oversight

California Department of Business Oversight -

The upstate New York company will gain branches in Rochester as part of its $35 million purchase of FSB Bancorp.

December 20 -

The company will pay about $58 million in cash for Melrose Bancorp.

December 19 -

Coastal Credit Union and Hascom FCU have added to their IT departments while others have appointed board members, recognized employee landmarks and more.

December 19 -

Five years after rebranding as a growth strategy, small Turbine FCU has been approved to merge into Durham, N.C.-based Self-Help Credit Union.

December 19 -

The Tennessee company said Rob Garcia will be in charge of building a commercial banking team in the city.

December 19 -

The company will pay $94 million for a bank with operations in New Jersey's Somerset and Morris counties.

December 19 -

The Mississippi company will also top $4 billion in assets when it buys Southwest Georgia Financial.

December 18 -

The Pennsylvania company will pay $65 million for six branches that will join its Buffalo, N.Y., division.

December 18 -

The company, which recently bought Monument Bank, has agreed to acquire Covenant Financial.

December 18 -

Charles Peck, the head of public finance, is temporarily joining the leadership of the public affairs team.

December 18 -

A dearth of bigger acquirers will likely force more banks with less than $2 billion in assets to seek out their own deals.

December 18 -

The New Jersey company paid $336 million for all stock owned by Blue Harbour Group.

December 18 -

It's no longer enough to conduct traditional demographic analysis of customers. TD Bank wants to know what is going on with individual consumers at any given moment and respond accordingly.

December 18 -

The credit union service organization has returned more than $20 million to member-owner institutions each year since at least 2016.

December 18