-

Bank's profits grow 5% on earnings growth; Citi's number 2 exec retirement shows the difficulty retaining a host of top executives.

April 12 -

Readers respond to this week's big-bank CEO hearing before the House, weigh the debate over Community Reinvestment Act reform, consider whether Wells Fargo needs a new brand and more.

April 11 -

Jamie Forese, long considered the potential successor to Citigroup Chief Executive Officer Michael Corbat, is departing after 34 years at the firm.

April 11 -

Some credit unions are embracing technology that makes it easier for consumers to start the notoriously difficult process of changing financial institutions.

April 11 -

Tanya Hobson will take over for Mechelle Johnson, who will step down in June after 24 years at the helm of the South Dakota-based institution.

April 10 -

A House Financial Services Committee hearing featuring seven large-bank CEOs tackled a host of contentious subjects, as Republicans and Democrats sparred over whether such institutions are simply too big.

April 10 -

The resignation of Wells Fargo CEO Tim Sloan represented more troubles for an already scandal-ridden financial institution.

April 9 -

The heads of three agencies reiterated their concern about the bank’s progress in fixing risk management and corporate governance flaws.

April 9 -

With an implementation deadline less than a year away, bankers will be pressed to detail how a new accounting rule for loan losses will affect reserves, earnings and capital.

April 9 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

Credit unions have promoted and hired employees in a variety of areas, including membership experience and operations, marketing, real estate lending and collections.

April 9 -

PR campaigns won’t be enough to salvage the bank’s reputation after a series of scandals. Instead, it should look into adopting a new name, among other crucial steps.

April 9 K.H. Thomas Associates

K.H. Thomas Associates -

The combined organization, representing nearly 500 member credit unions, is expected to launch early next year.

April 8 -

A plan to join Deer Valley and Canyon State credit unions still needs approval from regulators and members of both institutions.

April 8 -

The companies had planned to make Chemical CEO David Provost the new leader before October's market gyrations led them to break off talks. When they revisited the deal, several things changed — including Provost's role.

April 8 -

Hood was recently confirmed to the board after having previously served with the regulator from 2005 to 2010. He takes over for Mark McWatters, who often generated controversy.

April 8 -

Since Wells Fargo’s phony-accounts scandal broke in 2016, the bank has appeared contrite in public. In private, it’s a different story.

April 7 -

Mark Fierro, who was previously the CUSO's chief operations officer, was named as interim CEO late last year.

April 5 -

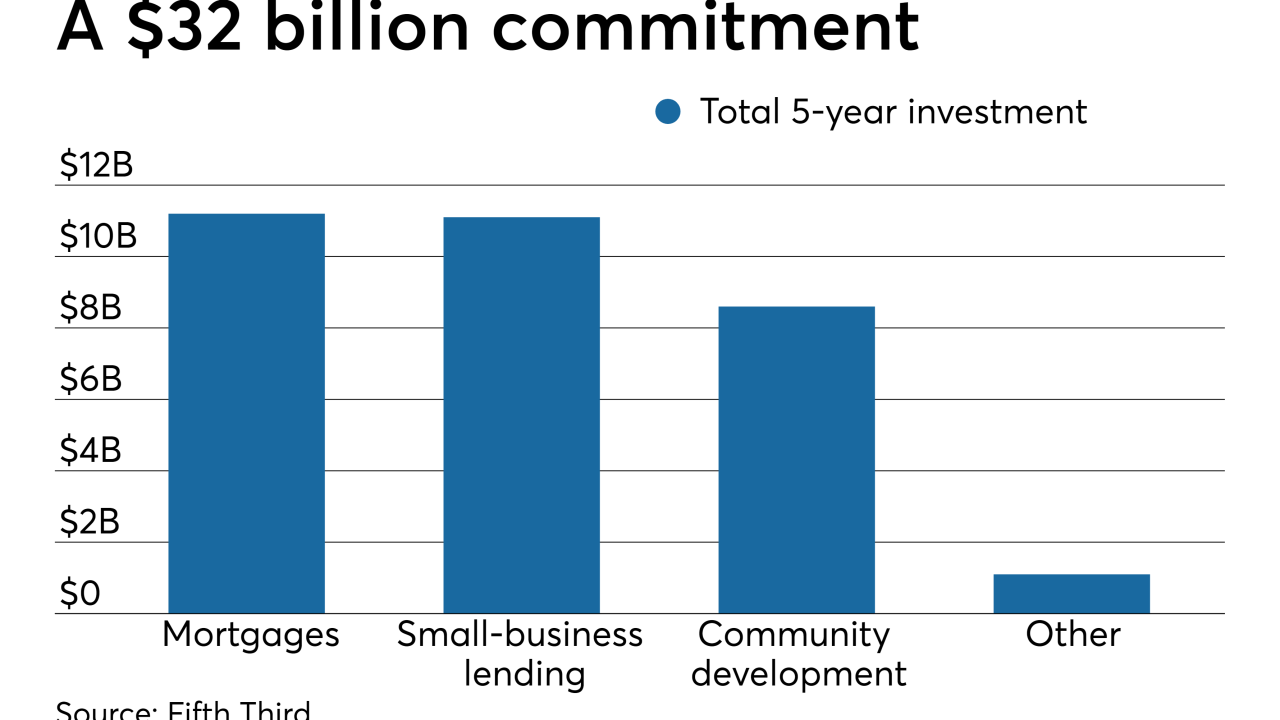

The bank is pledging to lend another $2 billion in a market where it has invested $3.6 billion in various community development initiatives since 2016. Most of the new funds will be used to make loans to small businesses that operate in low- and moderate-income neighborhoods.

April 5 - Moynihan's call for unity, CFPB payday revamp, Morgan Stanley's AI strategy: Top stories of the week

'There is no division in our industry,' BofA's Moynihan says; why CFPB's payday revamp is an even bigger deal than you think; Morgan Stanley's new data strategy for higher-quality AI; and more from this week's most-read stories.

April 5