-

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

The Massachusetts senator asked Richard Fairbank in a letter why the bank didn’t detect the breach for nearly four months and how it plans to prevent future cyber intrusions.

August 8 -

The Cincinnati regional bank says it will spend an extra $15 million a year to offer more competitive pay that it hopes will attract talented front-line employees.

August 6 -

Lenders could struggle to reprice deposits fast enough to offset downward pressure from adjustable-rate loans and refinancing.

August 6 -

The Los Angeles unit of Royal Bank of Canada plans to use FilmTrack to handle more complex transactions for major networks, studios and distributors.

August 6 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

The year's second-biggest bank merger created a Midwestern regional with nearly $50 billion in assets, and its CEO and executive vice chairman don't intend to stop there.

August 1 -

Earnings at the U.S. unit of the Spanish banking giant Banco Bilbao Vizcaya Argentaria fell 13% from a year earlier.

July 31 -

Banks submit millions of Bank Secrecy Act filings each year, yet only a fraction are valuable to law enforcement.

-

To combat the notion that regional banks’ tech offerings are inferior, the combined BB&T-SunTrust will have to go “toe-to-toe” with big banks, BB&T chief Kelly King said ahead of shareholder approval of the deal Tuesday.

July 30 -

Credit quality is being second-guessed after several banks reported higher 2Q charge-offs.

July 29 -

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

KeyCorp, Regions Financial and others have sacrificed short-term profits to avoid being crushed by an anticipated decline in interest rates.

July 23 -

Earnings at the Cincinnati company fell 25% from the same period last year, largely due to $109 million in expenses tied to its March acquisition of MB Financial.

July 23 -

Pressure to raise rates on deposits offset strong loan growth at the Salt Lake City company.

July 22 -

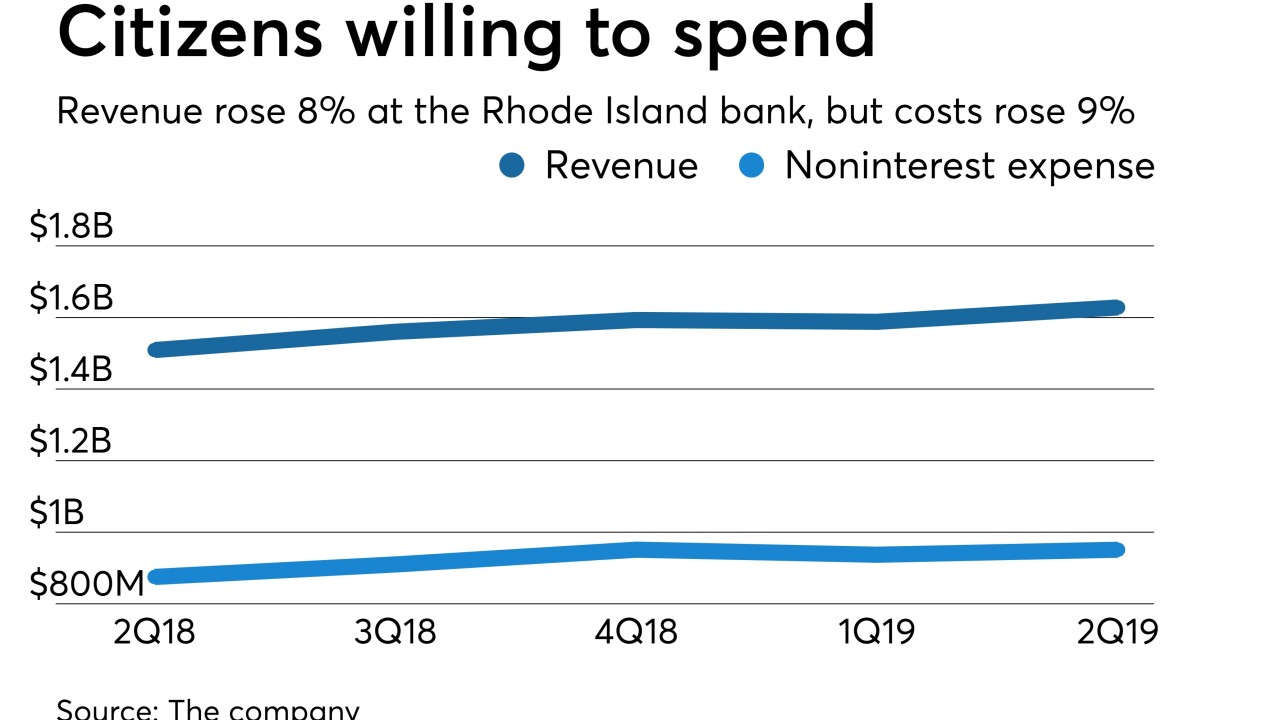

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

The Birmingham, Ala., company warned in its earnings call that moves by the central bank could make it harder to lower costs.

July 19 -

While executives at the Buffalo, N.Y., bank said they would take a closer look at spending, especially given the potential for interest rate cuts, they described investments in tech talent as an essential cost of doing business.

July 18 -

Ahead of a House hearing to examine his company's proposed merger with SunTrust, King tried to downplay regulatory concerns.

July 18 -

Executives at the Minneapolis bank, who expect two Fed rate cuts this year, said they can rely on growth in noninterest income to soften the blow.

July 17