-

The Los Angeles company will sell $1.6 billion in loans, largely tied to technology and health care, by the end of this year.

December 11 -

Fifth Third last bought a bank in 2008, but CEO Greg Carmichael says "strategic bank M&A absolutely makes sense," and the Cincinnati bank is poised to clear up a blot on its regulatory record that blocked dealmaking.

December 7 -

The company has been working to address an informal agreement with regulators tied to Bank Secrecy Act compliance.

December 7 -

The fires are raging in Los Angeles and Ventura counties, prompting California's governor to declare a state of emergency.

December 7 -

As some lenders exit indirect auto lending, those that stick around have an opportunity to control pricing and reach more customers.

December 7 -

The Tennessee company also set high expectations for revenue opportunities while projecting it will deliver a 15% return on equity in 2019.

December 5 -

During an industry conference Tuesday, executives from PNC, Wells Fargo, JPMorgan Chase and elsewhere offered differing takes on whether the Republican tax plan will boost loan demand.

December 5 -

Eagle Bancorp vigorously defended itself after a potential short seller made claims of dubious insider dealings, pushing back harder than many banks have in the past.

December 5 -

The expected refund is tied to loans that investors bought when they acquired the failed BankUnited in 2009.

December 4 -

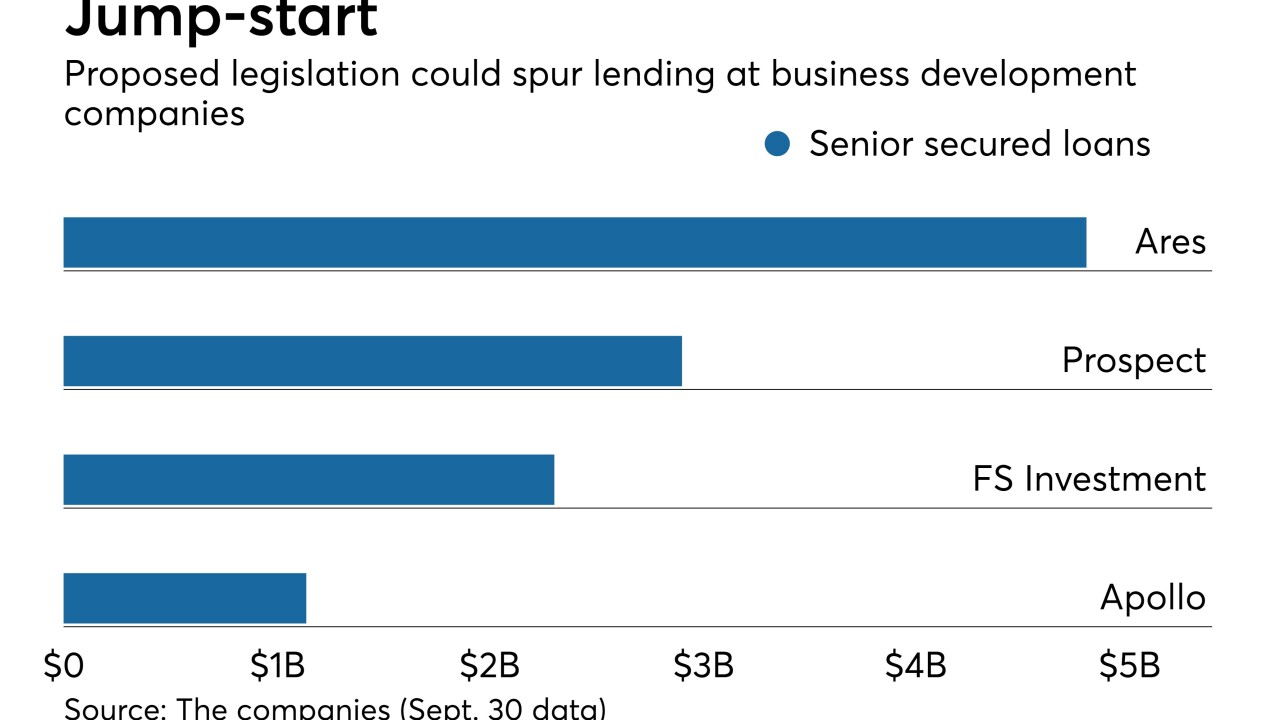

The Small Business Credit Availability Act aims to double the debt-to-equity ratio for business development companies. Increased leverage could spur more lending to small and midsize borrowers.

December 4 -

American Banker’s award winners for 2017 had moments in their careers where hard knocks taught an indelible lesson, they trusted their gut or they listened to good advice. Here is a takeaway from each of their stories.

December 4 -

The $528 million acquisition ends months of speculation that the foreign-owned banks were pursuing a deal.

December 1 -

Five years have passed since M&T agreed to buy Hudson City, only to be tripped up by anti-money-laundering issues. With a clean bill of health from regulators and Hudson integrated, management is again talking about its interest in deals.

December 1 -

The bank has taken a decisive step to protect its asset quality, but the move also raises questions about what will drive loan growth in the future — and whether the company is on the block.

November 29 -

For remaking East West Bank from a small savings institution into a $36.3 billion-asset player with a seat on the front lines of U.S.-China relations — all while churning out record earnings year after year — American Banker is recognizing Ng for being a "Consistent Performer" as part of our 2017 Banker of the Year awards.

November 28 -

The service will require more coordination between the bank and its parent company, BNP Paribas.

November 28 -

The pilot could help the agency improve its image after past criticism of slow responses to catastrophes.

November 28 -

A decision to slash the equity required for most change-in-ownership loans could help the small-business lending program top its recent record.

November 22 -

While technology will let many banks cut staff and reduce the size of branches, factors such as geography, customer demographics and strategic direction will ultimately shape the look and feel of future offices.

November 16 -

It’s good to be a business lender with a long contact list. Loan growth is weak and the talent pool has been shrinking, so banks big and small are paying top dollar to get an edge.

November 16