-

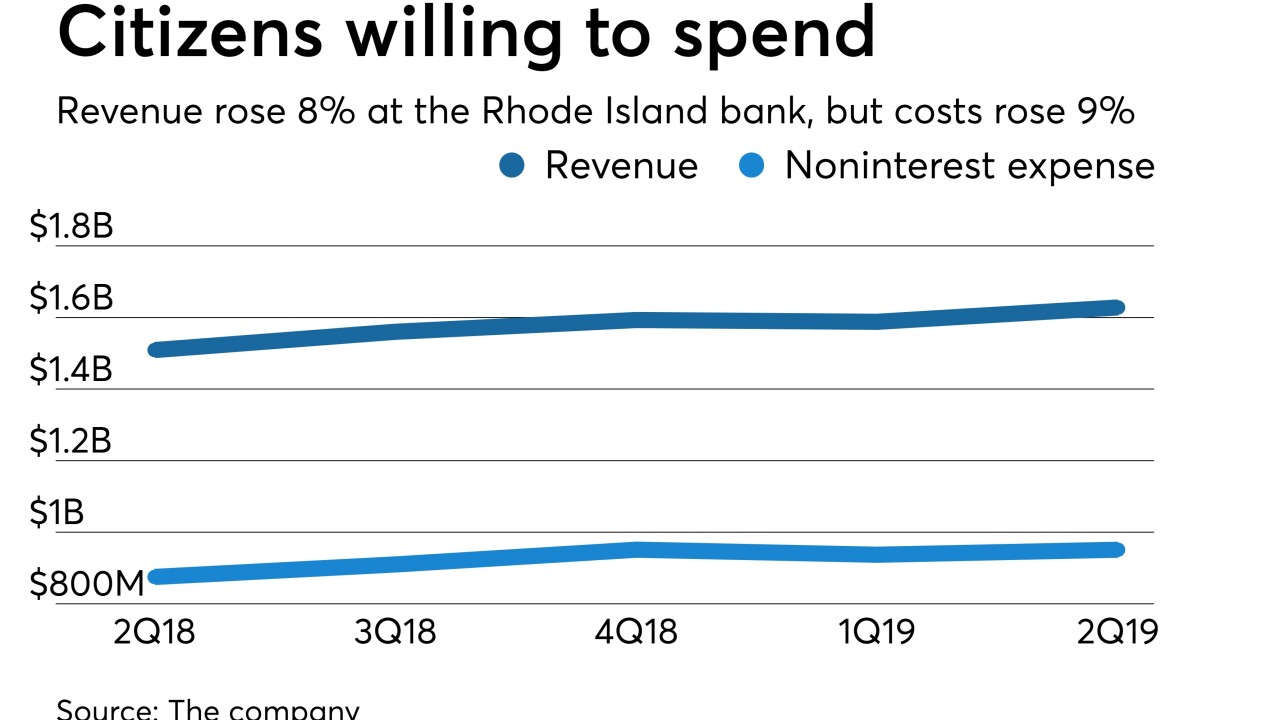

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

The Birmingham, Ala., company warned in its earnings call that moves by the central bank could make it harder to lower costs.

July 19 -

While executives at the Buffalo, N.Y., bank said they would take a closer look at spending, especially given the potential for interest rate cuts, they described investments in tech talent as an essential cost of doing business.

July 18 -

Ahead of a House hearing to examine his company's proposed merger with SunTrust, King tried to downplay regulatory concerns.

July 18 -

Executives at the Minneapolis bank, who expect two Fed rate cuts this year, said they can rely on growth in noninterest income to soften the blow.

July 17 -

CEO William Demchak, encouraged by early returns from new branches in Dallas and Kansas City, Mo., plans to enter even more markets.

July 17 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

The Memphis, Tenn., regional will explore the use of voice assistants as part of its digital banking push.

July 16 -

The agency's board voted 3-1 on Tuesday to give large banks additional time to comply with new rules that force them to keep better track of insured deposits.

July 16 -

The Cleveland regional said the matter is tied to a commercial client and that law enforcement is investigating it.

July 16 -

The Georgia regional plans to open more branches in the state as it looks to loan growth and fees as a way to offset intense competition for deposits.

July 16 -

The Connecticut company will add heft in its home state and Massachusetts when it buys the former mutual.

July 15 -

Aside from BB&T-SunTrust, dealmaking got off to a sluggish start this year. But that may soon change, not just because of pressure to achieve scale. For many banks and credit unions, a technology-capability gap could be the determining factor.

June 28 -

Some large banks, including Bank of America and JPMorgan Chase, will increase dividends and stock repurchases by double digits.

June 28 -

The new accounting standard for loan losses combined with an expected rule change around incentive-based compensation could hit bank chiefs in the wallet, according to a new report.

June 28 -

While other industries reversed their previous downward trend, perceptions of the banking industry continue to get worse. Here are some steps banks can take to try to burnish their reputations.

June 25 -

House Financial Services Committee Chairwoman Maxine Waters wants to examine the merger of BB&T and SunTrust, as well as Facebook's cryptocurrency plans.

June 24 -

Shareholders of both companies will meet separately next month to cast ballots on the $28 billion deal, and BB&T investors will also decide whether the new company should be called Truist Financial.

June 19 -

Truliant Federal Credit Union claims that the BB&T-SunTrust post-merger brand represents trademark infringement and unfair competition.

June 17