-

With virus cases in its home state hitting their highest level since February, the San Antonio company declined to release reserves — a route that many banks took to boost their second-quarter profits.

July 30 -

The Rhode Island bank is doubling down on the nation’s largest market after agreeing in May to buy dozens of branches from HSBC. Meanwhile, Investors Bancorp’s decision to sell itself underlines the challenges facing smaller regionals.

July 28 -

Combined with its pending acquisition of HSBC's East Coast branches, the deal would give the Rhode Island-based Citizens a top-10 deposit market share in metropolitan New York.

July 28 -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

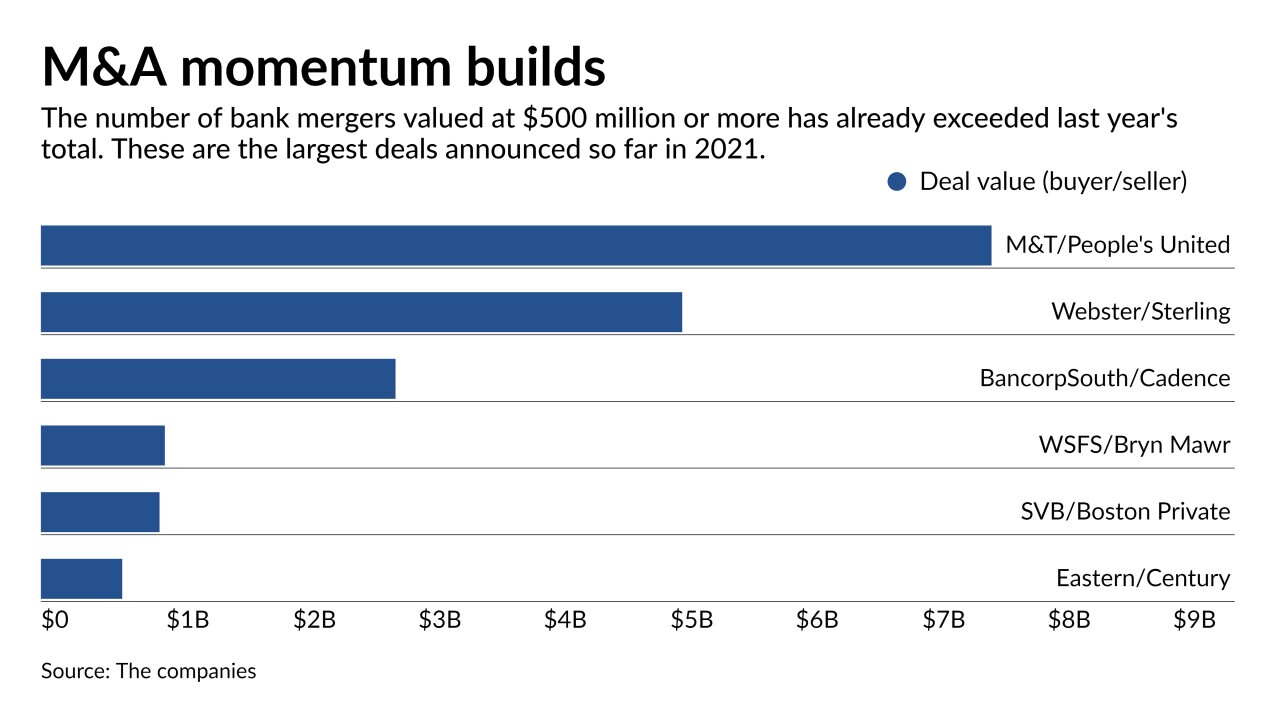

A flurry of activity in recent weeks has prompted chatter on earning calls about banks’ merger ambitions. While some CEOs bemoaned high asking prices, others said they are making more inquiries, identifying targets and, in some cases, closing in on deals.

July 21 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

PNC, Regions and TD are among the banks that have taken steps to reduce their reliance on charges that disproportionately hit consumers living paycheck to paycheck. The changes come at a time when the Biden administration is expected to take a tougher stance on overdrafts.

July 13 -

Andrew Harmening, who took the helm of the Wisconsin company in April, pointed to an economy emerging from the pandemic and waning loan deferrals, saying that loan growth could resume by the end of the third quarter.

July 1 -

Cannabis, though still illegal at the federal level, continues to inch into the financial mainstream. Small credit unions and lenders as large as Valley National and East West have moved beyond just taking deposits from marijuana companies.

June 21 -

Adding Community Bankers Trust would help United fill a key service gap between its branches in Northern Virginia and the Carolinas. It's United’s 33rd M&A deal under CEO Richard Adams.

June 3 -

The company had delayed a vote set for late April to give it more time to collect the legally required support from two-thirds of its outstanding shares.

May 4 -

Joe Skarda, who was previously managing director of JPMorgan Chase’s U.S. wealth management central division, will oversee a unit that houses Key’s private bank, family wealth and mass affluent business segments.

April 30 -

The company’s retail banking and auto-lending businesses in the U.S. generated a larger share of overall profits in the first quarter, and Executive Chairman Ana Botín and other executives unveiled expansion plans for both units.

April 28 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

April 28 -

The Tennessee company said an unauthorized party gained access to dozens of accounts and obtained less than $1 million from some of those accounts.

April 28 -

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

The Ohio company has opened just 32 of 120 new branches it plans in the region by 2022, but those offices are making a sizable contribution to growth.

April 20 -

The Connecticut company will have more than 200 branches and $64 billion of deposits after completing the acquisition.

April 19