-

Payment-focused fintechs are acquiring – and keeping – merchants' business thanks to services such as fraud prevention, analytics financing and loyalty tools, according to Capgemini's 2026 World Payments Report. If banks want to compete, they'll need to change their game.

September 26 -

Zelle secured a deal with Alacriti to help Alacriti's bank clients adopt person-to-person payments; Paze teamed up with Canadian payment processor Nuvei to expand merchant use of the wallet.

September 9 -

The credit card issuer renewed and extended its 15-year partnership with Amazon and touted fresh partnerships with Walmart and PayPal as wins, but lowered its full-year guidance due to lower purchase volumes and higher payment rates.

July 22 -

The pending law, which has passed the Assembly and Senate, prohibits food and retail stores from refusing to accept cash payments. Cashless establishments have been prohibited in New York City since 2020.

June 10 -

Prepaid cards are finding new use cases in the hospitality industry, where tip disbursements have traditionally been cumbersome.

May 20 -

Even with its IPO on ice, the Swedish buy now/pay later lender is building a base of high-profile distribution partners.

April 25 -

The Bank of Lithuania contends the U.S. fintech broke anti-money-laundering rules; while British contactless payments hit a record. That and more in the American Banker global payments roundup.

April 9 -

The bank has added Affirm as an option, after adding the fintech's rival Klarna to its merchant network in February.

March 25 -

The account-to-account payment method has become prevalent in countries such as China, India and Brazil, but adoption has been slow in the U.S. and limited to small- and medium-sized businesses. That paradigm is expected to shift amid continued fintech investment.

December 30 -

Improved consumer confidence helped to drive greater use of buy now/pay later as younger generations turned to short-term installment options.

December 27 -

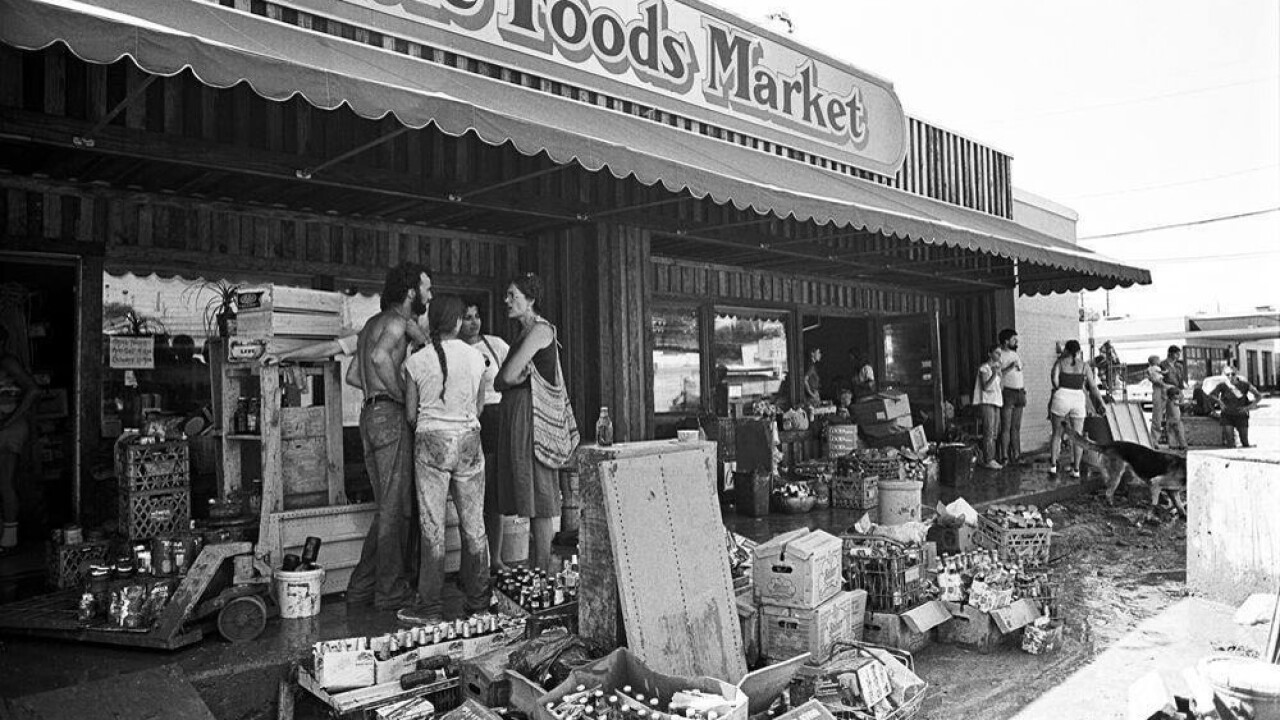

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

Klarna is looking to get out of one of its key payments businesses after the financial technology giant found the unit created a conflict of interest with peers like Adyen or Stripe.

June 24 -

A $30 billion settlement between Visa Inc., Mastercard Inc. and retailers to cap credit-card swipe fees is likely to be rejected by a federal judge in Brooklyn, a setback in the two decade-long litigation.

June 14 -

Retailers like Walmart, Target and Dollar General are changing the ways they collect payments in person. This, in turn, could influence payment habits, but it is unlikely to slow the overall momentum of digital transactions.

May 31 -

National Australia Bank is adding a Pay By Bank option for near-instant payments, Italy is bringing open-loop payments to buses in Tuscany, and more.

May 8 -

Companies are taking vastly different approaches to how they implement generative AI, whether it's to empower employees or to overhaul the way they bring products to market.

April 15 -

A digital-payment trend that began during the COVID pandemic is being bolstered by features such as rewards and state ID storage.

April 5 - AB - Policy & Regulation

As the Senate debates this year's defense spending package, analysts say the highly partisan politics of this Congress, as well as the banking industry's lobbying, make it difficult for Sen. Dick Durbin's, D-Ill., credit card legislation to slip through this round.

July 19 -

Two executives behind BMO's purchase of Bank of the West from BNP Paribas discuss how the deal happened and what comes next for BMO.

-

Supermarket chain Kroger refused to accept Apple Pay and similar options in stores for nine years. It's changed its mind — but Walmart, Home Depot and Lowe's remain holdouts.

April 17