-

Collaboration between banks and fintechs still lags, hurting security initiatives such as an authentication hub.

October 9 -

Emotional connections can make a difference when consumers have many different ways to shop and pay, according to Tom Caporaso, CEO of Clarus Commerce.

October 9 Clarus Commerce

Clarus Commerce -

Payment forms on e-commerce sites are the most common target for formjacking attackers, writes Robert Capps, vice president and authentication strategist for NuData Security.

October 5 NuData Security

NuData Security -

There is an expectation that customers should change and adapt their particular payment habits to match what the retailer has on offer, according to Matthijs Pronk, CCO of Intrapay.

October 4 Intrapay

Intrapay -

Financial-crime risks, properly mitigated, are business opportunities. Fintechs that recognize this can gain a competitive advantage, according to Julie Myers Wood of Guidepost Solutions and Gemma Rogers of Fintrial LTD.

October 4 Guidepost Solutions LLC

Guidepost Solutions LLC -

Gift card, reward points and payment information will continue to be exposed and available to whoever wants to purchase it. But it’s up to companies to implement security barriers that devalue this information, writes Don Duncan, security engineer for NuData Security.

October 3 NuData

NuData -

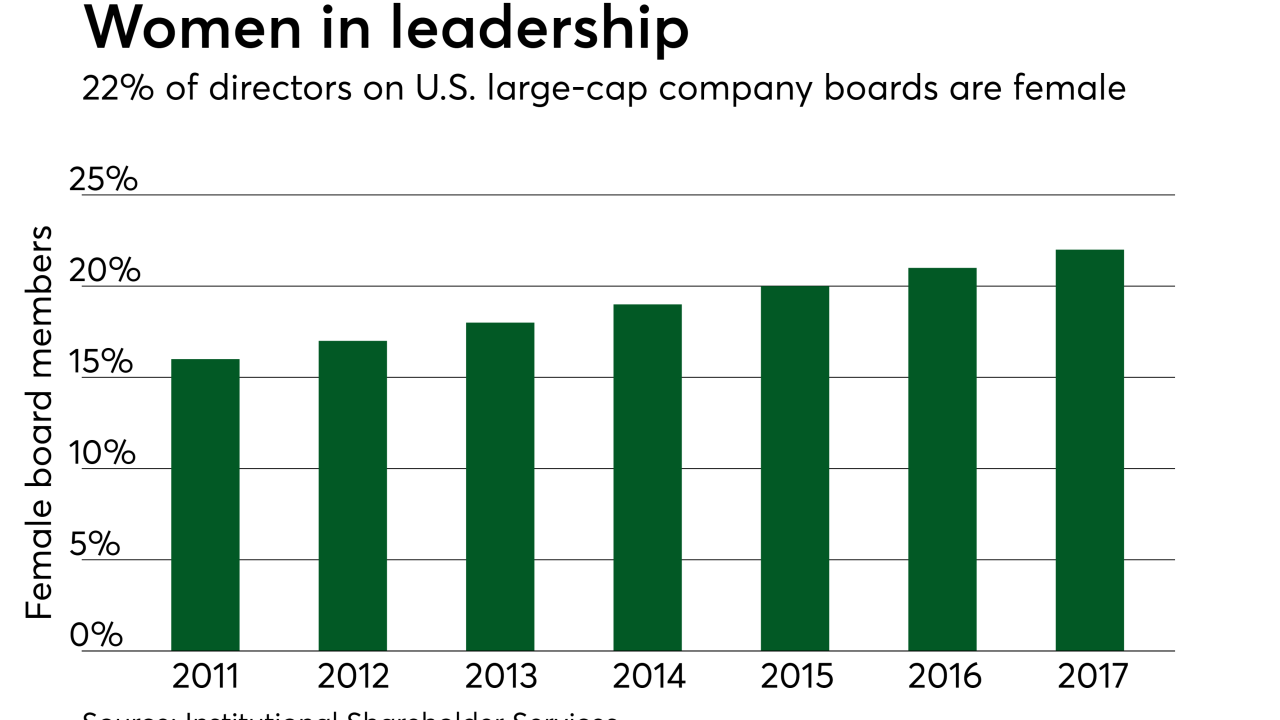

California will be the first state requiring public companies to meet gender quotas for their boards of directors, and women in the payments industry see the move as positive — with some caveats.

October 2 -

Payments will melt into the wider commerce experience and create new incremental value for consumers, according to Brendan Miller, a principal analyst at Forrester.

October 2 Forrester Research

Forrester Research -

China’s Golden Week started on Monday and with it, global cities and merchants are boldly promoting Alipay in an effort to capture Chinese tourist dollars. At the same time, merchants are building out a competitive acceptance network that could someday rival the major payment card networks.

October 2 -

For merchants to reap the full benefits of the modern mobile payments ecosystem, their payments strategy can go beyond accepting a contactless tap-and-go card and encourage use of smartphone payments at the point of sale, writes Jason Oxman, CEO of the Electronic Transactions Association.

October 2 Electronic Transaction Association (ETA)

Electronic Transaction Association (ETA)