-

During the pandemic-induced lockdowns, the Federal Reserve loosened a rule requiring banks to cap certain savings withdrawals at six per month. Some banks have since dropped ceilings and associated fees, while others have stood pat.

May 17 -

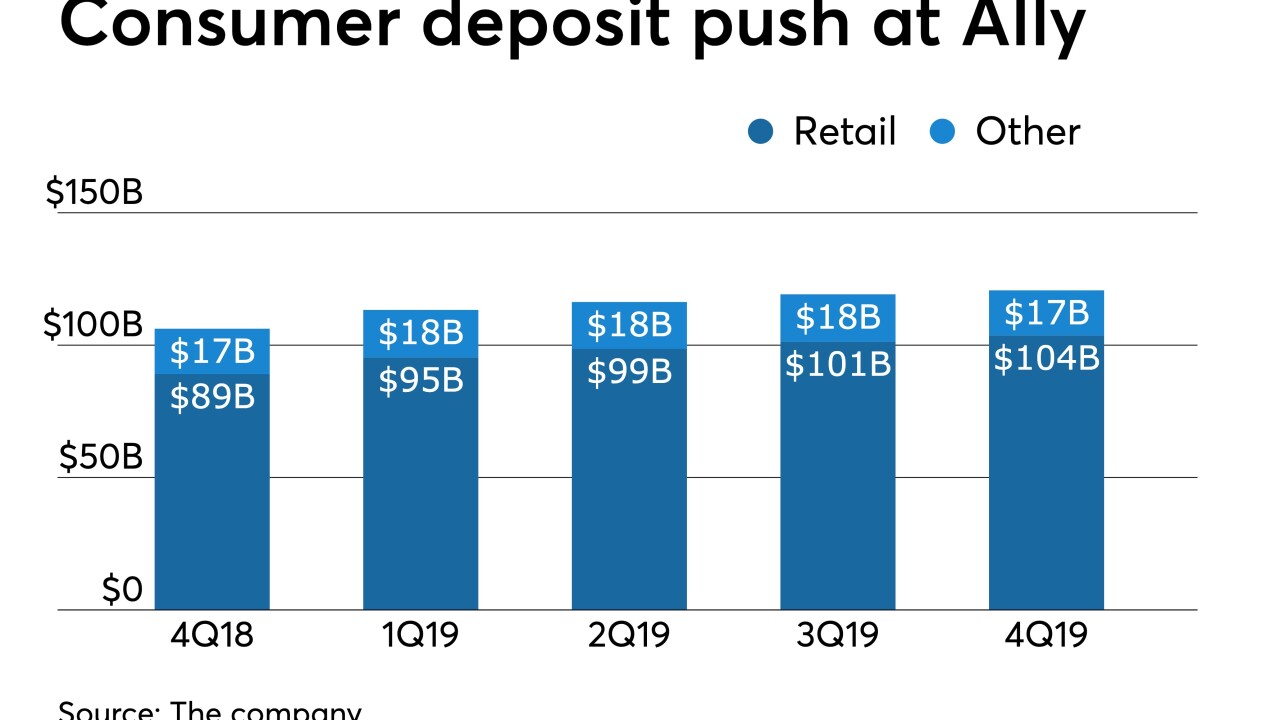

Ally, Huntington, KeyBank and others are reimagining automated savings tools challenger banks have made popular.

April 13 -

The New York company is seeding savings accounts offered by the challenger bank Goalsetter as a way to help minority communities as well as use technology to start building long-term relationships with young consumers.

March 23 -

PayPal is weighing a foray into stock trading and high-yield savings accounts as the firm pushes beyond its iconic checkout button.

February 12 -

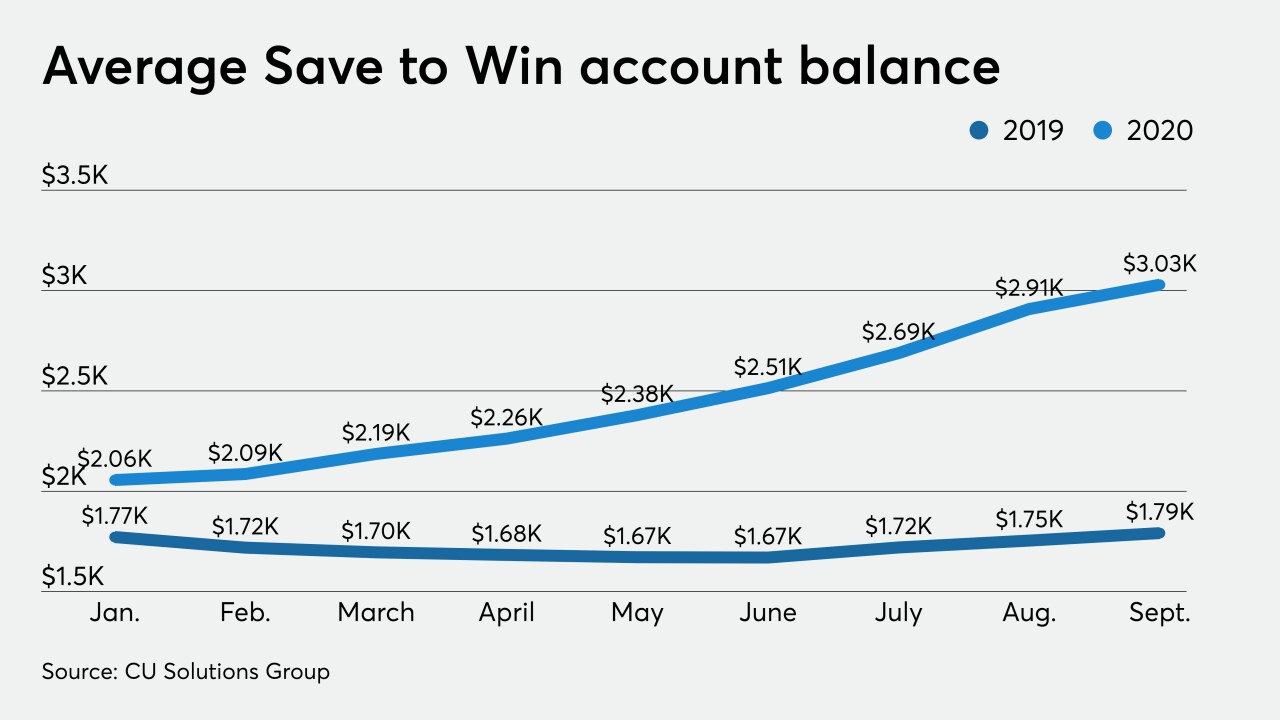

Many credit unions offer these accounts to help members improve their financial behaviors, but some in the industry are wondering how long the surge could last.

November 10 -

The Democratic nominee has not gone as far as some progressives in support of financial inclusion, but ideas such as postal banking, a government-run credit reporting system and universal bank accounts would likely gain traction under a Biden administration.

October 23 -

The industry can gain lifelong members in this demographic by validating their financial concerns as the economy struggles and offering guidance without judgment.

October 9 FindCreditUnions.com

FindCreditUnions.com -

At a time when some Americans are being tempted to pour their savings into risky investments, the son of a Wall Street veteran is encouraging them to set aside more money.

September 10 -

There are millions of U.S. consumers who don't have access to traditional financial services. One challenger bank's mission is to help them overcome the barriers to financial inclusion.

July 31 -

Congress and the FDIC are considering easing limits on banks' holdings of such deposits, a move that could inadvertently lead to more expensive failures.

July 6 Wells Fargo

Wells Fargo -

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

There were few fireworks at Wells Fargo’s first annual meeting under new CEO Charlie Scharf; billionaire investor and entrepreneur Mark Cuban pitches Fed-backed overdraft protection; as hotels sit empty, loan delinquencies pile up; and more from this week’s most-read stories.

May 1 -

The central bank said customers will be able to make more transfers and withdrawals "at a time when financial events associated with the coronavirus pandemic have made such access more urgent."

April 24 -

A new survey shows more Americans are tapping into their savings as job losses rise and the pandemic's impact on the economy gets worse.

April 6 -

The insurance and research company expects the U.S. to fall into a recession as unemployment spikes and the GDP declines.

April 2 -

Bankers groups are keeping close tabs on a host of legislative and gubernatorial proposals, from prize-linked savings accounts in Iowa to rent control in Massachusetts to a slew of bills modeled after California's recently passed data privacy law.

February 11 -

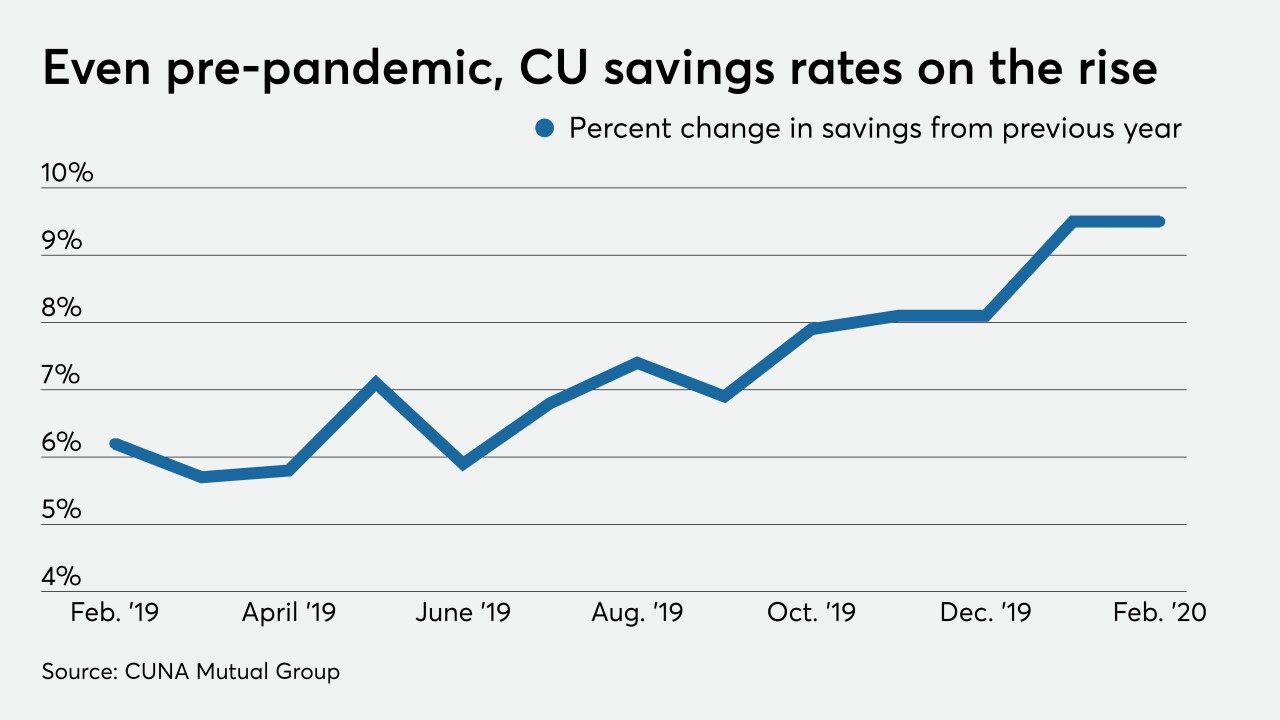

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

The new features use automatic transfers to encourage account holders to build savings faster and with less effort.

February 5 -

Bask Bank will offer customers AAdvantage miles for every dollar saved.

January 27 -

This is the second time in five years the California-based credit union has issued a giveback, for a total of $38 million.

November 20