-

The Democratic candidate insists too-big-to-fail banks are bigger than they were during the crisis, but their true sizes are masked by off-balance sheet reporting.

October 27

-

The Federal Reserve Board will hold a public meeting Oct. 30 to discuss a proposal that would require the largest and most systemically risky banks to hold capital and unsecured debt to protect taxpayers from issuing bailouts if they should become distressed.

October 23 -

The Federal Deposit Insurance Corp. is set to vote Thursday morning on a proposal that would force big banks to bear the assessment burden of growing the agency's federal reserves to a new minimum.

October 22 -

The industry will undoubtedly get bad press in an election cycle, but here is what institutions should do and not do about it.

October 22

-

Profits fell at New York Community Bancorp in Westbury, N.Y., as it continued to manage its balance sheet to stay below a key regulatory threshold.

October 21 -

General Electric is trying to entice its shareholders to exchange their stock for shares in Synchrony Financial, the spun-off credit card lender.

October 19 -

General Electric plans to ask early next year for relief from heightened regulatory scrutiny, while its former credit card arm says that it won't be subject to the same stress-testing rules as most banks its size.

October 16 -

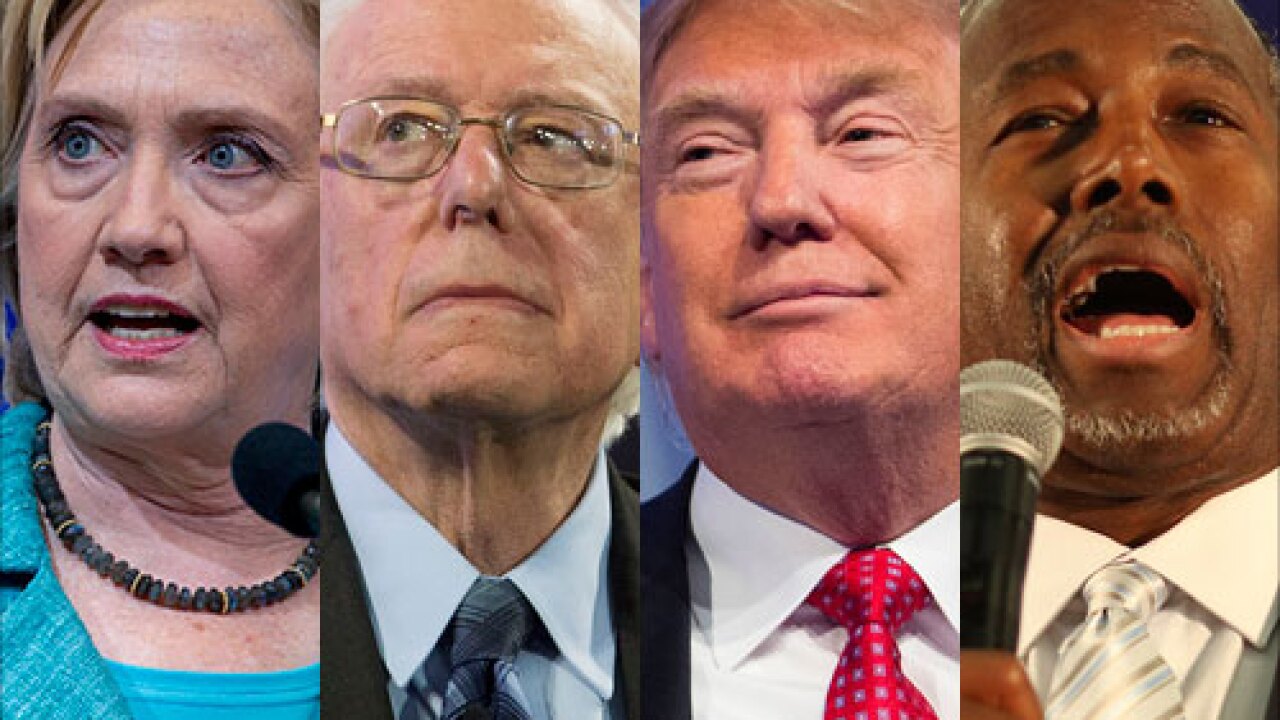

Democrats clashed over banking reform Tuesday night during the party's first primary debate, underscoring the sharp divide with GOP candidates on Wall Street issues.

October 14 -

The Democratic presidential candidates sparred over Wall Street reform Tuesday evening, debating how to best tame the banking industry roughly seven years after the financial crisis.

October 13 -

Since the G20 agreed in 2009 to route most over-the-counter derivatives through central counterparties, or CCPs, regulators have been increasingly concerned that those centers could pose a catastrophic risk to financial stability if they fail. But a years-long standoff between the U.S. and Europe is delaying efforts to deal with the risks they pose.

October 13 -

Democratic presidential front runner Hillary Clinton last week became the latest presidential candidate to outline her views on Wall Street reform, taking an incremental approach that tried to strike a balance between pleasing the liberal base while not taking a radical stance on issues. Following is how her plan compares with her competitors, both Republican and Democrat.

October 13 -

Democratic presidential front-runner Hillary Clintons first major speech on Wall Street reform Thursday is unlikely to persuade skeptics on the left that she is committed to going further than President Obama on the issue. Heres why.

October 8 -

The U.S. version of an international liquidity rule may include additional factors that make it harder to accurately compare between banks or examine the same institutions liquidity holdings over time, according to a paper issued Wednesday by the Office of Financial Research.

October 7 -

From "too big to fail" to Glass-Steagall, the two leaders of the postcrisis recovery hashed out the economic issues, while pitching Bernanke's new book.

October 7 -

The Federal Reserve Board said Monday that it would reopen its public comment period on Goldman Sachs' pending acquisition of roughly $16 billion in online deposits from GE Capital, citing a need for greater public examination of the deal.

October 5 -

WASHINGTON Senate Banking Committee Chairman Richard Shelby sent a letter to regulators this week raising concerns about the role of the Financial Stability Board in designating large banks as systemically risky and whether the international council has undue influence on U.S. policy.

September 30 -

Rules dealing with liquidity and other market-related items may be a better strategy for asset managers than higher capital requirements, said Federal Reserve Board Gov. Daniel Tarullo.

September 28 -

The only way to evaluate the appropriateness of Dodd-Frank's costs is to monitor the economic benefits that it creates. That's why the government needs to find a quantifiable way to measure the efficiency of its regulations.

September 23

-

Bank executives and outside experts finger technology as the area most in need of improvement when it comes to vetting financial institutions' ability to withstand the next bit economic shock.

September 21 -

Elizabeth Warren, D-Mass., and David Vitter, R-La., the lead sponsors of a bill to place more explicit limits on the Federal Reserve's emergency lending powers, say the bill is getting quashed by a full-court press from banking interests.

September 16