-

Many of its borrowers have struggled to make payments since the pandemic struck, so it is helping them by suspending debt collections and capping rates on new loans at 36%.

July 28 -

Trump-appointed regulators gave the industry the green light to offer installment loans during the pandemic. But with concerns that the light could turn red in 2021, bankers remain extra cautious.

July 19 -

Consumers now have more control over their own financial decisions and loan options.

July 14 Community Financial Services Association of America

Community Financial Services Association of America -

Consumers now have more control over their own financial decisions and loan options.

July 8 Community Financial Services Association of America

Community Financial Services Association of America -

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

June 2

-

The templates are meant to make it easier to obtain agency approval for small-dollar loan products and to accommodate mortgage servicers that want to provide online loss mitigation options.

May 22 -

The comptroller of the currency, who is stepping down after two and a half years on the job, ruffled feathers and won some fans in pushing through CRA reform, cutting costs and trying to reshape the agency’s examiner culture.

May 20 -

Four federal agencies offered guidance Wednesday on how to offer products that compete against payday loans without incurring Washington's wrath. The announcement could spark the rebirth of deposit advances, which were regulated out of existence during the Obama administration.

May 20 -

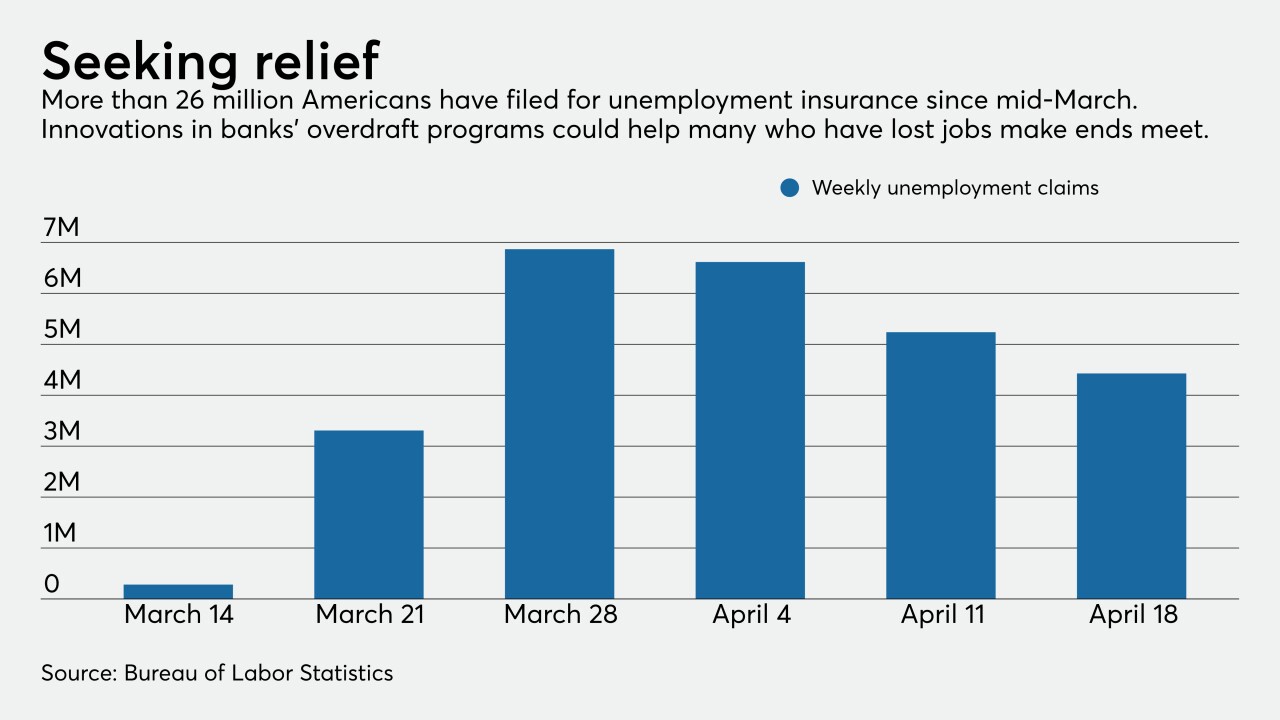

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

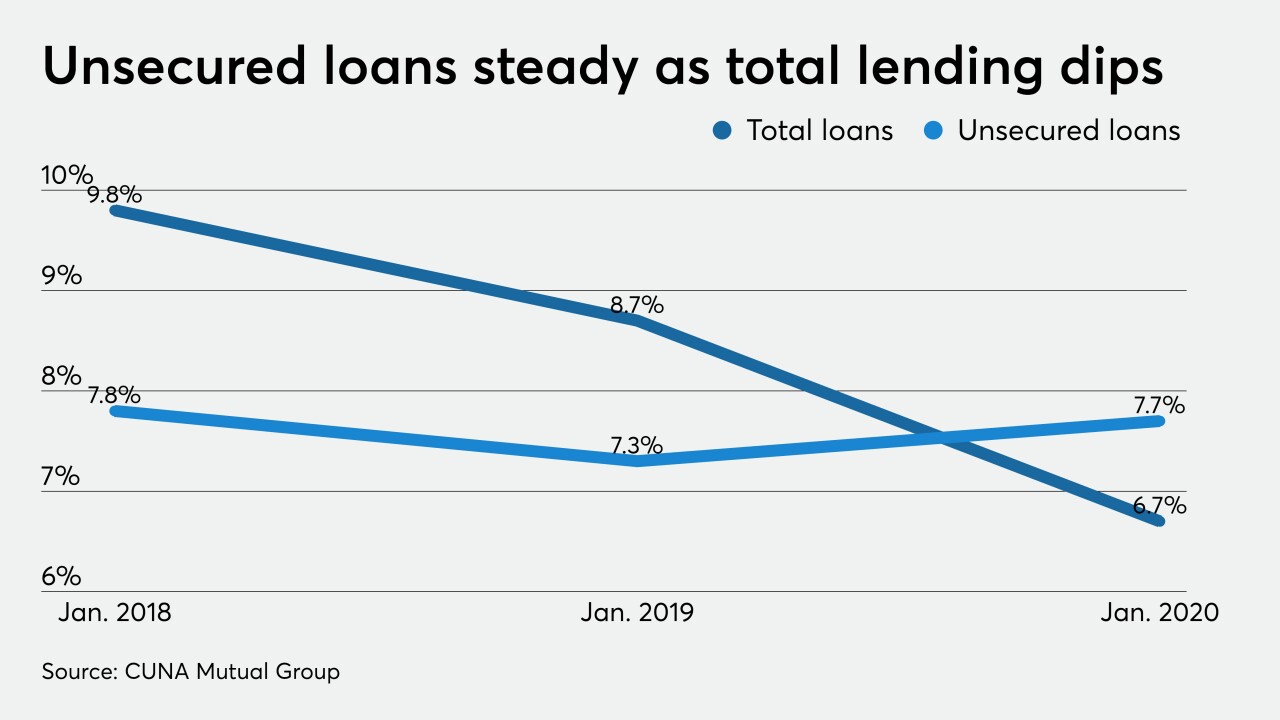

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13