-

The $5.9 billion-asset Liberty Bank in Middletown had set aside $5 million to make small-dollar loans to customers affected by the coronavirus pandemic.

April 3 -

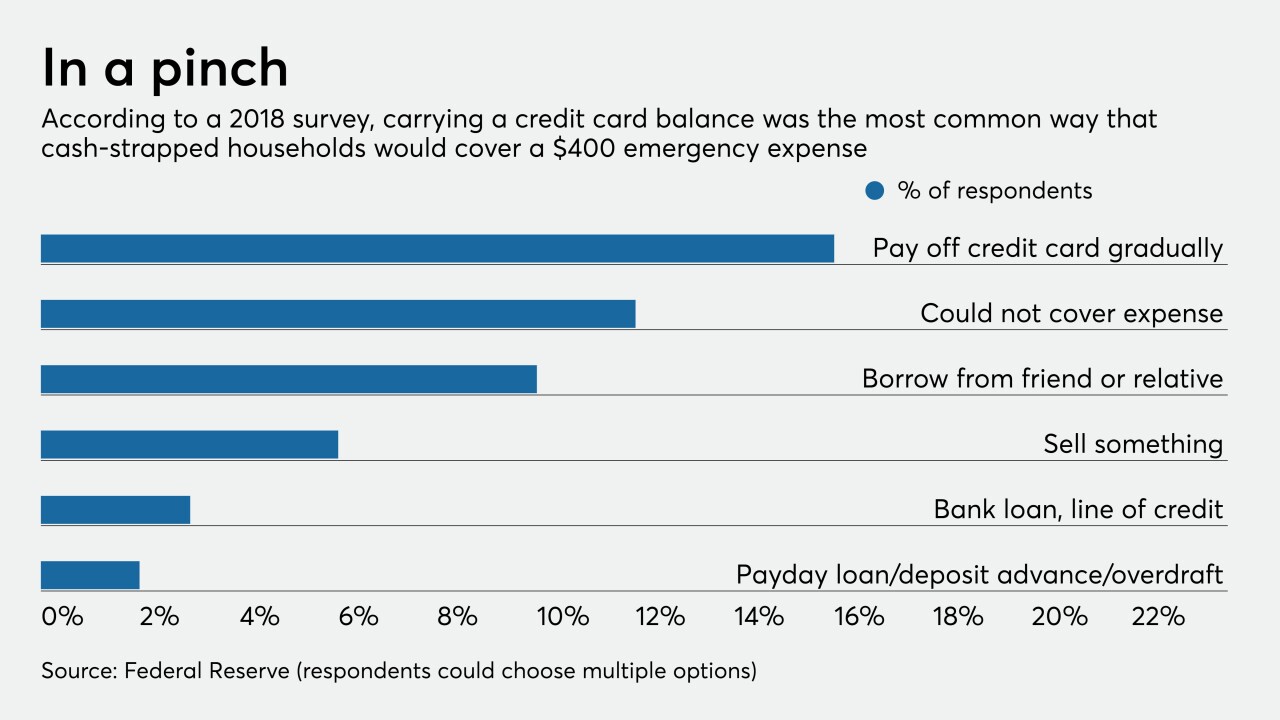

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

Citigroup CEO says it’s a “fine line” between supporting customers and burdening them with debt; Goldman gives away 600,000 N95 masks it had from prior scares.

March 27 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

Banks typically don't offer loans to cash-strapped consumers, and are poorly positioned to start doing so on an emergency basis — unless the government steps in to help.

March 13 American Banker

American Banker -

Maybe Congress shouldn’t be so quick to change laws without real-world input.

March 9 Community Financial Services Association of America

Community Financial Services Association of America -

Payday lenders have long used bank partnerships and similar means to circumvent state interest rate caps. Lawmakers should stop such practices now.

February 10 Colorado

Colorado -

Community development financial institutions could stand to gain from efforts to modernize the Community Reinvestment Act, but they fear the proposal offered by regulators may end up draining their capital.

January 23 -

In a letter to the agency's inspector general, the 15 lawmakers pointed to specific cases where they said the bureau departed from legal standards in deciding not to require restitution.

January 14