-

Moderates on the Financial Services Committee are attempting to block legislation that would extend the 36% interest rate cap on loans to military personnel to all consumers.

December 6 -

Instead of imposing interest rate caps, policymakers should require online lenders to provide clear disclosures and promote partnerships with banks.

December 4 CASH AMERICA

CASH AMERICA -

The team has already built three customer-facing AI tools this year, which it hopes to keep building upon.

November 4 -

The restriction on how often a borrower’s account is debited was supposed to be relatively straightforward, but one lender is trying to fight that provision.

October 29 -

Readers react to a regulator's promise to reduce regulation that hinders innovation, Sen. Elizabeth Warren's plan to impose heavier taxes on lobbying groups, Freddie Mac's exploration into AI and more.

October 3 -

Goldman’s consumer unit, Marcus, has so far lost $1.3 billion; big lenders like JPMorgan Chase and Amex are making loans for small-ticket items like clothes and cosmetics.

September 30 -

A first-in-the-nation bill that drew unanimous support from the state Senate failed to get over the finish line this year. What happened?

September 19 -

Nitin Mhatre of Webster Financial explains why the Consumer Bankers Association — whose members want a bigger piece of the student lending market — backs legislation that would make the federal government tell borrowers how much they will ultimately owe, as private lenders are already required to do.

September 18 -

The vote Friday was a victory for consumer advocacy groups that have been pushing for years to rein in lenders that charge triple-digit rates.

September 13 -

Next up for BB&T-SunTrust: deciding where to unload branches; how the Trump administration would reform Fannie Mae, Freddie Mac; why the CFPB's payday rule is in the hands of a Texas judge; and more from this week's most-read stories.

September 6 -

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

Consumer Financial Protection Bureau Directors Kathy Kraninger is under pressure to ask a federal judge to lift a stay that has kept the agency's short-term-lending rule from going into effect.

September 3 -

The debate over the CFPB's plan to revamp its payday lending regulation should focus on the benefits for borrowers.

August 30

-

House Financial Services Committee Chairwoman Maxine Waters and over a hundred other lawmakers want the agency to go forward with a mandatory underwriting requirement for payday loans.

August 23 -

Four advocacy groups questioned why the consumer bureau did not ask a judge to lift a stay of the rule's payment provisions.

August 12 -

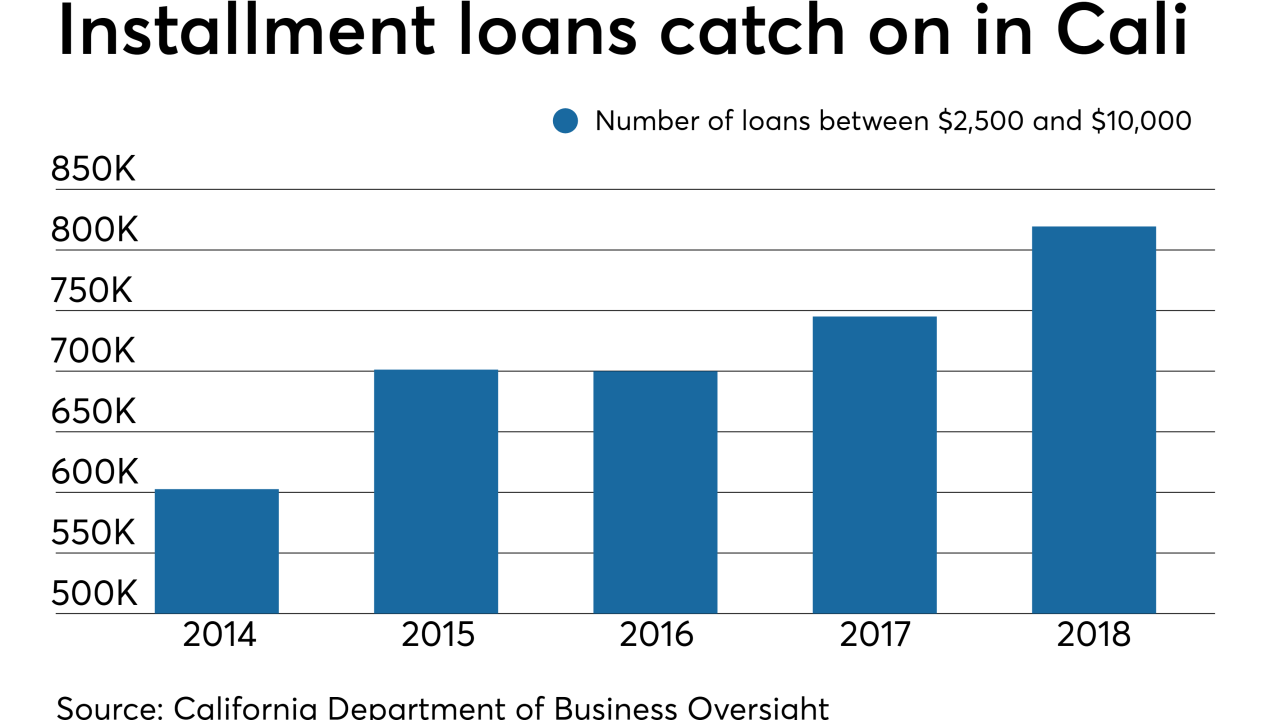

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

In a registration statement filed with the SEC, the company revealed new details about its financial performance and its growth plans.

July 18 -

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

Companies that offer early access to earned wages want a regulatory framework for their fast-growing industry. But the bill under consideration in Sacramento is exposing big divisions in the sector.

June 24 -

Despite renewed calls from Democrats looking to USPS to offer banking services, policymakers should instead consider reforms that would permit private-sector firms like Walmart and Amazon to offer a wider array of financial products.

June 13