-

A regulatory cloud still follows fintech companies following a judge's decision throwing out the Office of the Comptroller of the Currency’s special-purpose charter.

October 22 -

The Conference of State Bank Supervisors has proposed creating model payments legislation that states could adopt to improve the state-by-state licensing process.

October 10 -

The state's Democratic-controlled Legislature has enacted laws establishing data privacy rights, giving municipalities the ability to set up public banks, and requiring standardized disclosures on small-business loans, among other issues. Lawmakers elsewhere are taking notice.

October 8 American Banker

American Banker -

Officials said Thursday that they will not take regulatory action against state-chartered banks and credit unions solely for serving licensed cannabis businesses.

October 3 -

New plans for a ballot initiative in November 2020 threaten to overturn concessions that financial institutions, tech firms and other companies have won from state lawmakers.

September 26 -

A first-in-the-nation bill that drew unanimous support from the state Senate failed to get over the finish line this year. What happened?

September 19 -

The bureau issued three policies removing the threat of legal liability for approved companies that test new products.

September 10 -

A legislative measure would have made the Golden State the first in the nation where aggrieved borrowers could sue their servicers. The bill was delayed until 2020 after banks and other financial companies expressed opposition.

September 6 -

The Fed is seeking feedback on a "Building Block Approach" to risk-based capital standards for firms heavily engaged in insurance activities.

September 6 -

With no fintech applicant officially seeking the agency’s specialized charter, Judge Dabney Friedrich said claims by the Conference of State Bank Supervisors still were not ripe.

September 4 -

Under a state proposal, annual percentage rates would have to be disclosed on nonbank commercial loans of $500,000 or less. Lenders' responses have been mixed depending on their business model.

August 18 -

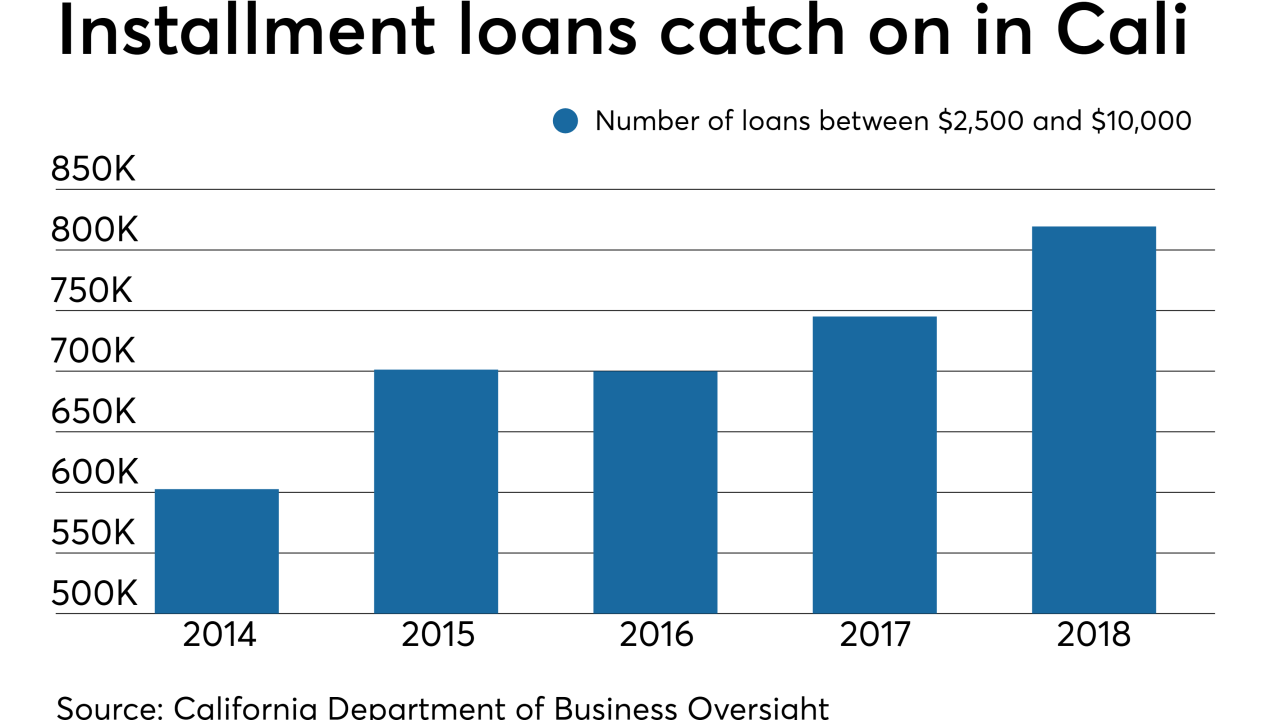

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

New York and 10 other states are looking into whether companies in the fast-growing sector are violating payday lending laws.

August 7 -

State regulator Ron Rubin had been asked to resign in May over a sexual harassment complaint, but he attempted to fight the allegations.

July 25 -

“Limited” digital-asset broker spots may be approved; Linda Lacewell’s plans for the New York State Department of Financial Services.

July 9 -

Former Trump campaign chairman Paul Manafort pleaded not guilty in a New York mortgage fraud case — state charges that are beyond the reach of a presidential pardon.

June 27 -

The Citigroup mortgage unit is not the first lender to be tripped up by California law requiring the interest payments on escrow impound accounts.

June 18 -

Regulators closed The Enloe State Bank in Texas late Friday, marking the first failure in 17 months and the first in the Lone Star State in over five years.

May 31 -

The revised statute provides clarity on director travel, supervisory committees, conservatorship and more.

May 30 -

In a state where laws are unusually favorable to high-cost business lenders, taxi drivers are not the only small-business people getting trapped in loans they can't afford to pay back. The question is, what are policymakers going to do about it?

May 24 American Banker

American Banker