A legislative push in California to impose tough new standards on companies that collect student loan payments has stalled after hitting strong industry opposition.

Under the bill, California would become the first state where borrowers have the right to sue for damages when student loan servicers fail to process payments in a timely manner or meet other obligations.

The measure, which bears similarities to the mortgage servicing rules that emerged following the housing crash, would also establish detailed requirements for how to apply borrower payments.

The legislation easily passed the state Assembly in May. But it hit a roadblock last week when Sen. Anthony Portantino, the Democratic chairman of the Senate Appropriations Committee, held the bill until 2020.

Democratic Assemblymember Mark Stone, who introduced the legislation, was surprised by the decision to table the legislation.

“It’s a little inexplicable,” he said in an interview.

A spokesman for Portantino did not respond to requests for comment.

Consumer advocates say that legislation is necessary to provide a check on an industry where abuses are rampant. Examples that were found by the Obama-era Consumer Financial Protection Bureau include: servicers allocating partial payments toward multiple loans in ways that were deemed unfair and servicers sending loans into automatic default if either the borrower or the co-signer filed for bankruptcy.

The California legislation would affect servicers in both the federal student loan market and the much smaller private loan market. Industry groups that lined up in opposition to the measure included the California Bankers Association, the Consumer Bankers Association and the California Credit Union League.

In early August, those three groups wrote to Portantino asking that the legislation be amended to exempt national banks. Wells Fargo, PNC Financial Services Group and Citizens Financial Group are among the national banks that offer private student loans.

“We believe significant portions of the measure are pre-empted and would create unnecessary, conflicting and confusing regulatory requirements between state and federal law,” the trade groups’ letter stated.

Among the consumer advocacy groups that support the California legislation is the Student Borrower Protection Center. A spokeswoman for the Washington, D.C.-based organization said that the California bill is “absolutely not pre-empted” despite what she called “the mischaracterization of big banks.”

The Golden State legislation is part of an effort by Democrats and advocacy groups to write stronger rules for the student loan industry at the state level, in light of what they see as lax treatment by the Trump administration.

A year ago, California enacted legislation requiring servicers of federal student loans to be licensed by the state. Several other states, including New York and New Jersey, have since followed suit.

States where Democrats hold key offices have also stepped up their enforcement activities in connection with student loans. On Thursday, the New York Department of Financial Services announced an investigation into companies that allegedly make misleading claims about student debt relief services.

Americans held $1.48 trillion in student loan debt in the second quarter of 2019, according to data from the Federal Reserve Bank of New York, more than double the level a decade earlier. Approximately 92% of all student debt is owed to the federal government, according to data from MeasureOne.

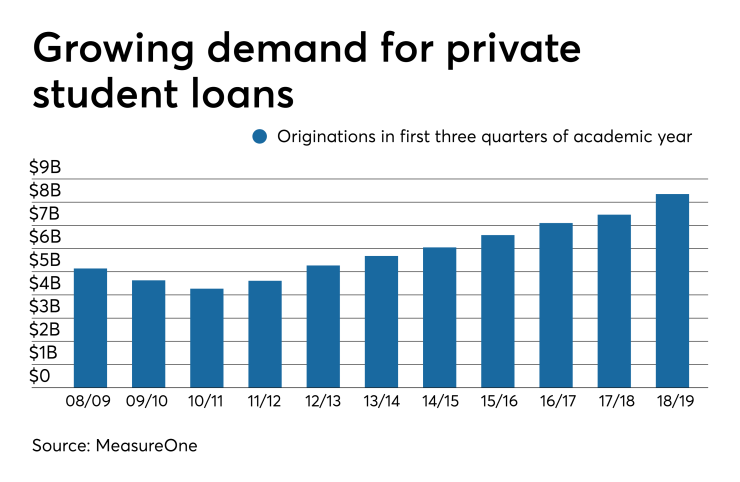

That said, private student lending has been on the rise ever since the financial crisis. Origination volumes at 19 private lenders, including Wells Fargo, Citizens, PNC and Sallie Mae, reached $8.35 billion in the first three quarters of the 2018-2019 academic year, which was up 95% from the same period eight years earlier, according to MeasureOne.

Stone, whose legislative district runs along California’s central coast, said that it makes no sense to exempt banks from the servicing rules. “Anyone who deals with a California borrower needs to treat that borrower the same way,” he said.

His bill would require servicers to post, process and credit student loan payments within certain timeframes. It would require servicers to apply overpayments in a way that is consistent with the borrower’s best interests. And it would mandate that they apply partial payments in a way that minimizes late fees and negative credit reporting.

The bill would also create a new borrower advocate position within California’s government who would receive consumer complaints.

Suzanne Martindale, senior policy counsel for Consumer Reports, said that the current situation with student loans harkens back to the problems that plagued mortgage servicing during the foreclosure crisis. Following a deluge of complaints about mortgage servicers, new federal rules were enacted.

“We haven’t done the same thing for student loans,” Martindale said.

But officials in the student loan servicing industry take issue with that analogy.

Complaints about student loan servicers represent a tiny fraction of those received by the Consumer Financial Protection Bureau, said Scott Buchanan, executive director of the Student Loan Servicing Alliance, which represents servicers of both federal and private student loans.

“It certainly is not some giant systemic issue,” said Buchanan, who contended that the California legislation raises a host of other problems.

He argued, for example, that student loan servicers will be unable to determine which method of allocating an overpayment is in the borrower’s best interest.

“To prognosticate about what the borrower thinks is in their own best interest,” he said, “that’s a standard that is very difficult to comply with, and practically not doable.”