-

Under a state proposal, annual percentage rates would have to be disclosed on nonbank commercial loans of $500,000 or less. Lenders' responses have been mixed depending on their business model.

August 18 -

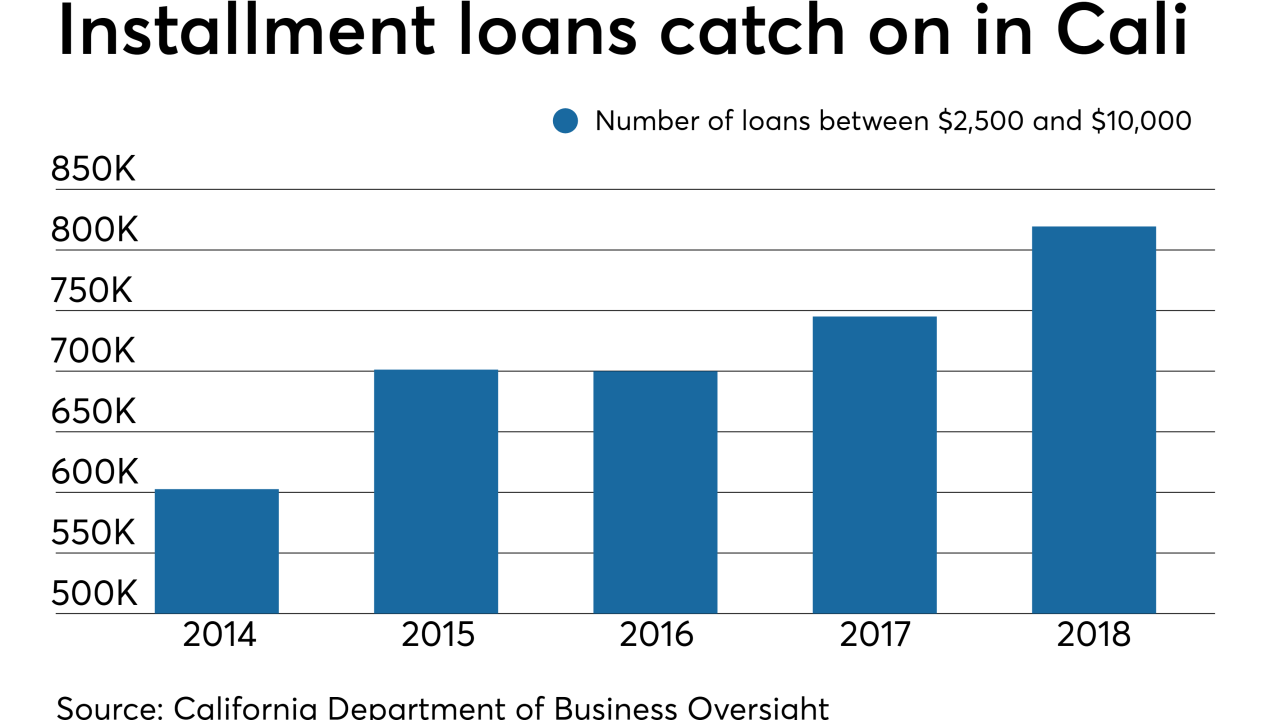

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

New York and 10 other states are looking into whether companies in the fast-growing sector are violating payday lending laws.

August 7 -

State regulator Ron Rubin had been asked to resign in May over a sexual harassment complaint, but he attempted to fight the allegations.

July 25 -

“Limited” digital-asset broker spots may be approved; Linda Lacewell’s plans for the New York State Department of Financial Services.

July 9 -

Former Trump campaign chairman Paul Manafort pleaded not guilty in a New York mortgage fraud case — state charges that are beyond the reach of a presidential pardon.

June 27 -

The Citigroup mortgage unit is not the first lender to be tripped up by California law requiring the interest payments on escrow impound accounts.

June 18 -

Regulators closed The Enloe State Bank in Texas late Friday, marking the first failure in 17 months and the first in the Lone Star State in over five years.

May 31 -

The revised statute provides clarity on director travel, supervisory committees, conservatorship and more.

May 30 -

In a state where laws are unusually favorable to high-cost business lenders, taxi drivers are not the only small-business people getting trapped in loans they can't afford to pay back. The question is, what are policymakers going to do about it?

May 24 American Banker

American Banker -

A recent court decision allowing New York’s financial regulator to proceed in a case meant to block the Office of the Comptroller of the Currency from offering fintechs a new federal banking charter is having a chilling effect on potential applicants.

May 15 -

Manuel Alvarez, who became commissioner of the Department of Business Oversight on Monday, is the former general counsel and chief compliance officer at the online lender Affirm.

May 13 -

The Office of the Comptroller of the Currency had sought to dismiss the case, but a court ruling suggested that the state regulator’s claim may have merit.

May 2 -

The attorney general told lawmakers that exempting states that have legalized marijuana from the federal ban is better than the current system where state and federal laws are in conflict.

April 11 -

The attorney general told lawmakers that exempting states that have legalized marijuana from the federal ban is better than the current system where state and federal laws are in conflict.

April 11 -

The Evergreen State is the latest to make a push to modernize the rules governing state-chartered credit unions.

April 10 -

Assemblywoman Monique Limon is in the “early stages” of exploring how to create a state-level Consumer Financial Protection Bureau as part of a broader push for more consumer protection for state residents.

March 27 -

The state's financial regulator says Fast Money Loan charged consumers interest rates and fees above the state's usury cap, and operated unlicensed storefronts.

March 19 -

The combined bank would be chartered in North Carolina, with the FDIC serving as its lead federal regulator, N.C. Banking Commissioner Ray Grace says. The merger partners had other options, including the Fed and the OCC.

March 12 -

Digital-asset companies will try to develop a less adversarial relationship with the state's securities regulator, who stopped several startups from selling digital currencies as investments.

March 7