-

The agreement between the state’s financial regulator and Meratas will subject the company to heightened regulation after years of criticism that income-share agreements have escaped scrutiny.

August 5 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12 -

Rohit Chopra, who was the Consumer Financial Protection Bureau's first student loan ombudsman, is expected to crack down on unfair debt collection and other practices once he is confirmed by the Senate to lead the bureau. Observers predict he'll work closely with former CFPB Director Richard Cordray, who now oversees the Education Department’s $1.7 trillion portfolio of federal student loans.

June 29 -

Splash recently raised $44 million from investors. It plans to use the funds to aid small institutions that lack the resources to build their own loan platforms but are flush with deposits and looking for new lending opportunities.

June 23 -

The new calculation of borrowers’ monthly obligations will allow for a higher debt load from tuition, potentially opening eligibility to more Black applicants, according to public officials.

June 18 -

Cordray, named this week to lead the Education Department's office of federal student aid, cracked down on banks, student loan servicers and for-profit colleges when he was director of the Consumer Financial Protection Bureau.

May 4 -

Consumer advocates say "income share agreements" like those issued by Blue Ridge Bank of Martinsville, Va., and a Boston CDFI should have to comply with laws that govern more traditional credit products.

April 21 -

The deal between San Francisco-based lender and Social Capital Hedosophia Holdings Corp. V is latest example of a closely held firm going public by merging with a special purpose acquisition company.

January 7 -

The consumer bureau said the bank’s migration to a new servicing platform led to unauthorized payment withdrawals, misrepresentations about what borrowers owed and violations of a prior 2015 enforcement action.

December 22 -

The $10 billion portfolio of what are described as high-quality private student loans will be serviced by Nelnet.

December 19 -

A group that includes the private equity firms Apollo Global Management and Blackstone Group is in talks to acquire Wells Fargo’s student loan portfolio, according to people familiar with the matter.

December 14 -

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11 -

Jobs will be harder to find for graduates, and there are new underwriting platforms that can better predict students' future income in their chosen field.

December 1 Climb Credit

Climb Credit -

Jobs will be harder to find for graduates, and there are new underwriting platforms that can better predict students' future income in their chosen field.

November 16 Climb Credit

Climb Credit -

Wells Fargo is exploring a sale of its corporate-trust unit that could fetch more than $1 billion and is considering whether to find a buyer for its student loan portfolio, according to people familiar with the matter.

October 26 -

With the sector facing serious headwinds — from declining enrollment during the pandemic to the prospect of a Biden administration making college free for many families — the departure of a major player could be a shot in the arm for the likes of Discover and Sallie Mae.

October 22 -

The Cleveland company will exit indirect auto lending and close branches so it can devote more resources to mortgages, student loans and other relationship-driven, digital-friendly businesses.

October 21 -

The industry can gain lifelong members in this demographic by validating their financial concerns as the economy struggles and offering guidance without judgment.

October 9 FindCreditUnions.com

FindCreditUnions.com -

Credit unions need to improve their processes to ensure the problems that have arisen with credit reporting during the coronavirus don't happen again.

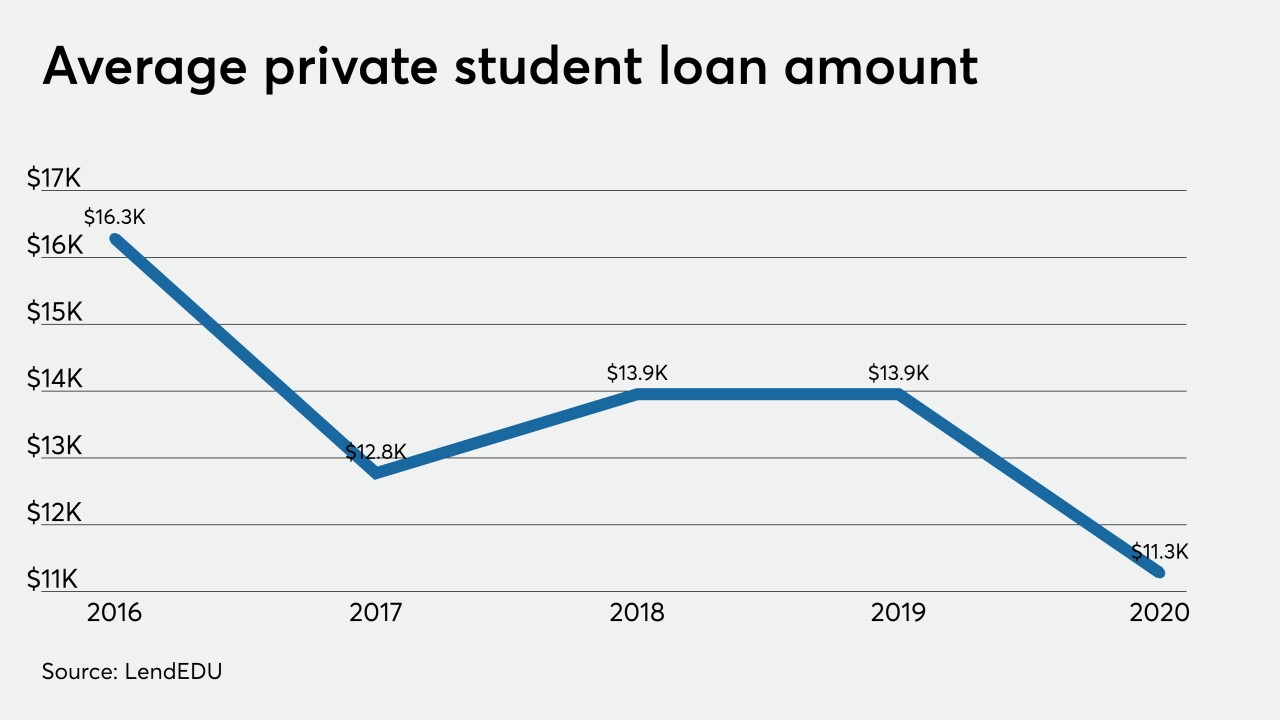

September 22 LendEDU

LendEDU -

Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

September 1