-

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

Wells Fargo is pulling back from student lending as the surge in coronavirus cases threatens to further disrupt higher education and the broader U.S. economy.

July 2 -

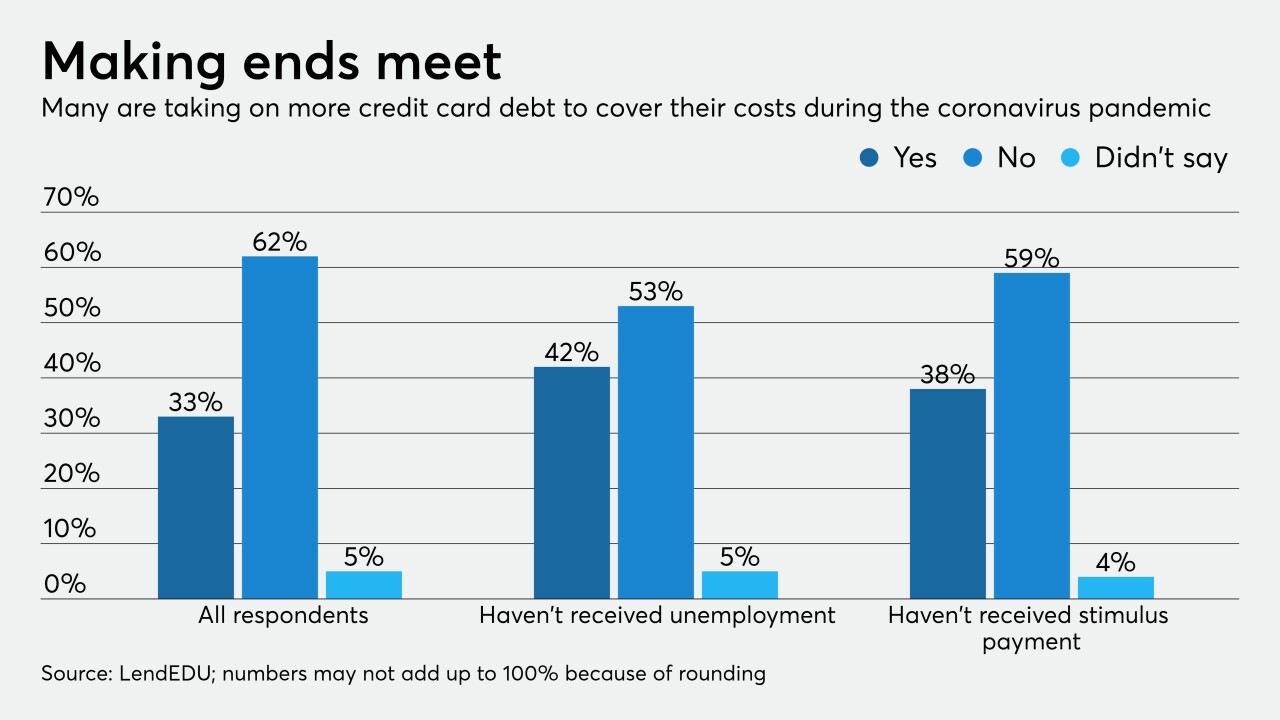

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12 -

A surge in demand for home loans drove the increase, but the second quarter could see a slowdown in borrowing and more delinquencies as consumers contend with the economic fallout of the coronavirus pandemic.

May 5 -

U.S. banks under $10 billion in assets made 60% of the loans in the first round of the Paycheck Protection Program; things go relatively smoothly in the U.K. as 110,000 small businesses apply for low-cost loans.

May 5 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

Discover and Sallie Mae are the latest to report a surge in forbearance requests as households struggle with job loss and other hardships resulting from the coronavirus pandemic.

April 23 -

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

April 22 -

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

April 15 -

The San Francisco bank said the amount of loans that could go into forbearance so far represents a small percentage of its total portfolio.

April 14