-

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

Beyond just maintaining the tax exemption, a look at how the recently signed Tax Cuts and Jobs Act might affect the credit union landscape.

January 4 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

About a third of U.S. banks are S corporations, and many are rushing to determine whether the new tax law has robbed them of their appeal and if they should convert to traditional corporations by the March 15 deadline.

January 3 -

The banks announced bonuses, wage hikes and charitable contributions resulting from the lower corporate tax rate enacted by Congress.

January 2 -

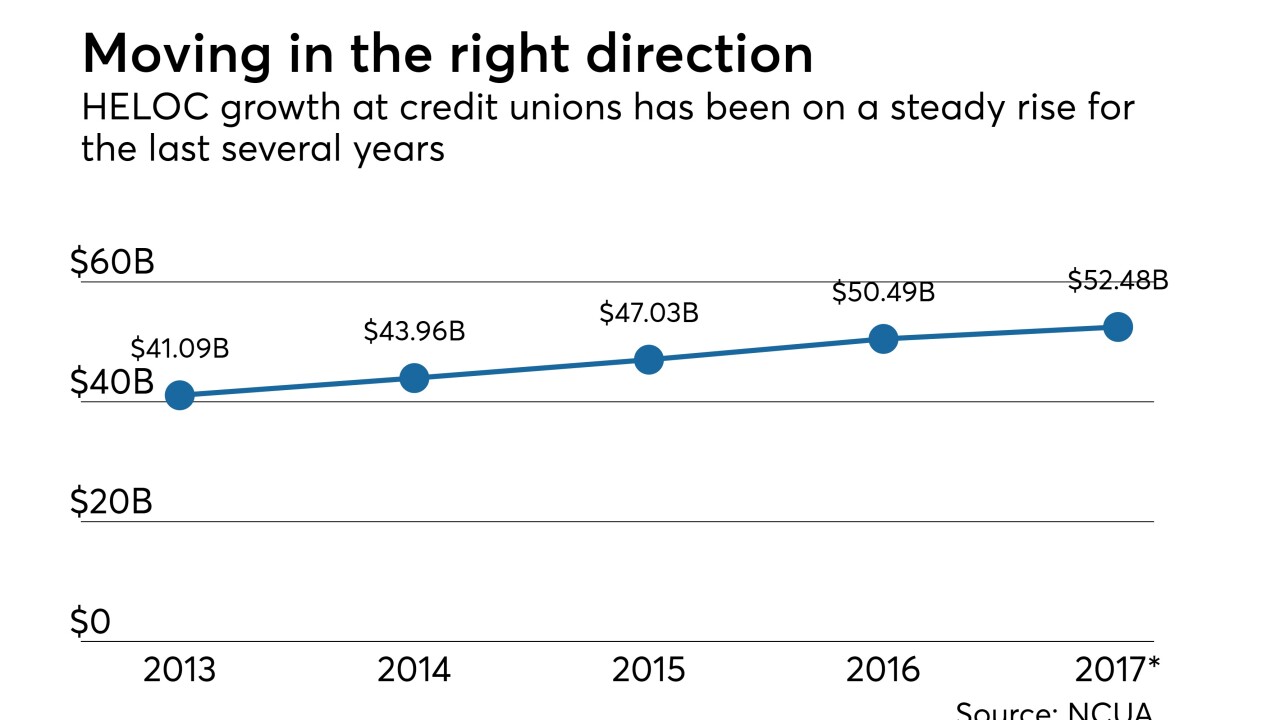

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing the risk for banks and credit unions.

January 2 -

But bank will benefit long-term from tax reform; judge says accounting firm failed to detect mortgage fraud that did in Colonial Bank.

January 2 -

Increases in charitable donations will be more important than ever for bank reputations, as tax breaks and a lighter touch from financial regulators rekindle public anger about the financial crisis.

December 29 -

They aren't creating new products, but some lenders are advising cash-strapped customers in high-tax states to tap home equity or other credit lines to prepay property taxes before the new tax law kicks in.

December 28 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing banks’ risk.

December 26 -

The reduction is “primarily” from a lower value of net deferred tax assets, the bank said in a securities filing Friday, the same day President Trump signed the legislation.

December 22 -

Bank of America, PNC join a growing list of banks planning to use the anticipated savings from the reduction in the corporate tax rate to boost wages for employees.

December 22 -

The legislation and public perceptions of it are expected to play a major role in 2018 elections that will determine whether Republicans retain control of Congress.

December 22 -

After Wells Fargo and Fifth Third said that the looming tax cut will allow them to raise pay, four smaller banks followed suit.

December 21 -

Fifth Third said it will give a bonus or raise to about three-quarters of its employees while Wells Fargo raised its minimum hourly pay in the wake of Congress' passing a tax reform bill.

December 20 -

The leaders of both national credit union trade associations praised lawmakers for maintain the movement’s tax-exempt status in the final version of a controversial tax reform bill.

December 20 -

The tax reform legislation approved by Congress on Wednesday and expected to be signed by President Trump soon is mostly good news for banks, but many will have to take big charges in the fourth quarter as a result.

December 20 -

The Senate approved the final tax reform plan 51-48 early Wednesday, the second-to-last obstacle before sending it to President Trump for his signature.

December 20 -

The House vote moved a sharp reduction in the corporate tax rate for banks and other businesses to within a few steps of becoming law.

December 19 -

Mary Mack adds mortgage and auto units to her already large portfolio; futures price dips but volume up compared to Cboe’s first day of trading.

December 19