-

In venturing into what's normally a province of large banks, nbkc in Kansas City, Mo., discovered innovative tax-management and other products that it could offer to its own customers or sell to other banks.

January 8 -

Despite continued growth and regulatory victories, this year saw challenges on a number of fronts that could have lingering – and even negative – consequences for the industry in 2019 and beyond.

December 17 -

Two U.S. senators demand an investigation into the German bank over security, criminal risks; the Treasury has proposed rules to help foreign banks deal with last year’s tax law.

December 14 -

Loans to house flippers dropped 11% in the third quarter, indicating "possible turbulence;" the German bank may have allowed some clients to claim tax credits on stock they didn't own.

December 10 -

CUNA and NAFCU have asked lawmakers to include a variety of specific provisions in an update to the 2017 tax reform package.

November 29 -

Banks earned $62 billion in the third quarter thanks to tax reform and higher asset yields, while the Deposit Insurance Fund crossed a statutory threshold.

November 20 -

The Swiss banking giant has been accused of helping wealthy French clients hide assets from tax authorities.

November 8 -

The industry and its allies have their work cut out for them navigating the political standstill.

November 7 -

Can farmers — and the banks that lend to them — survive Trump's trade war?

November 5 -

Bob Kressig, who is running for re-election of his state house seat, helped defeat a measure earlier this year that would have increased taxes on Iowa credit unions.

November 2 -

Federal "Opportunity Zones" that reduce exposure on capital gains could draw rich investors — and commercial lenders along with them — into economic development projects in thousands of troubled communities around the country.

October 29 -

Earnings were bolstered by lower taxes and higher asset-servicing fees, but revenue was flat and analysts raised concerns about a shrinking deposit base.

October 18 -

Amid a push to re-examine the tax status for large credit unions, let's look at the reality of the benefits they provide to CUs a fraction of their size.

September 21 Freedom Credit Union

Freedom Credit Union -

Unlike previous spots produced by the group that just backed candidates, the latest ones reflect a somewhat different approach.

September 19 -

Policymakers are right to re-examine the industry’s exemption and the unfair competitive advantage it provides.

September 14

-

The payments technology that powers international trade is crucially important because it helps streamline the processes and trim the costs of conducting business overseas, according to Darren Hutchinson, head of commercial in the Americas for WorldFirst.

September 13 WorldFirst

WorldFirst -

Rising tariffs are rapidly increasing the cost of building materials, putting banks at risk.

September 10 Contract Simply

Contract Simply -

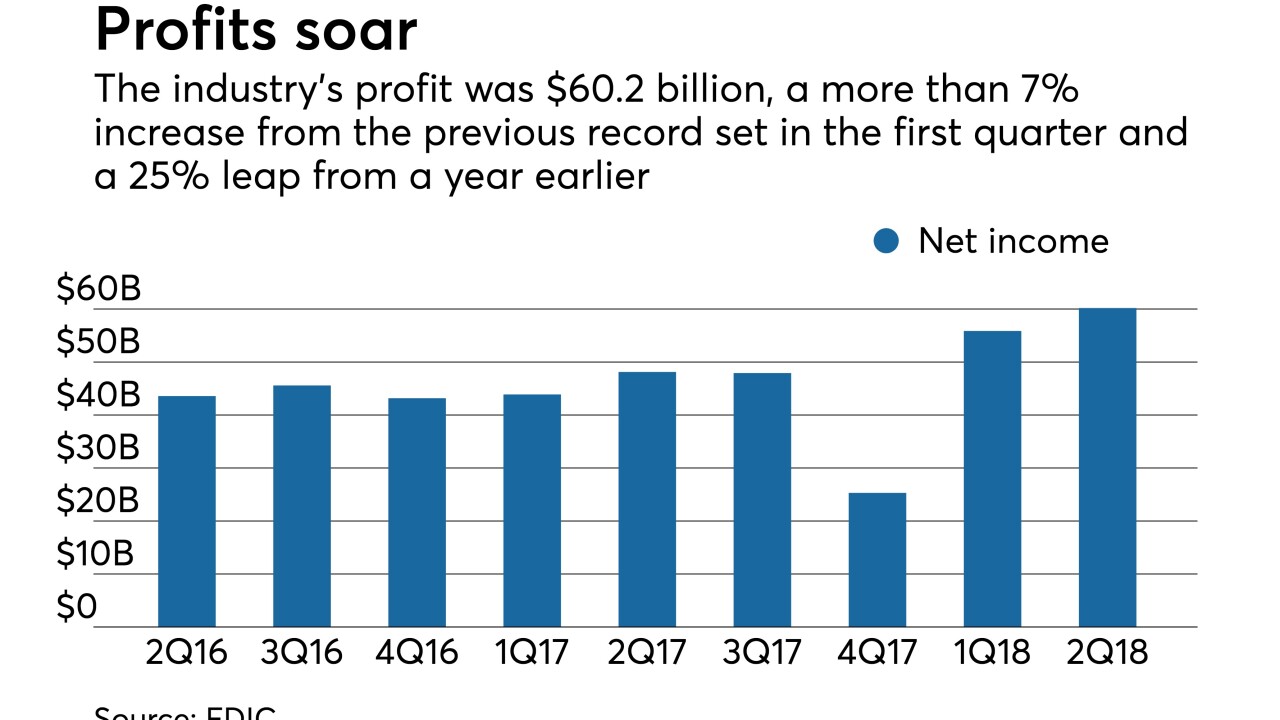

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

The industry’s profit was $60.2 billion, a more than 7% increase from the previous record set in the first quarter and a 25% leap from a year earlier, the agency said in its quarterly report on the industry's health.

August 23 -

What are community banks doing with savings from the corporate tax cut? Several CEOs share how they've put that money to use.

August 23