-

Reading Cooperative Bank recently launched a program that aims to hire young Black and Hispanic adults from low-income communities. Its leaders say it’s part of a broad strategy to develop new pipelines of talent and better serve low-income communities.

June 30 -

The movement encouraging investment in banks run by African American management teams gained huge momentum in recent weeks, but a spat between one of those lenders and an activist investor highlights the potential downside.

June 24 -

It's imperative that financial services firms find ways to ensure all Americans have access to the banking services necessary to thrive.

June 24

-

As the U.S. celebrates Juneteenth, it's imperative that credit unions find ways to ensure all Americans have access to the banking services necessary to thrive.

June 19

-

As the U.S. celebrates Juneteenth, it's imperative that credit unions find ways to ensure all Americans have access to the banking services necessary to thrive.

June 19

-

Uwharrie Capital in North Carolina and Valley National in New York used their community connections to seek out small companies in need of loans from the Paycheck Protection Program. They found plenty of them.

June 12 -

Industry figures have begun to speak out in support of demonstrations in the wake of the deaths of George Floyd and other African Americans, and new data is expected to show how the coronavirus impacted balance sheets.

June 8 -

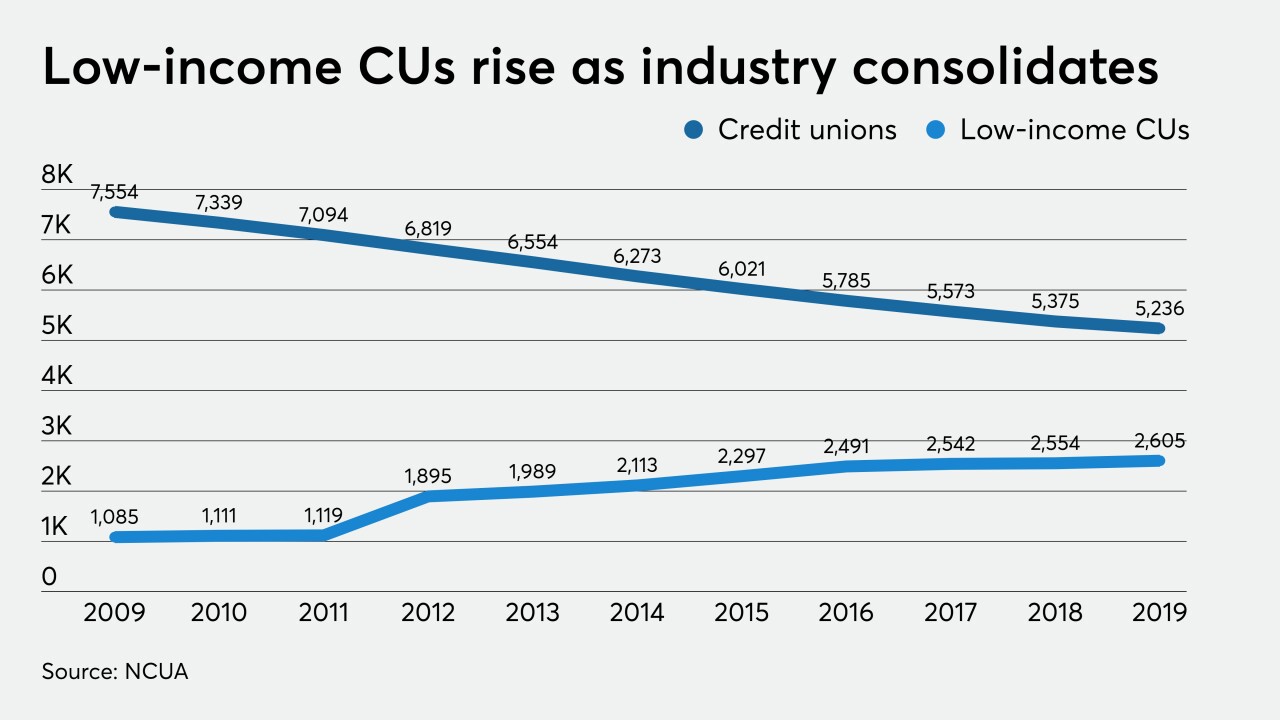

The Independent Community Bankers of America has asked NCUA's inspector general to review the agency's decision to change how low-income credit unions receive that designation.

May 29 -

A new program is intended to reach individuals without a fixed address or checking account more easily access COVID-19 relief funds — and hopefully keep those consumers as members.

May 27 -

The Independent Community Bankers of America accused the National Credit Union Administration of using the coronavirus to usher in additional changes without the normal amount of scrutiny.

May 7 -

Millions of Americans have yet to receive their stimulus checks, leading progressives to demand reforms improving underbanked consumers’ access to the financial system.

May 5 -

As the market deals with the short-term challenge of getting stimulus payments into the hands of citizens, the country has a unique opportunity to put the unbanked and underbanked on a long-term path to electronic payment methods, Jim Johnson of FIS says.

April 17 FIS

FIS -

As the market deals with the short-term challenge of getting trillions of dollars of relief and stimulus payments into the hands of citizens in the coming weeks and months, we as a country have a unique opportunity to put our unbanked and underbanked citizens on a long-term path to electronic payment methods, says FIS' Jim Johnson.

April 17 FIS

FIS -

Community advocates would like to see changes to the 1977 Community Reinvestment Act, but say regulators should suspend such efforts until the coronavirus pandemic has passed.

April 8

-

In underbanked markets, app-based firms can't live on digital alone, says dLocal's Michel Golffed.

February 27 dLocal

dLocal -

Giving more Community Reinvestment Act credit to such partnerships will help low-income communities, despite industry concerns.

February 25 Clearinghouse CDFI

Clearinghouse CDFI -

Phenix Pride FCU in Alabama is one of several institutions Inclusiv and the African-American Credit Union Coalition are celebrating during Black History Month.

February 19 Inclusiv

Inclusiv -

Capital Corps, founded by former Banc of California CEO Steven Sugarman, wants the minority-run Broadway sold to a buyer that serves low- and moderate-income borrowers.

February 12 -

Popular’s branch in a Brooklyn neighborhood faced an uncertain future until it was designated as a bank development district. Now it’s eligible to receive millions of dollars in municipal deposits.

February 5 -

The benefits include improved financial inclusion, the chairman of the NCUA argues.

January 30