-

The London-based banking giant announced a plan this week to exit the mass-market U.S. retail business and focus on managing the wealth of affluent globe-trotters. But other international banks will provide stiff competition.

May 28 -

The London-based banking giant is selling 90 of its branches and shuttering about three dozen more. The 20 or so branches it is retaining will be transformed into international wealth centers.

May 26 -

Cypress Trust in Palm Beach is poised to pull off a rarity: the conversion of a wealth management firm into a community bank. It’s simply another way to take advantage of the ongoing melding of the two financial services sectors, CEO Dana Kilborne says.

May 22 -

Princeton Portfolio Strategies Group would become the sixth asset management business that the New Jersey banking company has bought since 2014.

May 13 -

Women in the United States have a lot in common when it comes to managing their money. They prioritize financial stability and nearly half equate negative emotions with financial planning - far more than men. Join Financial Planning's Lynnley Browning and Jennifer Barrett, Acorns' Chief Education Officer as they discuss and explore how financial institutions can better engage with women and help them create a new model of wealth.

-

In partnership with the startup Hope Trust, the Chicago bank is piloting tools that will help people with disabilities, their families and caregivers manage their finances, government benefits and medical care.

May 11 -

At the brokerage and wealth management arm of Ally Financial, Bell leads the team responsible for shaping the insight on investing and the global markets that is shared with customers.

May 5 -

Ta is aiming to reduce turnover at Wells Fargo Advisors by revamping the succession planning program.

May 5 -

The company will start to offer insurance planning and risk management services as part of its purchase of Strategic Wealth Group in Valdosta, Ga.

May 4 -

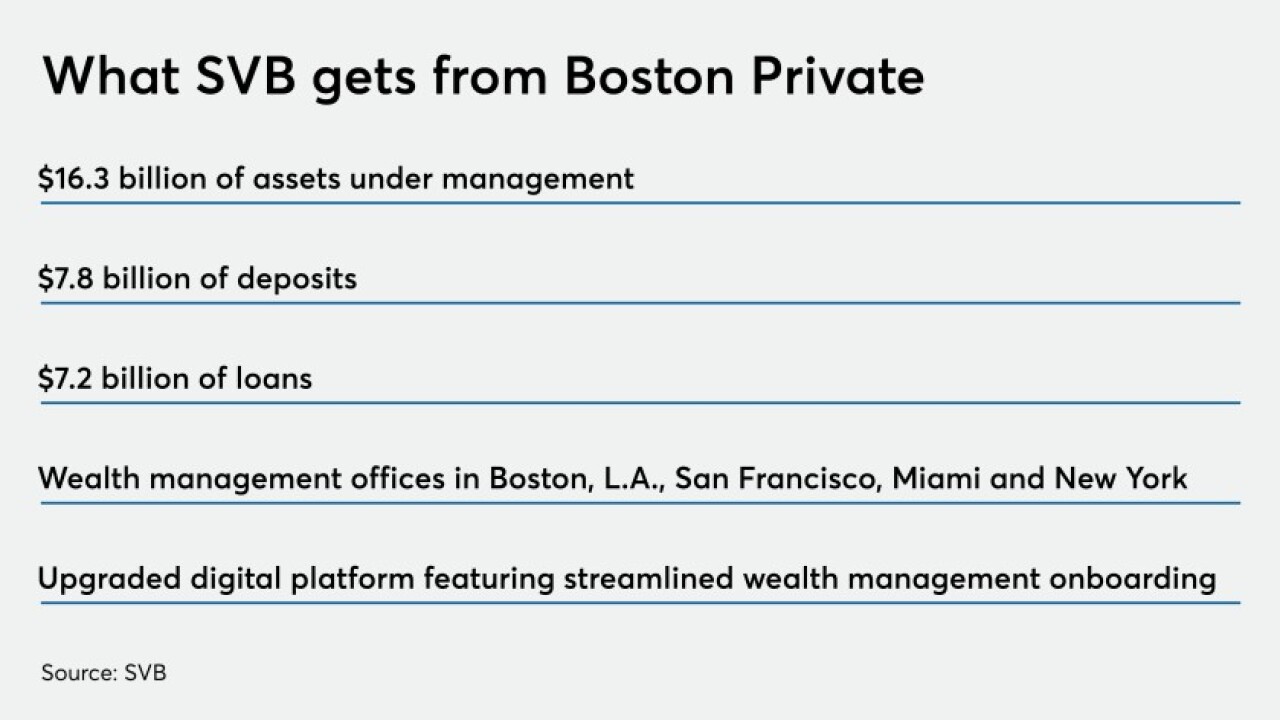

The company, which has faced opposition from a big investor, had to reschedule its shareholder vote after it was unable to secure the legally required two-thirds backing of outstanding shares at an April 27 meeting.

May 3