-

The jobs of chief investment officer departments and financial advisers are likely to change as banks and stand-alone wealth managers adopt artificial intelligence to inform the advice they give clients.

January 5 -

The Minneapolis company's addition of Karen Wimbish, a former Wells Fargo executive, to oversee wealth management products is one of several moves by U.S. Bancorp as it builds up its investment-advisory services.

December 28 -

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20 -

It is time for financial services to rethink retirement savings given changing work habits, customers' expectations of technology and the need for better transparency in 401(k)s.

December 15 -

Bank of America's forthcoming mobile app update will include personal financial management features.

December 13 -

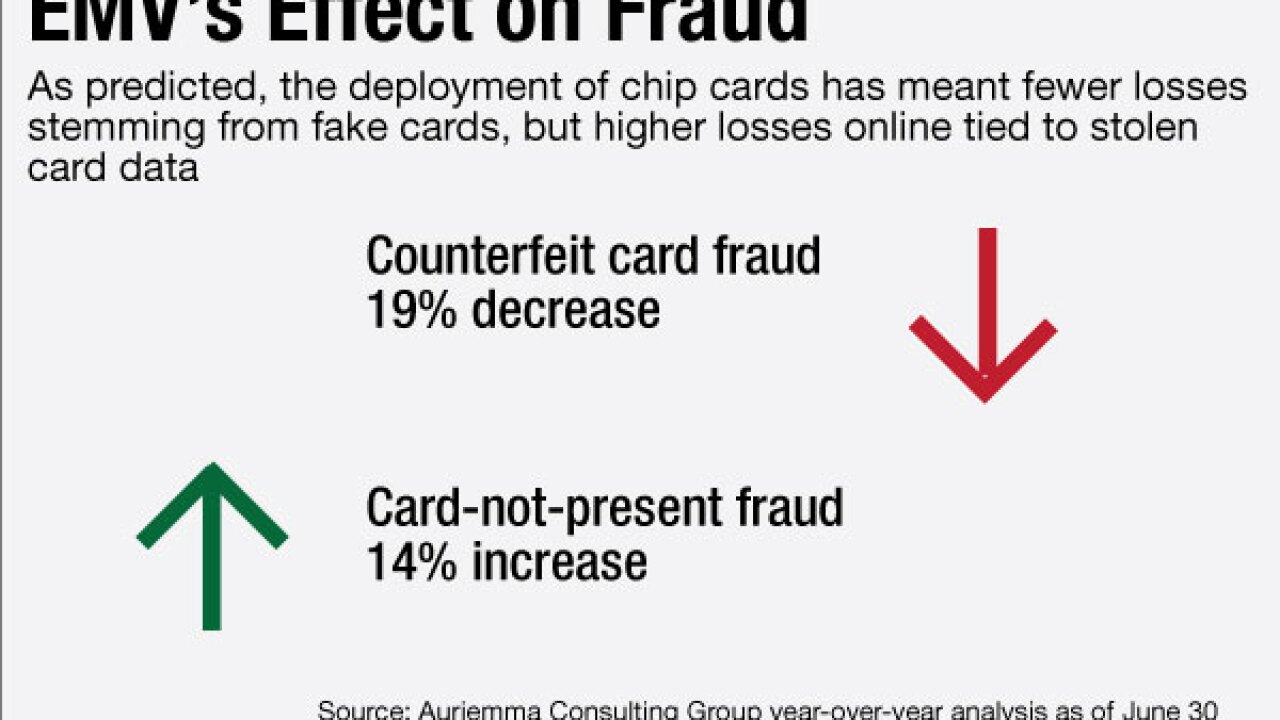

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Banks and data aggregators agree that screen scraping is a practice probably best left behind. In the coming year, the two might get better at sharing data via APIs.

December 12 -

A preview of the next version of Moven's personal financial management app finds a new direction helping people understand the trade-offs they make between short-term and long-term financial goals.

December 6 -

Intuit's personal finance app Mint has launched a bill tracking and payment function to keep customers on top of their bill management.

December 6 -

The $9 billion-asset company said in a press release Monday that it bought the business assets of Ronald N. Lazzaro in Rutland, Vt., a financial planning an investment services firm.

December 5 -

Mobile could become the one-stop shop that banking companies never quite achieved, blending basic banking, wealth management and other services, if efforts like those underway at Citigroup's fintech unit succeed.

December 5 -

Citizens Bank is the latest to partner with a robo-adviser, but it plans to quickly make the digital investment advice its own.

December 1 -

For its commitment to improving the long-term health of depositors, and a nimble, failure-is-not-a-dirty-word approach to innovation, USAA has earned an honor American Banker normally bestows on a single individual.

November 29 -

Americans could have significantly more money saved for their retirement, if not for all the fees that the asset management industry charges. What's worse is most savers are unclear how much they are paying, to whom, and for what. The authors of "What They Do With Your Money: How the Financial System Fails Us and How to Fix It" propose some changes that they say would not only help the economy grow faster but improve corporate America overall.

November 29

-

Johnson, 54, will succeed her father, Edward "Ned" Johnson, as chairman of the family-run firm in early December.

November 22 -

In the days of diskettes, Quicken was an innovator. Now, the personal financial manager aims to reclaim its glory days as it targets the 35-and-older crowd.

November 18 - Illinois

Northern Trust on Tuesday promoted Michael O'Grady to president. O'Grady currently serves as head of corporate and institutional services at the Chicago-based custody bank, overseeing businesses such as asset servicing and investment management.

November 15 -

The digital-advice startup SigFig has now teamed up on robo-advisory offerings with Wells Fargo and UBS, while BlackRock's FutureAdvisor has lined up agreements with U.S. Bancorp, BBVA and others.

November 15 -

Midland States Bancorp in Effingham, Ill., has launched an efficiency push after a period of expansion that reached another milestone Thursday.

November 10 -

The bank's decision, announced Wednesday is an indication many in the industry believe the rule isn't going away, despite speculation that the incoming Trump administration could delay or kill it.

November 10