-

Christopher Myers will retire as president and chief executive of CVB next spring, and the California bank says it will hire a search firm to begin seeking his replacement.

July 19 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

The San Francisco company said its loan pipeline would be strong the rest of this year.

July 16 -

Citi’s chief lending officer to take over HSBC’s U.S. business; Pittsburgh banks brace for incursion of industry heavyweights; borrowing by nonbank leveraged lenders is growing (maybe too much); and more from this week’s most-read stories.

July 12 -

The chamber passed a bill that would clarify how certain loans backed by the Department of Veterans Affairs are securitized, and legislation encouraging first-time homebuyers to participate in counseling programs.

July 10 -

Credit unions can reduce concentration risk and free up funding for new loans though participations but many institutions are hesitant about the process.

July 3 LoanStreet

LoanStreet -

Independent Bank in Texas, the seller, gained the business after buying Guaranty Bancorp.

June 24 -

Credit unions reported gains in areas such as loan balances and membership but it was at a slower pace than a year earlier.

June 21 -

Scientific techniques can help credit unions better understand how consumers are likely to behave in certain instances, allowing CUs to shape their tactics and responses to a variety of situations.

June 21 Common Cents Lab

Common Cents Lab -

In her first four and a half months, Kathy Kraninger met with lawmakers more than twice as often as her predecessor, but her schedule demonstrates willingness to meet with industry and policy stakeholders from various camps.

June 17 -

Student CU Connect CUSO, which had made high-risk loans to students of the now-bankrupt ITT Technical Institute, agreed to a settlement resulting in an estimated $168 million of loan forgiveness.

June 14 -

Even relatively wealthy Americans are so worried about their finances that it's affecting their mental and physical health. That's one of the findings in a Bank of America survey of more than 1,000 people in the U.S. who have enough investable money to qualify as "mass affluent."

June 14 -

The CEO of the digital-only bank Chime says it has quadrupled its membership in a year. So why doesn't his counterpart at Varo believe him?

June 13 -

To make a credit card top of wallet and build interchange income, credit unions must develop trust, provide great service and ensure the card works every time.

June 13 Member Access Processing

Member Access Processing -

Highland Associates has $26 billion in assets under management on behalf of not-for-profit medical endowments and foundations. Regions Financial is following the lead of other regionals, which have been scooping up investment firms that specialize in health care.

June 7 -

For First Republic Bank in San Francisco, “the pain index is likely somewhere between excruciating and traumatic,” says one expert. But few realize how much the bank got for its money.

June 6 -

Provident Bancorp, one of the nation's oldest active banks, is setting the stage to become a fully stock-owned company.

June 6 -

Sandler and his wife, Marion, built a small California thrift into a powerhouse before selling it to Wachovia prior to the housing collapse, but were heavily criticized for engaging in some of the same practices that caused the financial crisis.

June 5 -

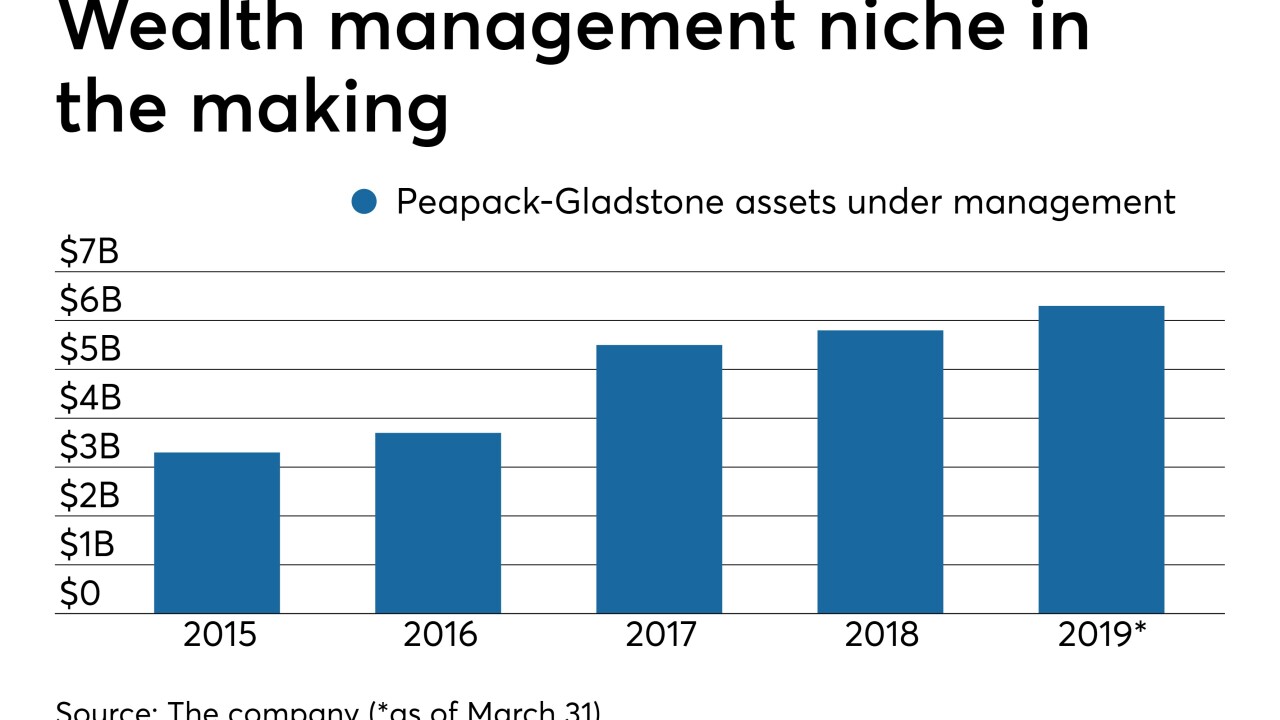

The New Jersey bank is entering a business dominated by larger players. In doing so, it could create a blueprint for other small banks.

June 5 -

The merging banks, whose new headquarters would be Charlotte, N.C., will each double their charitable giving over the next three years in Atlanta and Winston-Salem, N.C.

June 5