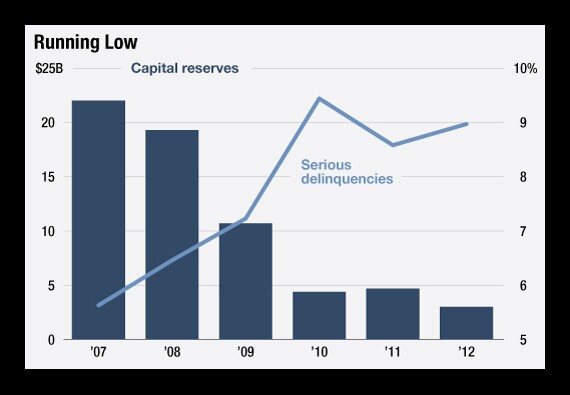

FHA Goes Bust

CFPB's No. 2 Moving Out

(Image: Bloomberg News)

Can Congress Extend TAG

(Image: Bloomberg News)

Regulators Hammered Over Basel III

(Image: Bloomberg News)

Bank Execs Offer Advice for Geithner Successor

(Image: Bloomberg News)

Clearing House War Games Megabank Failure

FSOC Acts on MMF Reform

(Image: Bloomberg News)

Fed Details Stress Test Scenarios

(Image: Bloomberg News)

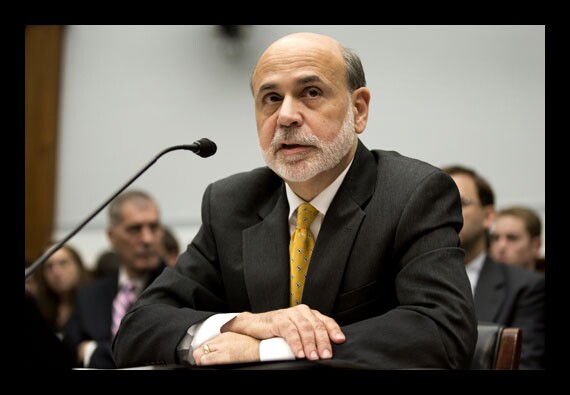

Bernanke: Housing Market Still Struggling

(Image: Bloomberg News)