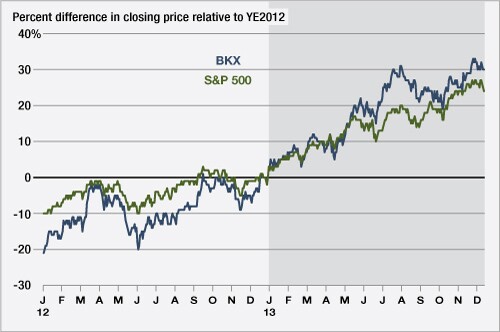

Total return, year through Dec. 12: 30.2%

Data: Sandler O'Neill and SNL Financial

SVB Financial (SIVB)

SVB, which lends and invests in Silicon Valley companies, earned $157 million in the first nine months of 2013,

East West Bancorp (EWBC)

In September, East West in Los Angeles

FirstMerit (FMER)

FirstMerit executives were under fire a year ago for

City National (CYN)

City National in Los Angeles took advantage of its strong stock price by announcing a

First Republic (FRC)

Another bank that focuses on wealth management, First Republic posted strong earnings throughout the year. Lending also increased, and the Los Angeles company

KeyCorp (KEY)

KeyCorp is one of the few large to make the list. The Cleveland company posted consistent earnings and brought in capital by

Comerica (CMA)

Comerica in Dallas benefits from a large Texas footprint. It also focused on cost-cutting earlier in the year and reported strong loan growth in the third quarter. Despite a its stock's impressive performance, the company has said it feels