On how banks should approach their assessments of customers' creditworthiness:

Related Article:

On whether economies of scale exist in the banking industry:

Related Article:

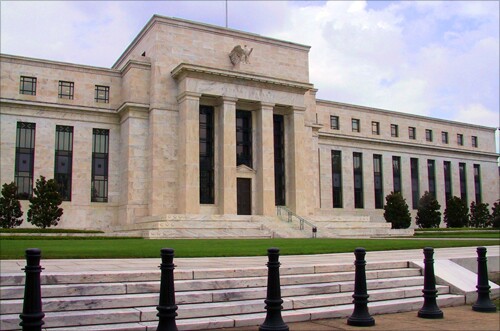

On the intended purpose of the Federal Reserve's emergency powers:

Related Article:

On how smartphones are changing Americans' day-to-day behaviors:

Related Article:

On alternatives to the complex Volcker Rule:

Related Article:

On the reasons for the dearth of female chief executives in the banking industry:

Related Article:

On a banker's proposal for a more-secure Internet payment system that requires identification of all users:

Related Article:

On JPMorgan Chase refusing to process payments for a condom company due to reputational risk:

Related Article:

On blaming Operation Choke Point for JPMorgan's severing ties with a condom seller:

Related Article:

On the argument that taxpayers remain on the hook for bank failures:

Related Article:

On a commenter's flippant suggestion to put Santa Claus in charge of the Fed:

Related Articles:

On lavish spending by executives at CertusBank:

Related Article:

On banks' efforts to gather new client data in order to personalize customer service:

Related Article:

On the news that Thomas O'Brien, the new president and CEO of Sun Bancorp, planned to cut 242 jobs and close the bank's retail mortgage, health care and asset-based lending businesses:

Related Article: