On Fincen Director Jennifer Shasky Calvery's response to concerns that no one reads suspicious activity reports:

Related Article:

On Fincen Director Jennifer Shasky Calvery's response to concerns that no one reads suspicious activity reports:

Related Article:

On a warning that underperforming banks must fold or be sold:

Related Article:

On a warning that underperforming banks must fold or be sold:

Related Article:

On a warning that underperforming banks must fold or be sold:

Related Article:

On a warning that underperforming banks must fold or be sold:

Related Article:

On a call for bank regulators to provide clear standards for acceptable living wills:

Related Article:

On the possibility that the Consumer Financial Protection Bureau may issue rules for virtual currencies like Bitcoin:

Related Article:

On the CFPB's warning to consumers about the risks of cryptocurrencies:

Related Article:

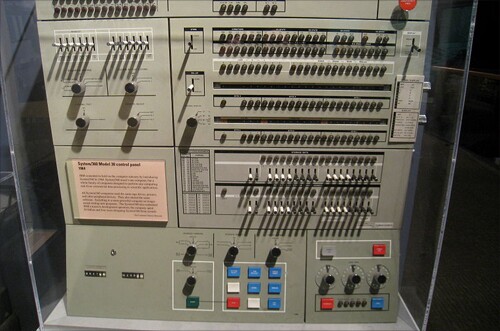

On the difficulty replacing tech personnel who understand legacy core systems that run on old mainframe computers:

Related Article: