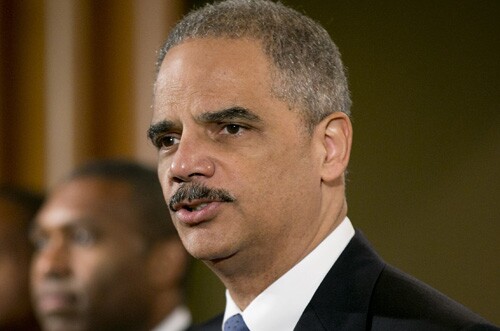

Time for Tarp Fraudster

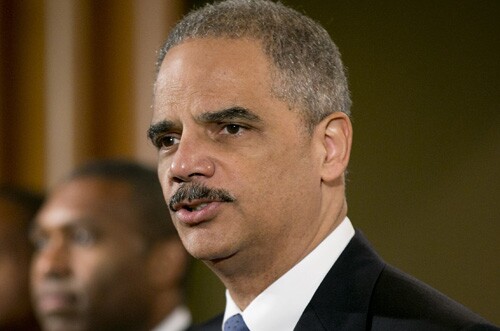

Georgia's Bank Fraud Problem

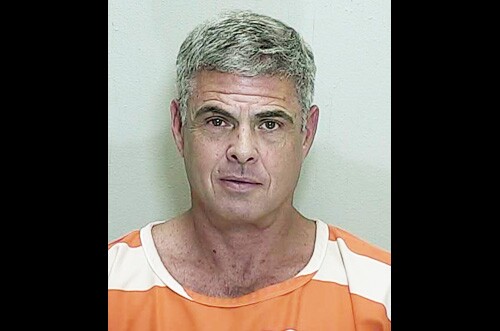

Busted for Mortgage Fraud

Bribes and Tax Evasion

30 Months for Book-Cooking

Nailed for Masking Bad Assets

Paying for a Lie

Bank-favored provisions that were included into the House's version of a bipartisan housing bill threaten to derail Senate passage, but Senate Banking Committee moderates seem skeptical of the combination.

The digital bank slashed its share volume and pricing the day before its public debut and following a mixed U.S. public debut for fellow Brazil fintech PicPay.

The Ohio bank said its 2027 earnings per share will be lower due to an accounting revision linked to its acquisition of Cadence Bank. But CEO Steve Steinour remains sold on Huntington's expansion plans, calling the Cadence deal a "home run transaction."

Houston developer Colony Ridge Development agreed to resolve allegations that it operated a bait-and-switch scheme targeting Hispanic immigrants that led to massive foreclosures.

JPMorganChase, Citi and Custodia are among the banks that have built digital asset projects on the Ethereum blockchain.

The district's appeals court let stand a May 2025 ruling that dismissed most of the D.C. Attorney General's claims against EarnIn in a major win for the firm and good news for fintechs looking for favorable regulatory treatment.