-

AmericanWest Bank in Spokane, Wash., has agreed to buy eight southern California branches from First PacTrust Bancorp in Irvine, Calif.

June 3 -

First PacTrust Bancorp (BANC) has landed another deal and a co-chief executive.

August 22 -

Other banks say small acquisitions take too much work, but Sterling Financial says a good, small deal is better than a risky, big one.

May 6 -

CEO Scott Kisting says the Spokane, Wash., which recently agreed to buy the $1.2 billion-asset PremierWest, realizes the value of scale. AmericanWest will still look at banks of different sizes, but it now prefers bigger deals.

October 31

Some community banks on the West Coast have been trading branches like baseball cards lately.

AmericanWest Bank in Spokane, Wash., recently announced it would sell branches in Idaho, Utah and Washington on Monday to three different buyers. At the same time AmericanWest is

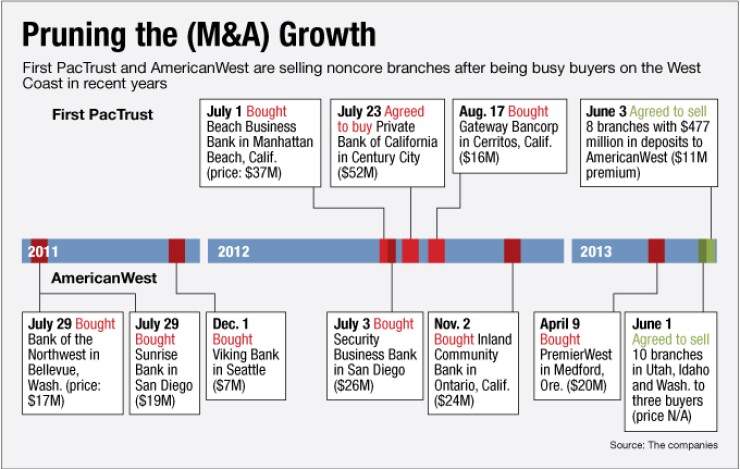

AmericanWest and First PacTrust belong to a group of West Coast banks that new investors recapitalized after the economic collapse. Those investors brought new visions for the banks that started a flurry of acquisition activity. AmericanWest and First PacTrust have spent the last few years buying smaller peers and say they are not finished, but the rejiggering of their branch networks is part of an effort to get closer to what - and where - they want to be.

"The first two years were all about buying, integrating, converting and dealing with the problem loans -- it was all an effort to make the bank as good as it can be," says Scott Kisting, chief executive of the $3.8 billion-asset AmericanWest. "To me 2013 is a year of transition."

SKBHC Holdings bought AmericanWest Bank in late 2010 in a bankruptcy auction. With $750 million of capital pledged, AmericanWest has completed six acquisitions since 2011.

"Today we have 112 branches, but we have to look at that and ask, 'Are all 112 in markets where the opportunity is consistent with our strategy?' "

What's consistent with one roll-up bank's strategy is noncore to another.

First PacTrust, a former credit union that converted to a mutual thrift in 2000 and became a stock company in 2002, has been focused on becoming more of a commercial lender since it raised $60 million in a private placement in November 2010. Steven A. Sugarman, one of the lead investors in the raise, took over as chief executive of the $2 billion-asset company in September.

It has completed two acquisitions and has a third pending. It also announced Wednesday that it plans to raise preferred equity to help it continue to make and buy more loans.

The goal is to build a $5 billion-asset commercial lender that operates from San Diego to Santa Barbara and focuses west of Interstate 5. The branches it is selling to AmericanWest are mainly east of I-5 and heavily retail. All of the branches date back to the 2002 conversion or earlier.

"They are good banking clients, they are good branches but they don't fit the same way with the new strategy," Sugarman says. "Someone who wants to build out the branches with a commercial business will be well suited."

That someone is Kisting.

"We've already made the investment in commercial banking that will enable us to lever this opportunity," Kisting says. Half of AmericanWest's acquisitions have been in Southern California. "Our teams are building assets, and these sticky deposits will be used to fund it."

Other recapitalized banks have undertaken similar initiatives recently. Opus Bank in Irvine, Calif., which raised $460 million in 2010,

Sterling Financial (STSA), which raised $730 million in 2010,

"We've been pruning our orchard, as I like to say," Pat Rusnak, chief financial officer of Sterling, said last month.

The moves, of course, are more than musical chairs. Some of them involve shedding parts of acquisitions that buyers did not want but had to take as part of the larger package.

"When you buy, you can't buy the perfect geography," Kisting says.

It is also about gaining efficiency and streamlining expenses. With low rates and tepid loan growth across the industry, cutting expenses has become a top priority in 2013. Analysts of First PacTrust spoke positively about the deal because it should go a long way toward improving the company's efficiency ratio. Its Pacific Trust Bank had an 80% efficiency ratio at the end of the first quarter, according to data from the Federal Deposit Insurance Corp. Sugarman has set a near-term goal of 65% by yearend.

"When you're trying to grow, you have to invest in your platform and your team," Sugarman says. "We've caught up on that part for now; now the goal is to get the efficiency ratio in line."