-

Ten Federal Housing Administration lenders could be facing hefty penalties from the government following an investigation into their underwriting practices, according to the Department of Housing and Urban Development's inspector general.

September 11 -

Sen. Elizabeth Warren, D-Mass., is pressuring the Department of Justice for more details related to payments made to the Federal Housing Administration as part of the $25 billion mortgage servicing settlement announced last year.

August 21 -

The regional banks face a False Claims Act probe by the departments of Justice and Housing and Urban Development into how they originated FHA-insured loans. Large fines may follow.

August 23

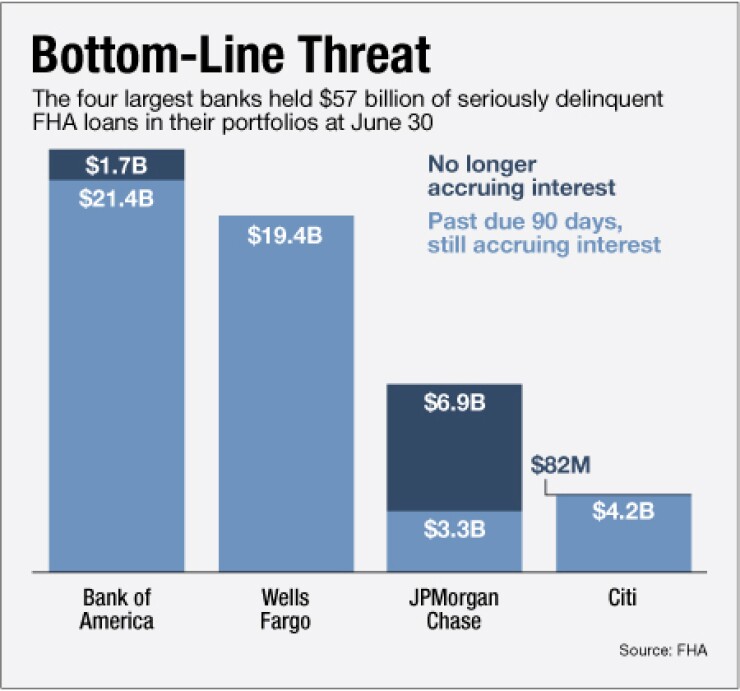

The nation's four largest banks are holding $57 billion of seriously delinquent loans that they've been slow to move into foreclosure over concerns that the Federal Housing Administration, the government mortgage insurer, will refuse to cover the losses and hit them with damages, according to industry sources.

The banks Bank of America (BAC), Citigroup (NYSE:C), JPMorgan Chase (JPM), and Wells Fargo (WFC) have assured investors in the footnotes of quarterly filings that the loans are government-insured and therefore pose no threat to their bottom lines, even if they end up in foreclosure. What's more, the banks have used these supposedly iron-clad government guarantees as a pretext for continuing to classify the loans as performing and for holding no reserves against them.

The FHA insures home loans issued by banks and other mortgage lenders to low-income and first-time home buyers. Those buyers pay the FHA insurance premiums to cover potential losses. In the event that an FHA-backed loan goes into foreclosure, the lender has the right to file a claim for reimbursement of losses.

However, the FHA's guarantee does not apply if lenders are found to have violated underwriting or servicing standards, or to have engaged in misconduct. Banks can also be held liable for treble damages under the False Claims Act if they are found to have "falsely certified" that mortgages met all FHA requirements.

As a result, the banks face hefty losses if the loans go into foreclosure because there is no guarantee that the FHA will cover them, asserts Rebel Cole, a former Federal Reserve Board economist who is now a professor of finance and real estate at DePaul University in Chicago.

In the last year, the Department of Housing and Urban Development, which oversees the FHA, has forced four banks to pay a total of $1.5 billion under the False Claims Act on FHA loans that defaulted. More settlements are expected soon.

"The banks say they are certain of repayment on these distressed assets, but that's simply not true," says Cole.

To be sure, even if all $57 billion of loans went into foreclosure, losses to the FHA and banks would likely be substantially less, thanks to recoveries on the properties. The FHA's overall recovery rate was 42% of the principal value in the second quarter.

Some lenders acknowledge that they will likely end up eating losses on defaulted loans held on their balance sheets and settlements related to past claims. They are also likely to try to avoid the risk of getting hit with damages by forgoing the FHA claims process and absorbing some losses themselves.

"There's a distinct possibility that they [banks] do not file all claims and just self-insure [absorb losses] on those loans," says Melissa Klimkiewicz, an attorney at BuckleySandler. "Lenders may err on the side of not filing claims where there is uncertainty because of the potential for HUD action or treble damages."

For their part, lenders bristle at the claim that they're intentionally keeping loans out of foreclosure. Even Ed Pinto, a resident fellow at the American Enterprise Institute and a sharp FHA critic, attributes the backlog of delinquent FHA loans to efforts by consumer groups to slow foreclosures, and to the unreasonably long time it takes to complete a foreclosure in states such as New York, New Jersey and Florida, where foreclosures are processed through the courts.

"Servicers are engaged in vigorous, robust loss mitigation efforts and that's one of the reasons foreclosures are taking longer and so many loans are still on (banks') books," says Phillip Schulman, a partner with the Washington office of K&L Gates, who represents several banks currently in negotiations with HUD.

"You can't file a claim until the house is in foreclosure or has [been the subject of] a short sale. It's a lengthy process, and foreclosure is the last option we look at," adds Jerry Dubrowski, a spokesman for B of A.

Moreover, it is not as if the FHA whose own financial health is in question is pressuring the banks to file claims. Like any insurer, the FHA wants to avoid paying claims, so it is providing incentives to mortgage servicers when they modify loans, offer a forbearance of past due mortgage payments or provide other alternatives to foreclosure. The FHA's goal is "to reduce the number of full claims against the insurance fund," a 2012 Government Accountability Office report on its finances said.

Some bank critics say they have intentionally held off from filing claims in the wake of their scandal involving the 'robo-signing' of foreclosure documents. That episode led to $25 billion national settlement between state attorneys general and the nation's five largest servicers. Critics suggest the banks are now unable to foreclose on FHA loans because they do not have proper documentation, and therefore cannot file claims with the FHA.

"It's like saying you'll be reimbursed for expenses when you've lost the receipts," says Reuben Guttman, who specializes in False Claims Act cases against banks at Grant & Eisenhofer.

Most banks define delinquent FHA loans as those 90 days or more past due but still accruing interest. B of A has $21.4 billion of delinquent FHA loans on its books, while Wells has $19 billion, Citi has $4.2 billion and JPMorgan Chase has $3.3 billion. The banks also have on their books more than $8.6 billion of "nonaccrual" delinquent loans on which the FHA is no longer covering interest. Almost $7 billion of those loans are held by JPMorgan Chase.

DePaul's Cole says that the numbers are misleading, however.

Bank of America, for example, lists only a fraction of its $23 billion in defaulted FHA loans as nonaccrual. But in a footnote to its second quarter filing with the Securities and Exchange Commission, B of A says the FHA, as the insurer, has stopped paying interest on $17 billion of the defaulted loans. Cole insists those also should be listed as nonaccrual.

Some observers suggest that the loans could sit on the four banks' balance sheets until they settle existing disputes with the FHA over their underwriting. B of A and Citibank have already negotiated settlements over False Claims Act violations with the FHA or are in the midst of doing so.

The settlements are to resolve claims involving an unknown amount of previously filed FHA claims that could date back a decade or more. After the legal claims involving these mortgages are cleared up, the banks will be able to file new claims for loans still on their balance sheets.

"At some point there is going to be a settlement and it will include the loans held on their balance sheets, and at that point they will be able to file claims," said one attorney who represents a bank currently in settlement talks.

In all, 10 FHA lenders are currently in negotiations with HUD and the Justice Department, David A. Montoya, HUD's Inspector General,

"Given the sheer volume of loans involved and high error rates identified in underwriting, settlements and favorable court actions may result in significant recoveries by the government from each of the 10 lenders," Montoya told a House subcommittee on Sept. 10.

Any recoveries, of course, would help the FHA bolster its own finances. Though the FHA says it has already set aside reserves to cover losses, the agency remains undercapitalized and

"There's no question that HUD is stepping up its enforcement efforts and that's a euphemism for collection efforts," says Schulman, the K&L Gates attorney.

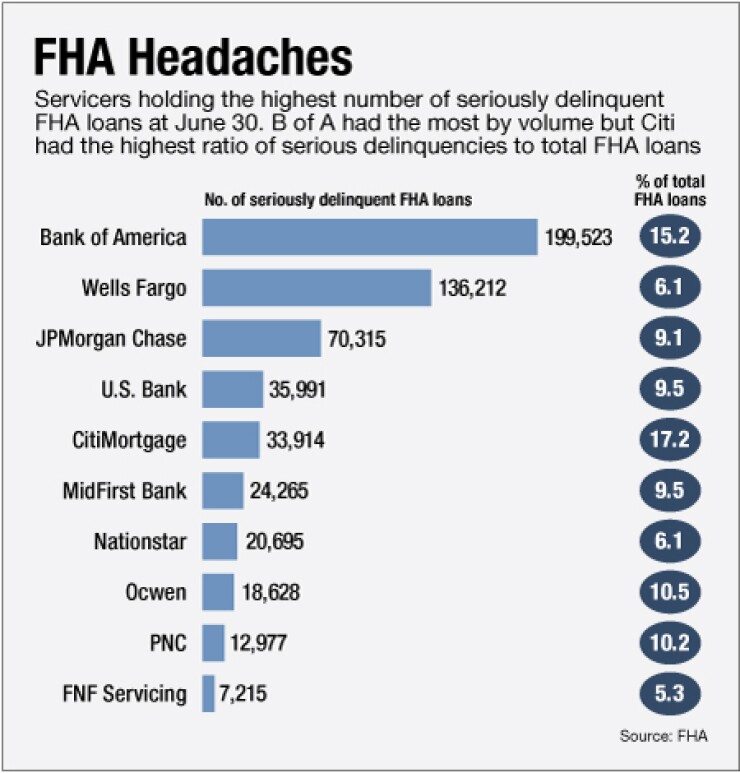

The FHA has more than $32 billion in reserves, but it faces an estimated $70 billion in future payouts on loans originated just from 2007 through 2009, according to the 2012t from the Government Accountability Office. In all, the FHA has roughly 686,000 seriously delinquent loans, representing $106 billion in total principal balances for all lenders. These distressed assets continue to be a major drag on the housing market, distorting the supply of homes for sale because so many remain stuck in the foreclosure process.

Last year, the U.S. Attorney for the Southern District of New York, the Justice Department, HUD's general counsel and HUD's Office of Inspector General settled civil fraud cases with three large banks: Deutsche Bank's Mortgage IT unit for $202.3 million, CitiMortgage for $158.3 million and Flagstar Bank for $132.8 million. Each of those settlements involved the lender's admission that they submitted what are called "false annual certifications" to HUD. A spokesman for Citi says because of its past settlement, it has continued to file new claims and expects the FHA to pay for all losses.

In addition,

B of A in particular has dramatically whittled down its backlog of delinquent FHA loans. From the fourth quarter of 2012 to the second quarter of this year, B of A sold off $8 billion in mortgage servicing rights, essentially unloading soured FHA loans to nonbank servicers Nationstar Mortgage (NSM) and Ocwen Financial (OCN). Those servicers now have the authority to file claims with the FHA once loans go through foreclosure.

Of the four lenders, Wells appears to be the most resistant to a settlement.

The

Wells has claimed it received a

Wells "believes it acted in good faith and in compliance with FHA and HUD rules," a spokesman said in an email. "We look forward to presenting facts to vigorously defend against this action."