-

Bryan Jordan, the CEO of First Horizon, says regulation and competition are forcing banks to find ways to connect with customers who don't want face-to-face contact.

March 5 -

Some analysts say the government-sponsored enterprises are sending a bold signal to banks that elevated buyback demands will continue and may peak this year.

June 27 -

First Horizon National Corp.'s next chief executive said he expects to inherit a stronger, albeit smaller company that could earn nearly $500 million a year excluding the provision expenses that contributed heavily to a $19 million net loss in the second quarter.

July 16 - Texas

With agreements to sell its branch network outside Tennessee, First Horizon National Corp. in Memphis on Tuesday formalized its retreat from a national retail expansion that is no longer viable as it battles a tough environment on several fronts.

September 26

First Horizon (FHN) in Memphis, Tenn., has been quietly building out a commercial lending operation even as it copes with its failed mortgage expansion.

Industry observers for years have focused on the $25.5 billion-asset company's mortgage missteps before the financial crisis and their aftermath. It isn't hard to do given First Horizon's lingering exposure to

First Horizon finally has some traction and is looking to make business loans in more Southeastern cities, Chairman and Chief Executive Bryan Jordan said in an interview Tuesday.

"The commercial product set feels like a place where we can provide more differentiation, so we look at the business as an area where we need to continue to invest," he said. In terms of commercial lending and bond distribution, "we have been front-footed promoting these platforms."

First Horizon's goal is to identify markets that closely resemble Tennessee cities such as Memphis or Chattanooga where it already operates. Good examples include Huntsville, Ala., and Little Rock, Ark., Jordan said. He also has an interest in expanding First Horizon's commercial lending operations in Nashville.

The company aims to hire bankers who could attract new business, but Jordan is open to acquisitions if a suitable bank comes along. "We can grow through organic efforts or, with the right opportunity, an acquisition," he said. "We have continued to be inquisitive with M&A, but we haven't hit on anything that works at this point."

First Horizon has largely deployed capital to repurchase stock, but "we'd certainly participate in M&A if we had the right transaction," he added.

"Nashville is the market where investors would like to see them consolidate," said Marty Mosby, an analyst at Guggenheim Securities and a former chief financial officer at First Horizon. "It is a natural expansion … that increases their franchise value" if they ultimately become a seller.

First Horizon is benefiting from the overall surge in the stock market, hitting a 52-week high of $10.99 during trading Wednesday. Its fourth-quarter earnings rose 16% from a year earlier, to $40.7 million.

Jordan

Fox manages one of four regions at First Horizon. He declined to discuss the size of its loan book other than to say it exceeds the $14 million in deposits held at its offices at June 30. The unit once focused solely on clients with at least $50 million in annual revenue, but it now courts borrowers with a fifth of that amount.

"The commercial side of banking is the one part of the economy that is working today," Mosby said. "I'm sure they will look to attract lenders and find pockets to grow."

Competition is fierce for commercial loans, with BB&T (BB&T) and PNC Financial Services Group (PNC) representing some of First Horizon's largest sparring partners in the Southeast. "Not every bank can be successful, so it will come down to getting the right people and landing the business," Mosby said.

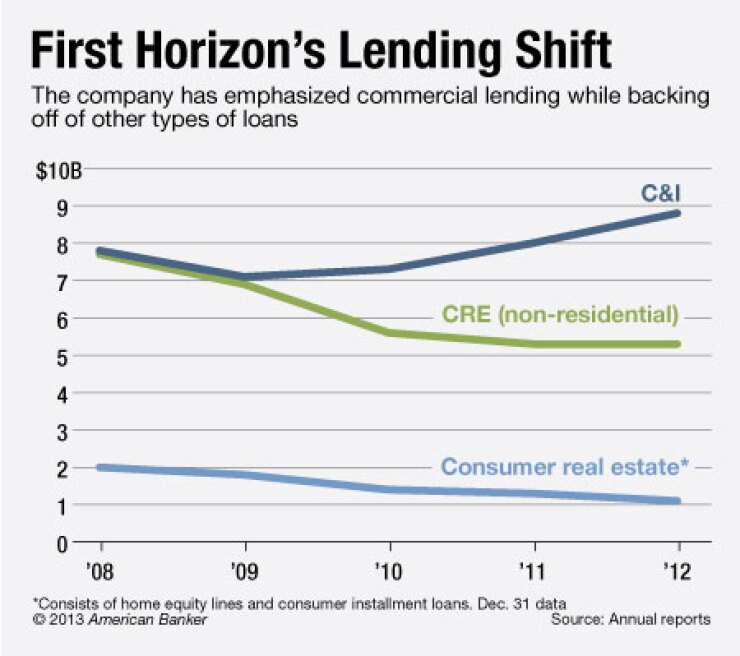

At Dec. 31, First Horizon's total portfolio of commercial and industrial loans rose 10% from a year earlier and 24% from a low point at the end of 2009, to $8.8 billion. Over the same time, the company has reduced exposure in areas such as commercial real estate and residential mortgages.

Still, First Horizon has a sizable mortgage warehouse business, the strength of commercial lending will be crucial as refinancing tapers off.

The company pursued several ill-fated initiatives under former CEO Ken Glass before the financial crisis. First Tennessee became First Horizon as it began an aggressive strategy of converting mortgage offices in cities such as Atlanta and Dallas into full-service branches. It also built a national mortgage lending platform.

When the housing bubble burst, subsequent CEOs Jerry Baker and Jordan

"Most of the difficulty was oriented in the national mortgage business," Jordan said. "You hear a lot about the wind down of the mortgage business in analysts' reports, but it has never been a distraction for our bankers and customer base."

The commercial lending push is quite different from First Horizon's mortgage initiative under Glass, Mosby says. "It is a regional expansion and not a national growth strategy," he said. "These are small steps and not big bites."