-

Kevin Cummings, CEO of Investors Bancorp, wants to reach $30 billion in assets in the next six years, but he admits that Investors must sharpen its focus on commercial clients to achieve that objective.

May 8 -

Meridian Interstate Bancorp (EBSB) in East Boston, Mass., is planning a second-step conversion.

March 11 -

Clifton Savings Bancorp (CSBK) in Clifton, N.J., received orders for more than $170 million of common stock in a subscription offering tied to its second-step conversion.

March 19 -

Investors Bancorp had hardly announced its deal for Roma Financial, a fellow mutual thrift in New Jersey, than speculation began whether it should buy more mutuals before it restructures and is barred from doing so.

December 20

A recent move by TFS Financial (TFSL) in Cleveland has fueled speculation that it could be the next big mutual conversion.

TFS, the holding company for Third Federal Savings & Loan Association of Cleveland, on June 25 said it planned to seek shareholder and regulatory approval to pay its public shareholders a dividend of up to 28 cents per share. The announcement came less than three months after the

TFS is now the nation's largest publicly traded mutual, with Investors Bancorp (ISBC) in Short Hills, N.J.,relinquishing that title after

TFS could raise hundreds of millions of dollars through a second-step conversion and the plan to seek a dividend waiver may be an early step towards that goal, says Ted Kovaleff, an analyst at Halcyon Cabot Partners. Paying a dividend could be the first of several potential new shareholder-friendly items, including stock buybacks or a conversion.

"I expect that, at some point, they will do a second step," Kovaleff says.

Other large publicly traded mutuals have recently announced plans for a second-step conversion, such as the $2.7 billion-asset

However, TFS has strong capital levels and doesn't need a conversion as badly as other mutuals did in order to expand, Kovaleff says. Investors Bancorp needed to raise capital to help fuel its ambitious growth plans.

"Investors really needed the capital to grow," Kovaleff says. "That's not the case with TFS."

Then there are family ties. TFS is run by Chairman and Chief Executive Marc Stefanski, the son of founders Ben and Gerome Stefanski, and he has not indicated an interest in pursuing a conversion, says Rick Weiss, an analyst at Boenning & Scattergood. Stefanski, along with his wife and children, own 2.7 million shares or just under 1% of TFS stock.

"I think they're hedging their bets and waiting to do it when the time is right," Weiss says.

In an April 25 conference call with analysts, Stefanski was asked about a second-step conversion and indicated that it's not in his immediate plans.

"It is nothing that is going to be enacted on in the near future," Stefanski said during the call. "I always said that that is for the next generation of management for Third Federal. But I will never say never."

TFS's dividend waiver proposal "is not a precursor to a second-step conversion, but rather part of our three-dimensional approach to adding value for our shareholders, including stock buybacks, reinstating the dividend and growing Third Federal," says David Reavis, a company spokesman.

Whenever TFS sets its sights on a conversion, it has some intriguing possibilities it could pursue, Kovaleff says.

For one, TFS could help boost the size of the conversion's capital raise by acquiring other mutuals. That's what

The acquisition of additional mutuals increases the percentage of the full company that's owned by the mutual holding company. That means a bigger capital raise, because there are more shares to sell to the public.

Acquiring mutuals can also help improve a mutual's tangible book value, based on the quality of the loan portfolio being acquired, Kovaleff says.

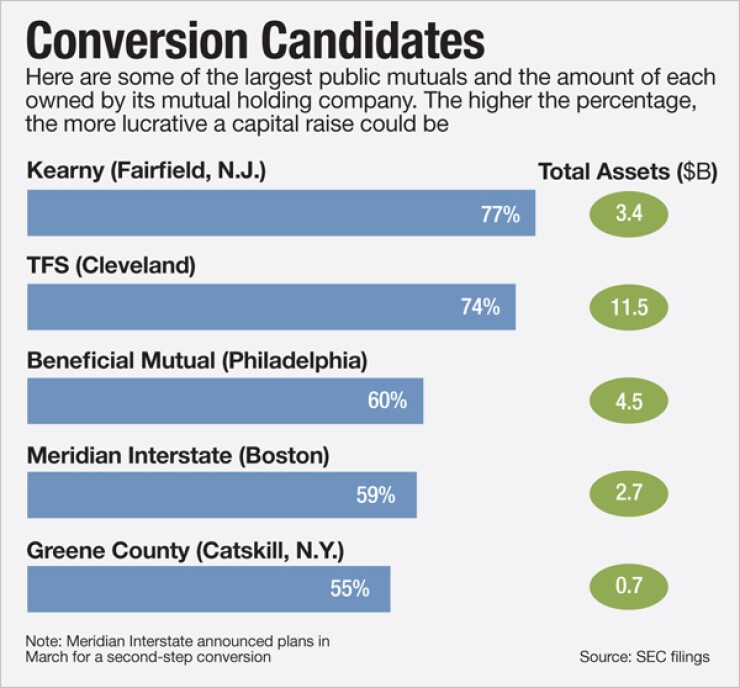

TFS's mutual holding company already owns about 74% of TFS Financial. That's a bigger share than Investors Bancorp's mutual holding company owned.

But TFS is somewhat limited in the mutuals it could possibly acquire, Kovaleff says. Investors Bancorp is based in New Jersey, where a large number of mutuals are located. But TFS's two states, Ohio and Florida, are bereft of mutuals.

"You've got a problem with TFS's footprint," Kovaleff says.

TFS has made only two purchases in its 75-year history, one in 1976 and the most recent in 2005 when it bought DeepGreen Bank in Cleveland.

Still, despite the caveats and the company's attempts to dampen speculation, Stefanski is going to be hounded by questions about whether he will seek a conversion, Weiss says.

In the April conference call, Stefanski said that he wants Third Federal to be more aggressive, a strategy that would seem to require additional capital.

"We continue to remain very, very competitive and very, very aggressive," Stefanski said. "We plan to grow the balance sheet regardless of what the economic conditions are."