-

BB&T (BBT) in Winston-Salem, N.C., reported a decline in quarterly earnings because of lower mortgage activity and a narrower net interest margin.

July 21 -

SunTrust Banks (STI) said second-quarter profit rose on higher revenue from investment banking and the sale of an asset-management unit.

July 21 -

Bank of America executives downplayed expectations about commercial lending and warned about the dangers of lowering prices to build loan portfolios, while their counterparts at U.S. Bancorp reveled in double-digit growth in the category and pledged to stay aggressive.

July 16 -

The ongoing search for expense cuts continues, as investors wonder why regional banks such as KeyCorp, Fifth Third, Webster Financial and M&T aren't cutting more and faster.

July 17

Several regional banks are realizing that loan growth comes at a price.

BB&T and SunTrust Banks, for instance, touted significant increases in their loan books during the second quarter, particularly in commercial lending. Unfortunately, that sector is highly competitive, putting pressure on margins and revenue.

Such duress will likely persist as long as lenders chase after the best commercial credits, which in turn will drive down yields.

"The competition is more intense if you're lending into the leveraged-loan market or in the plain-vanilla, small, middle-market commercial customer market," said Gerard Cassidy, an analyst at RBC Capital Markets.

SunTrust reported growth in revenue, to $2.2 billion, but it fell year over year if one excludes the proceeds from its

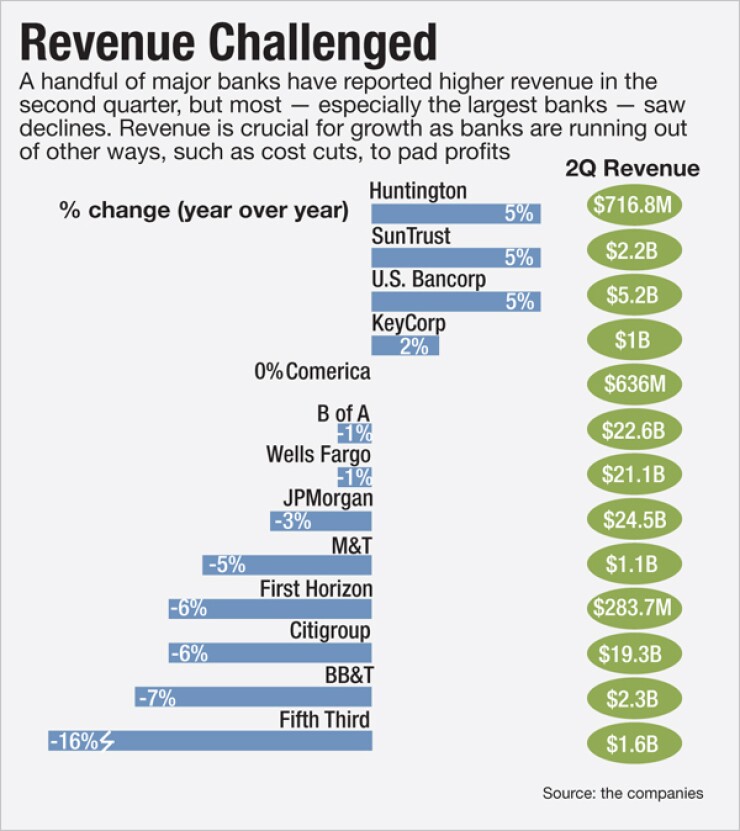

Those banks have lots of company, though the reasons for revenue declines vary widely throughout the industry.

BB&T and SunTrust, which compete against each other in many markets, face revenue challenges despite increased lending.

SunTrust had strong loan growth in wholesale banking, which includes equipment finance and commercial real estate. That category has significantly lower yields, which hurts the net interest margin.

Net interest income rose just 0.2%, to $1.2 billion, after loan yields on earning assets fell 15 basis points.

Lower yields were most pronounced in commercial lending, because of "the sheer amount of competition in the C&I space," William Rogers, SunTrust's chairman and chief executive, said during a conference call with analysts. Yields also narrowed in nonguaranteed mortgage loans and indirect auto lending.

Still, management viewed loan growth as a positive development. "I don't have any reason to be other than optimistic about where we are from a loan-growth standpoint," Aleem Gillani, SunTrust's chief financial officer, said.

Fee income, excluding the RidgeWorth sale, fell slightly, to $852 million. Investment banking helped offset the degree of decline, posting a 28% increase, to $119 million, largely because of increased volume in bond originations.

BB&T also struggled with top-line growth, though the Winston-Salem, N.C., company's executives sought to avoid year-over-year comparisons and emphasized improvement in linked quarters. They touted loan growth, especially in commercial lending, though acknowledging that first-quarter activity was stymied by harsh winter weather.

Yet analysts seized on the $188 billion-asset BB&T's weak performance compared with a year earlier. Its revenue decline included an 11% decrease in fee-related income and a 5% drop in net interest income.

"Overall, it was a mixed quarter," John Pancari, an analyst at Evercore Partners, wrote in a note to clients about BB&T's results. Despite solid balance-sheet growth, BB&T suffered from weaker-than-expected revenue, he wrote.

BB&T is making more loans its portfolio rose 2.5% from a year earlier, to $121 billion but its lenders appear to be giving more on rate, as its net interest margin narrowed by 27 basis points, to 3.43%.

Some compression is tied to loans BB&T gained from failed-bank deals. Still, management noted that commercial pricing remains highly competitive and that they expect the margin to shrink by 5 to 10 basis points in the third quarter before stabilizing.

"It's a real tightrope in terms of managing the right level of growth, in terms of quality and spreads," Kelly King, BB&T's chairman and chief executive, said during a conference call. The company "got a little close to the market" in terms of pricing in the second quarter, he said.

On the fee side, mortgage-banking income fell 82% from a year earlier. BB&T also reported a 7% decline in investment banking and brokerage fees and commissions.

Management, determined to cut costs as it deals with tight margins and revenue challenges, reiterated a commitment to improving its efficiency ratio from 59.8% at June 30 to 56% by Dec. 31. BB&T expects noninterest expenses to fall below $1.4 billion in the third and fourth quarters, compared with nearly $1.6 billion in the second quarter.

The company said it cut nearly 450 jobs in the second quarter, though it added about 150 people when it bought Citigroup's branches in Texas. More job cuts are planned in coming quarters.

"I understand that's a big leap," King said of the targeted efficiency ratio. "But we feel very confident that's what's going to happen."

To be sure, U.S. Bancorp, Huntington Bankshares and KeyCorp reported revenue increases last quarter.

U.S. Bancorp and analysts attributed the Minneapolis bank's strong showing to low-cost funding and high efficiency that allowed it to effectively offer lower rates on commercial loans.

But more banks have had bad news on the revenue front.

M&T's revenue fell 5.1% from a year earlier, to $1.1 billion, on a decline in net interest income that was fueled by narrower margins, and by drops in trading account and foreign-exchange gains and deposit-account service charges.

Revenue at Fifth Third fell 16% to $1.6 billion, largely because of a 67% decline in mortgage revenue, as well as a $17 million devaluation of real estate, and a $16 million negative adjustment on its Visa total return swap.

Revenue at Citigroup fell 6% from a year earlier, to $19.3 billion, on lower volumes of fixed-income trading and mortgage refinancings. The revenue slowdown prompted concerns from analysts during a conference call last week.

CEO Michael Corbat played up near-term growth prospects in a hopeful pitch that echoed many of his industry counterparts as they have urged patience among investors.

"If you look at the underlying drivers and fundamentals of the business, deposits, loans what's going on [with] investment banking parts of the firm are performing well, and we think in the second half there's some continued revenue uplift there," he said.