-

Listen to any bank earnings call these days and odds are that, at some point, executives will discuss how they are addressing the persistent lack of revenue growth by simultaneously cutting expenses and investing in new business lines.

January 2

First Niagara's chief executive shares at least one thing in common with his predecessor: a willingness to frustrate Wall Street by spending money.

Beyond that, the similarities end. John Koelmel,

Gary Crosby, perhaps looking to put his own stamp on the Buffalo, N.Y., company, is determined to invest internally. He plans to spend up to $250 million in the next three to four years to upgrade infrastructure in hopes of boosting revenue and improving long-term efficiency.

In his first conference call

Investment must "be undertaken at some point," Crosby said. "The sooner we do it, the better. Otherwise, you risk falling further behind and saddled with a lot more integration costs and a lot more integration risk."

"The days of taking a year to put in a new product is not the way banks can operate going forward," Greg Norwood, First Niagara's chief financial officer, said in an interview Friday.

Analysts, who had been hopeful that executives would discuss cost-cutting, seemed disappointed at the thought of more spending. Investors also voted with their feet; the company's stock plunged more than 10% on Friday.

First Niagara's investments should help the company integrate more technology, boost fee income and stay ahead of regulatory requirements, Crosby said, although benefits may go unseen for several years.

The strategy will make it easier and, over time, cheaper to introduce new products, and ideally would allow the $37.6 billion-asset company to "plug in" new technologies without an unwieldy integration process, he said.

But the returns could come too late for many existing investors, Bob Ramsey, an analyst at FBR Capital Markets, wrote in a note to clients where he downgraded the company's stock to "market perform" from "buy."

First Niagara's quarterly profit rose 31% from a year earlier, to $70 million, and met the average estimate of analysts polled by Bloomberg. But Crosby seemed unimpressed by the results.

"We have a solid core, but where we are today is just not good enough," he said. "Our returns are not where we want them to be, where they can be."

In terms of short-term cost-cutting, Crosby said First Niagara had already "squeezed out all the low-hanging fruit" and "doesn't have lots of inefficiencies left to squeeze."

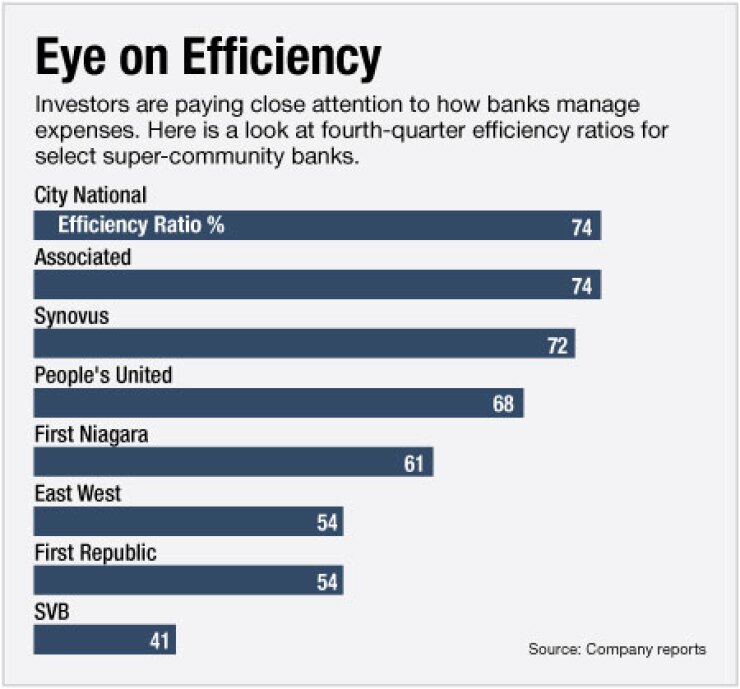

First Niagara's efficiency ratio fell to 61.5% in the fourth quarter, down from 68.4% three years earlier.

Streamlining has come in the form of shedding branches, including

First Niagara also wants to boost fee income, which is "not what it should be for a top-25 bank," Crosby says. Noninterest income fell by 3% from a year earlier, to $89.3 million. Mortgage banking revenue plummeted 66% from the fourth quarter of 2012, to $2.8 million.

First Niagara sees room to record more fees in its commercial business. It is planning to introduce cash-management products to gather commercial deposits. Fees on the retail side have been solid; revenue from deposit service charges increased by 14% last year compared to 2012, to $104.1 million.

Crosby served as First Niagara's interim CEO from April to December, when he was given the job permanently. Since locking down the job, he has

A focus on internal investment marks a sharp break from Koelmel, who pulled off bold deals, including the 2011 purchase of more than 100 HSBC branches, but lost his job when predicted cost savings and efficiencies failed to materialize.

The days of risky deals are over, Crosby said. "Being bigger is not a priority," he told analysts during Friday's conference call. "There is no next M&A deal."