-

Listen to any bank earnings call these days and odds are that, at some point, executives will discuss how they are addressing the persistent lack of revenue growth by simultaneously cutting expenses and investing in new business lines.

January 2 -

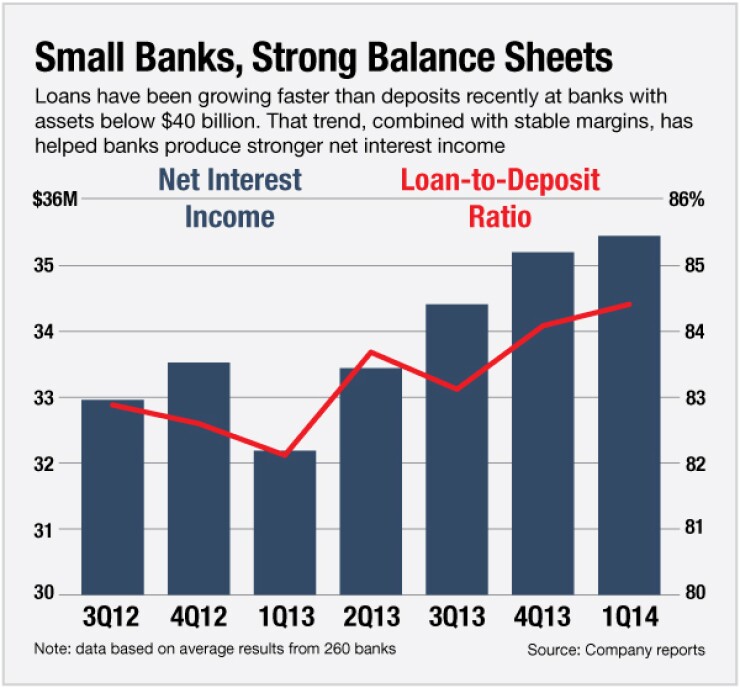

Slowly but surely, community banks have been lending out more of the deposits they take in, a healthy sign for the industrys profitability.

July 25 -

Community banks reported increased lending in the fourth quarter. Experts believe loans could continue to grow this year, but at a marginal rate.

February 4 -

Smaller banks have historically shied away from equipment finance because it requires a lot of expertise that typically has an up-front cost. But a desire to book assets at higher yields has made the business more attractive, industry experts say.

February 12

Community banks have seized on a chance to book more loans as larger institutions tap the brakes.

Quarterly earnings are revealing that the biggest banks are bringing in deposits much faster than they are adding loans as tougher liquidity and leverage rules loom. This shift has given smaller banks an opportunity to make more loans, especially in commercial lines that have traditional been the domain of larger lenders.

Smaller banks, as a result, are reporting better loan-to-deposit ratios that, along with stable net interest margins, are lifting earnings.

"The big guys are actually shifting the market," says Mark Fitzgibbon, an analyst at Sandler O'Neill. Superregional banks "are mired in the [Comprehensive Capital Analysis and Review] process and Basel III and have not been growing their loan books, but they are attracting deposits in the hope that interest rates will change."

"Small and midsize banks have been taking market share as they diversify away from real estate," says Jefferson Harralson, an analyst at Keefe, Bruyette & Woods. "Many banks have seen growth by doing more syndicated loans and more C&I."

Banks with $40 billion or less in assets are on pace to report an improved loan-to-deposit ratio in the first quarter, based on American Banker research of more than 240 quarterly reports. It would be the second straight quarterly improvement at those institutions.

Average loans at those banks increased 12% from a year earlier. Deposits, on average, rose 10% from a year earlier.

The four largest banks increased the size of their loan portfolios by an average of 2% in the first quarter, according to KBW data. Deposits increased by 9%.

Loans at banks with $50 billion to $500 billion increased by an average of 1% from a year earlier, KBW said. Deposits rose by 4%.

Bigger banks are coveting deposits, in part, because of a

Regulators in October

Smaller banks would be exempted from the proposed rule, so they are facing less pressure to aggressively chase deposits. Larger banks "value liquidity more because they're being held to higher liquidity standards, and they've been strong bidders for deposits," Harralson says.

Competition for deposits has been intense among larger banks. In the first quarter, Fifth Third (FITB) increased its core deposits by 8% from a year earlier. Deposits at U.S. Bancorp (USB) rose 5%, while KeyCorp (KEY) and Comerica (CMA) reported 4% growth.

Deposit growth was more striking at the largest banks: JPMorgan Chase (JPM) and Wells Fargo (WFC) increased average deposits by 9%. Bank of America's (BAC) deposits rose 6%.

As big banks remain cautious about leverage, smaller banks have been taking market share. Harralson says he expects that, once all banks have reported, loan growth at smaller banks will average 7%. That compares to 3% to 5% at bigger banks.

Strong quarterly loan growth is a boon to smaller banks that are hoping to replace revenue lost when the refinance boom ended.

Margins have also stabilized, increasing slightly in the first quarter among the smaller banks studied by American Banker. As a result, net interest income, on average, rose 10% from a year earlier.

Lending began rebounding at smaller banks in the fourth quarter. BankUnited (BKU) in Miami Lakes, Fla.; Suffolk Bancorp (SUBK) in Riverhead, N.Y.; and Peapack-Gladstone Financial (PGC) in Bedminster, N.J., are among the smaller banks to report improved loan-to-deposit ratios compared to a year earlier.

Suffolk has been able to book more loans by expanding into new markets on Long Island and by taking advantage of a slowly improving economy, Howard Bluver, the company's chief executive says. "We are taking market share from other institutions," including some of the biggest banks, he says.

"Our sweet spot involves [commercial] loans between $3 million and $10 million," Bluver adds. "That is pretty small for a lot of big banks but it could move our needed if we pick up those types of customers."

Much of the growth at other banks has come from niches, such as asset-based lending, that have not been the strong suits of smaller banks, analysts say. It's a strategy of finding growth where they can get it, and it's paying off.

Revenue at banks with less than $40 billion in assets increased 6% from a year earlier, based on preliminary American Banker research. The four biggest banks reported a 4% dip in operating revenue, KBW says.

Credit quality is also an area to watch as smaller banks push harder for loan growth. So far, credit quality continues to improve, but it can take years before poorly underwritten loans wreak havoc on the bottom line.

The long-term outlook for loan growth at community banks remains unclear despite the strong showing so far this year, says David Powell, president of the bank consulting firm Vitex. Lending activity is "steadily improving but it is not gangbusters like back to the old days, not by any means," he says.