-

Valley National Bancorp (VLY) in Wayne, N.J., has agreed to buy 1st United Bancorp (FUBC) in Boca Raton, Fla.

May 8 -

Enterprise Financial and Reliance Bancshares in St. Louis, under pressure to grow like most community banks, believe they have figured out how to expand into faraway markets yet avoid the mistakes that cost many banks during the financial crisis.

October 9 -

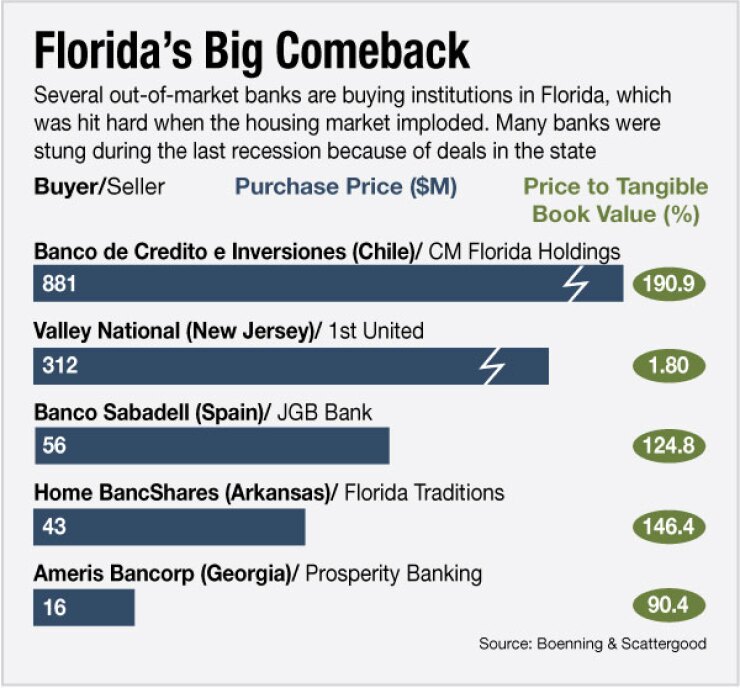

The state had a dozen deals last year as foreign investors looked to expand, particularly in the Miami area.

January 2 -

First American Bank in Elk Grove Village, Ill., has agreed to buy Bank of Coral Gables in Florida.

May 5 -

Park National in Ohio, is selling its most of its Florida operations for a fraction of what it paid for the bank in 2007. Analysts say this closes a bad chapter for the company, which could re-emerge as a buyer in the next few years.

November 23

In what could be considered a flashback to a popular strategy before the financial crisis, a pair of banks is pursuing growth with Florida acquisitions.

A number of banks in the Midwest and elsewhere poured money and resources into the Sunshine State a decade ago, only to absorb large losses when the housing market imploded. Some of those banks exited the market. Others opted to stay after seriously contemplating retreat.

Valley National Bancorp (VLY) in Wayne, N.J., and First American Bank in Elk Grove Village, Ill., are willing to give the strategy another go. Valley has

Still, it might be awhile before Florida's allure attracts a new wave of distant acquirers. While there are aspects to Florida that might make it appealing, out-of-state buyers may be few and far between, some say.

"That was an interesting phenomenon," Walter Moeling, a lawyer at Bryan Cave in Atlanta, says of banks that jumped into Florida before the financial crisis. "The theory is that Florida has good deposits and is a good growth market. But those who fail to learn from history are doomed to repeat it."

Banks that have been successful in coming into Florida from far away markets usually recognize that the state has different characteristics than their home turf. Executives who "have tended to do the best in Florida are the ones who are able to accept the existing strategy of the Florida bank and affirm it with a strong local management," Moeling says.

Executives at those banks assert that they are taking steps to avoid repeating other banks' past missteps, while insisting that their deals should not be considered speculative plays.

First American is aware of recent history in Florida and hopes to avoid a repeat with "a management style that is very involved in decision-making," says John Ward, the bank's president and chairman of its holding company.

"The people we're getting into business with down there are cautious, too, and survived the downturn," Ward says. "We think that will help us avoid the boom and busts, but booms and busts happen to the industry. We still very well remember the lessons."

"We are not just jumping in ourselves and saying we are smarter than everyone else," says Gerald Lipkin, chairman and chief executive of the $16 billion-asset Valley. "We have to rely on local talent," he says, adding that 1st United's management will run the Florida operations.

Valley looked at "every state from New Jersey to Florida" for acquisition targets before agreeing to buy 1st United, Lipkin says. The other states lacked Florida's appeal and demographics.

The state is on pace to surpass New York in terms of population, and its corporate tax base is significantly lower than those in New York or New Jersey, which Lipkin says is beneficial for entrepreneurs. All of that sets the stage for lending opportunities.

Analysts didn't pressure Lipkin to defend the distance between New Jersey and during a conference call with analysts Thursday. And management made sure to take time to explain their rationale for the long-distance deal.

Valley has previous experience lending in Florida, Lipkin says. It worked with a national insurance company for about 40 years to make auto loans from Canada to Florida but eventually cut ties to the firm, he says. Valley had a residential mortgage office in Jacksonville, Fla., but decided to close it around 2005 when the market seemed frothy.

First American also has a familiarity with Florida, where it has been offering trade finance services for about a decade.

Other banks have toyed with the notion of pulling out of Florida. Reliance Bancshares (RLBS) in Des Peres, Mo., considered selling its Florida operations, which it launched in the early 2000s. Reliance decided to keep the bank, Tom Brouster, the $1 billion-asset company's chairman, said.

"Things have changed around quite a bit in Florida,"

Still, executives must be mindful that Florida, which was hard hit during the housing crisis, is still in recovery mode, says Michael Rose, an analyst at Raymond James.

Bankers should recall that banks like National City in Cleveland, Park National (PRK) in Newark, Ohio; and Colonial BancGroup in Montgomery, Ala., all stubbed their toes in Florida a few years ago. Of those, Nat City sold under pressure to PNC Financial (PNC) and Colonial failed. Park sold its Florida bank to Home Bancshares (HOMB) in Conway, Ark.

"Florida is an attractive, deposit-rich state," Rose says. "More people are moving in than out, and it has great weather, so the demographics are attractive. But while there has been a pickup in business activity, it is still subdued and depressed."

Since Florida is a deposit heavy state, banks there could become more attractive to potential buyers as interest rates rise, Rose says. Valley is paying a 16.7% core deposit premium in its $312 million all-stock deal for 1st United.

This deal could also "be a game changer" in Florida M&A, says Rudy Schupp, chief executive at the $1.7 billion-asset 1st United. Previously, outside buyers were usually in neighboring states or foreign investors.

"In the Florida M&A scene, the upstream buyer group has changed," Schupp says. "When banks think about a change of control, what is remarkable about this transaction is they will be able to think about someone like Valley" as a potential buyer.

As interested as some potential buyers might be in Florida, they may find a dearth of sellers that would fit their needs, Rose cautions. There are only a handful of banks that have the scale necessary to make sense for an out-of-state buyer. Many of those banks seem unlikely near-term sellers, he adds.

A potential buyer would also need to be the right size, have a strong enough operation and offer a good range of products to complete such a deal, Schupp says. All of this could limit out of market acquisitions in Florida.

"The truth of the matter is it is very hard to be successful in a totally different market where you don't have a lot of experience," Moeling says.

Robert Barba and Paul Davis contributed to this report.