-

John W. Allison of Home BancShares was on the prowl for a deal in Florida when a "game-changer" came up in its home state of Arkansas. He sacrificed geographic diversification for a local moneymaker. Was it the right move for the long term?

July 3 -

The bank wants to double in size by pursuing acquisitions and hiring bankers away from competitors.

May 30 -

Latin American banks are eager to expand in South Florida, but there are few banks in Miami that can provide immediate heft. As a result, even the city's smallest banks could spark bidding wars if they choose to sell.

May 29

Much like Florida's weather, the forecast for bank consolidation in the state is bright.

Mergers in the state picked up last year and some industry observers believe the pace of acquisitions could accelerate in 2014. Interest from foreign investors, along with regulatory pressures, could prompt more banks to sell.

"I fully expect there to be a flurry of activity in the coming year," says Bowman Brown, a partner at Miami law firm Shutts & Bowen. Small banks in Florida are "under tremendous pressure so a very large number are thinking in terms of acquisition or disposition."

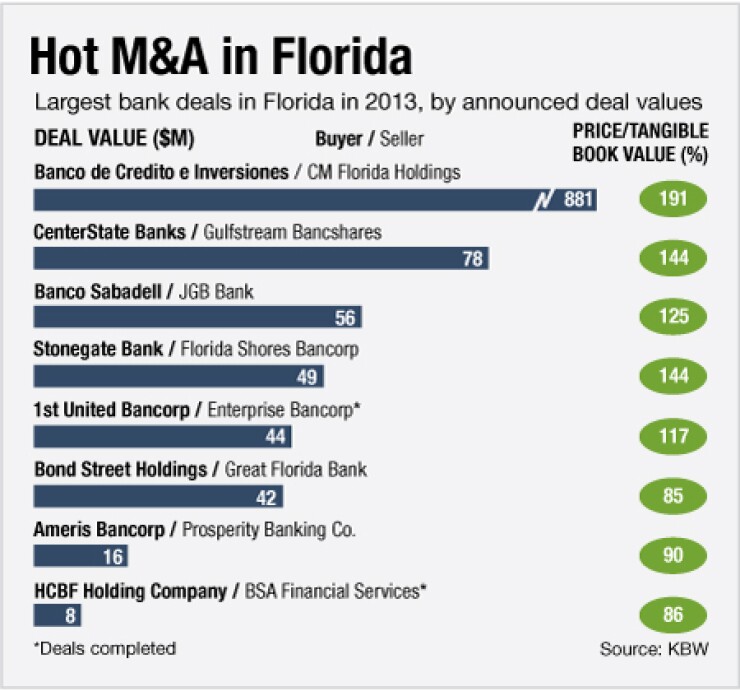

Through Dec. 12, Florida had 13 deals last year, or nearly twice the activity that took place a year earlier, according to KBW. Nationwide, M&A is on pace to be relatively flat compared to a year earlier, in terms of the number of deals.

The bulk of Florida's deals involved banks in the southern part of the state. South Florida has roared back since the financial crisis, as evidenced by several new construction projects, says James Cassel, chairman and co-founder of Miami investment banking firm Cassel Salpeter.

"For a while when I looked out [my office window] there were maybe 20 cranes and then there was a time there was just one," Cassel says. "Now we are on our way back up to 20. South Florida is a growing, thriving market."

The Miami area's recovery involves an influx of investment from foreign groups based in Spain and South America. Citizens from countries like Brazil frequently visit south Florida, and Miami continues to serve as an important place for international trade, says Fernando Alonso, a partner at Miami law firm Hunton & Williams. So it makes sense for foreign banks to seek out acquisitions to expand in the region.

In early 2013, Chilean bank Banco de Credito e Inversiones agreed to buy the $4.7 billion-asset

Similar acquisitions could take place next year, industry observers say.

"Miami has shown it is a resilient market, not just domestically but also with strong foreign investor influence and strong infrastructure from international trade," says Carl Fornaris, co-chair of the financial regulatory and compliance practice at the firm at Greenberg Traurig. "You will see continued interest in south Florida."

Pricing has firmed up, with at least five banks selling for more than tangible book value. Valuations should continue to rise next year, especially around Miami, as banks have fewer problems, industry experts say. As the number of community banks declines, buyers might be willing to pay more for the institutions that remain, Fornaris says.

Foreign interest in southern Florida could influence activity elsewhere in the state, says Alonso, who worked with Sabadell on the JGB and Lloyds deals.

"It is not unusual to look up the coast for other potential targets," he says. "I do think Florida can and does work in many ways as a unified market. I don't think it has in the past, but it is becoming more of a natural expansion for those already in south Florida."

There were a handful of deals across the rest of Florida in 2013, and industry observers are hopeful that more will take place next year. Real estate prices have recovered enough to allow banks to sell foreclosures at better prices, says Thomas Rudkin, a principal at FIG Partners. Stronger community banks are also looking for ways to grow in existing or adjacent markets, especially in areas like Orlando, Tampa and Jacksonville, he adds.

Buyers could include other Florida banks or institutions in nearby states such as Arkansas, Louisiana and Texas, Rudkin says.

For instance, John W. Allison, chairman of Home BancShares in Conway, Ark., has

Sellers will likely include smaller banks that are finding it difficult to compete as the cost of regulation rises, though this is not a unique issue for Florida, industry experts say. Some banks could opt to sell if they struggle to raise new capital, Rudkin says.

Banks with significant market share "are the ones that are seriously looking to raise capital because they have the market presence to do well," Rudkin says. "Others have a more difficult process ahead of them."

HCBF Holding in Fort Pierce, Fla., which bought BSA Financial Services in St. Augustine, Fla., last year, would like another deal, possibly along Florida's east coast or the central part of the state near existing markets, says Chairman and CEO Michael Brown Sr. The $621 million-asset company has access to enough capital for a bigger deal, he says.

HCBF would prefer to buy a bank with a clean balance sheet, though it is willing to consider one with some troubled assets. HCBF's first acquisition was a failed bank, so Brown feels like his management team has the expertise to work out problem loans.

"Clearly the operating environment has improved in Florida," Brown says. "We still have the regulatory challenges, so we are likely to see the same pace of deals next year. Not everyone who talks to suitors is really ready to sell, though. There are a lot of conversations."