Few answers for Netspend customers unable to access paychecks

(Full story

Elizabeth Warren rebukes Comerica over fraud in benefits program

(Full story

FDIC poised to revamp deposit rules. Banks say it's about time

(Full story

CFPB writing rule to define 'abusive' standard: Mulvaney

(Full story

Big banks, aggregators launch group to hash out data-sharing issues

data-sharing-survey.jpeg

(Full story

Banks should measure their social impact

(Full story

As digital banks proliferate, so do risks

(Full story

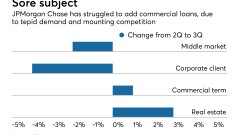

JPMorgan's 3Q offers glimpse of big questions facing banking

(Full story

USAA dips toe into small-business lending

(Full story

Missing chapter from Comerica's turnaround story: Loan growth

(Full story